PI Industries Ltd shares are on the verge of a consolidation breakout on the weekly charts. Technical and derivative data indicate a long buildup in the stock, suggesting upside momentum.

On June 20 at 1:20 PM, PI Industries was trading up 142 points, or 3.91 percent, at Rs 3,790.

"The stock is trading with a positive bias and is on the verge of a consolidation breakout on the weekly charts. The counter looks strong and is expected to surpass the psychological mark of 3,900-4,000-plus levels on the daily charts in the coming week," said Arun Kumar Mantri, Founder of Mantri Finmart.

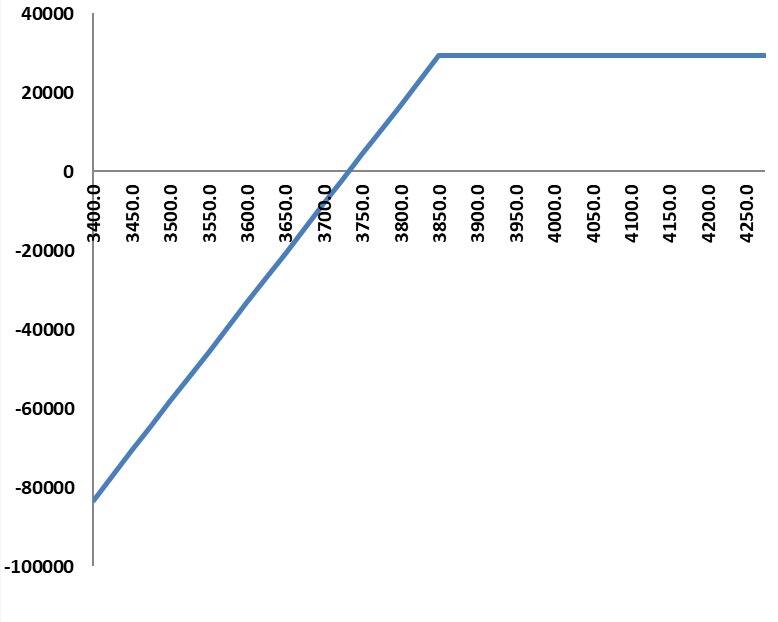

Mantri recommends a Covered Call strategy to capture the upside in PI Industries:Trade Recommendation: Buy one lot of PIIND June Futures at Rs 3765 and Sell one lot of PIIND June 3850 CE at Rs 37.

Also read: F&O Manual | Indices trade rangebound; 23,500 acting as crucial support

Stock Code: PIINDFirst Leg: Buy Future at Rs 3765

Second Leg: Sell Call Option (CE)

Break-Even Point: 3728 (Future Levels)

Max Profit: Rs 29,250

Max Loss: Unlimited Below BEP

Stoploss: 3710 (Spot Levels)

Technical ViewMantri highlights that the technical indicators are exhibiting bullish signs, and the positive momentum is likely to continue in the coming sessions based on the recent price and volume action.

A covered call strategy involves holding a long position in a stock and selling call options on the same stock to generate additional income from the premiums. This strategy is used when the investor expects the stock price to remain relatively stable or increase slightly. By selling call options, the investor collects premiums, providing a cushion against potential losses. However, if the stock price exceeds the strike price of the sold call option, the investor must sell the stock at that strike price, potentially missing out on higher gains.Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.