Indian benchmark indices are trading within a range as they consolidate at higher levels. At 10:18 AM on June 20, the Sensex was down 134.56 points, or 0.17 percent, at 77,203.03, while the Nifty was down 18.70 points, or 0.08 percent, at 23,497.30.

According to experts, the Nifty is likely to trade neutrally, with short-term support between 23,400-23,450 and resistance between 23,650-23,700.

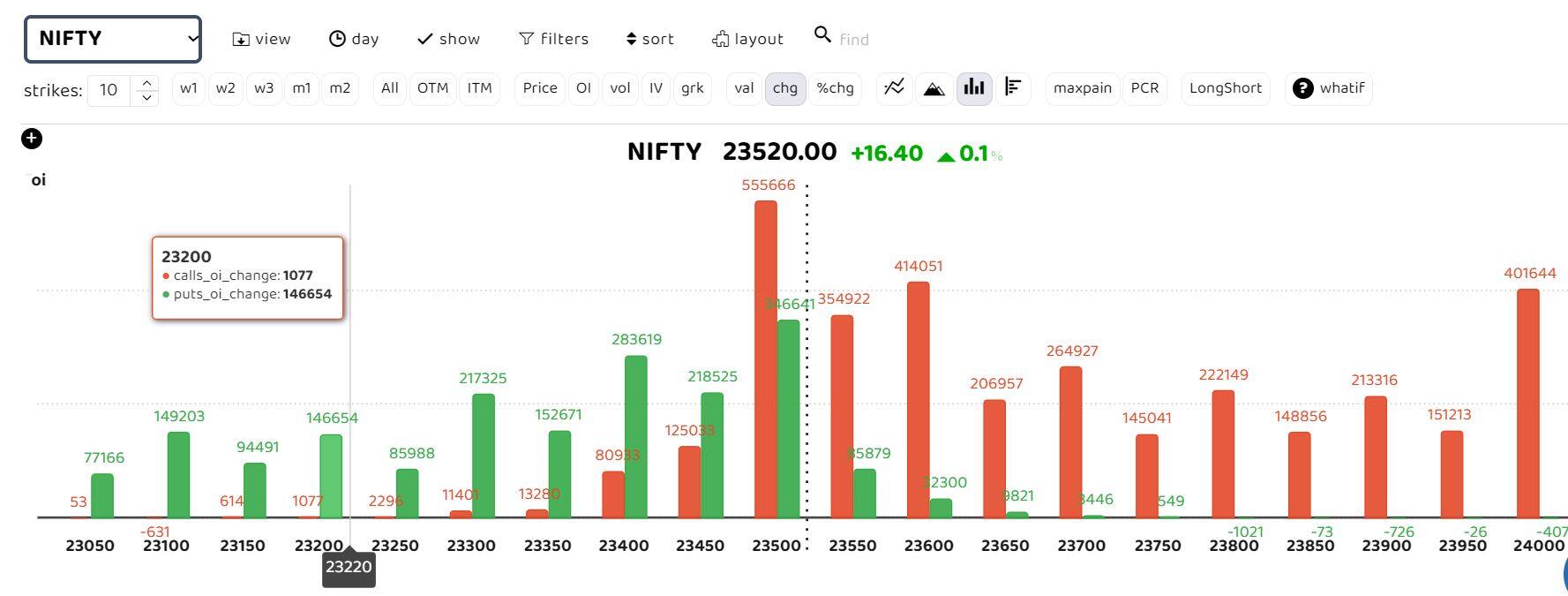

Options data suggests heavy call writing across strikes from 23,650 to 24,000. "The Nifty closed above the critical resistance level of 23,350 last week, and we believe it is likely to test the next resistance zone of 23,750-23,800 in the coming days. Support for the Nifty is now seen at 23,500 and 23,300-23,350 levels. On the higher side, immediate resistance is at 23,600, with the next resistance zone at 23,750-23,800," said Tejas Shah, Vice President - Derivative Research at JM Financial.

From a technical standpoint, the index is facing profit-taking pressure at consistently higher levels. On the daily chart, a bearish candle formed at yesterday's close, indicating temporary weakness at current levels.

Drop below 23,500 may lead to intraday correction to 23,400

"However, the short-term market structure remains positive. We believe that the 23,500/77,200 level could be crucial support for day traders; a drop below 23,500 may lead to a quick intraday correction to 23,400-23,350/77,000-76,800. In the worst-case scenario, it may drop to the 20-day SMA, which is around 23,150/76,200," said Shrikant Chouhan, Head of Equity Research at Kotak Securities.

Chouhan believes that 23,680/77,850 could represent immediate breakout levels for a bullish trend. If the market surpasses 23,680/77,850, it is likely to move towards 23,750-23,850/78,000-78,300.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.