The broader indices erased some of the previous week gains and underperformed the main indices in the truncated week ended March 13 with 116 smallcap stocks fell between 10-42 percent as market remained under pressure throughout the week.

During the week, the BSE Large-cap, BSE Mid-cap and BSE Small-cap indices shed 0.8 percent, 2 percent and nearly 4 percent, respectively.

For the week, the BSE Sensex index fell 503.67 points or 0.67 percent to close at 73,828.91, and Nifty50 declined 155.3 points or 0.68 percent to close at 22,397.20.

All the sectoral indices ended in the red with Nifty IT index shed 4.5 percent, Nifty Media index declined 3.4 percent, Nifty PSU Bank index fell 2.5 percent, Nifty Auto and Realty indices fell 2 percent each.

"In the last week, the benchmark indices witnessed range-bound activity. After a roller-coaster week, the Nifty ended 0.69 percent lower, while the Sensex was down by 500 points. Among sectors, IT and Capital Market indices lost the most, shedding over 4 percent, while some buying was seen in selective Financial and Pharma stocks," said Amol Athawale, VP-technical Research, Kotak Securities.

"Technically, the market is exhibiting non-directional activity; on the lower side, it is consistently finding support near 22300/73300, while profit booking has been witnessed between 22600/74700 and 22650/74900. We believe that the current market texture is non-directional, and traders may be awaiting a breakout in either direction."

"For the bulls, the key breakout zone is at 22650/74900. A dismissal of the 22650/74900 breakout could push the market towards 22800-22900/75500-75800. Conversely, if the market falls below 22300/73300, selling pressure is likely to accelerate. Below this level, the market could retest levels of 22100-22000/72700-72400," he added.

"For the Bank Nifty, a double bottom support is placed at 47700. As long as it is trading above this level, a pullback formation is likely to continue. On the higher side, it could move up to the 20-day Simple Moving Average (SMA), or 48600 and 48800. However, if it falls below 47700, the sentiment could change, increasing the likelihood of hitting 47300-47000," Athawale further said.

Foreign Institutional Investors (FIIs) continued their selling on sixth consecutive month as they sold equities worth Rs 21,231.25 crore in the month of March till now. In this week, FIIs sold equities worth Rs 5,729.68 crore, while Domestic Institutional Investors (DII) bought equities worth Rs 5,499.47 crore.

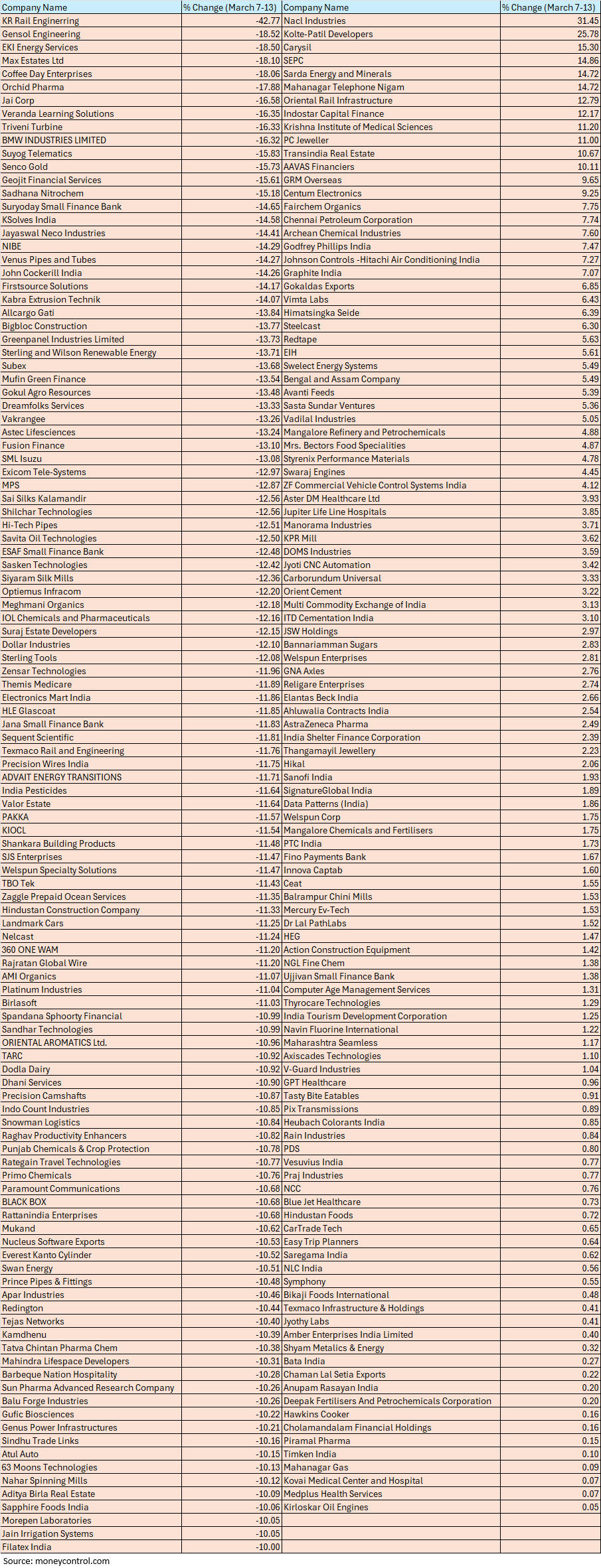

The BSE Small-cap index fell nearly 4 percent with KR Rail Engineering, Gensol Engineering, EKI Energy Services, Max Estates, Coffee Day Enterprises, Orchid Pharma, Jai Corp, Veranda Learning Solutions, Triveni Turbine, BMW Industries, Suyog Telematics, Senco Gold, Geojit Financial Services, Sadhana Nitrochem fell between 15-42 percent.

On the other hand, Nacl Industries, Kolte-Patil Developers, Carysil, SEPC, Sarda Energy and Minerals, Mahanagar Telephone Nigam, Oriental Rail Infrastructure, Indostar Capital Finance, Krishna Institute of Medical Sciences, PC Jeweller, Transindia Real Estate, AAVAS Financiers added between 10-31 percent.

For the past three days, Nifty has largely remained within the range of 22,350–22,550. A decisive move above 22,550 could trigger a meaningful rally in the short term. Conversely, a decisive fall below 22,350 could weaken sentiment in the short term.

Nagaraj Shetti, Senior Technical Research Analyst at HDFC SecuritiesAfter showing smart recovery from the intraday lows in the last couple of sessions, Nifty slipped into weakness amidst choppy movement on Thursday and closed the day lower by 73 points. After opening with a positive note, the market was not able to sustain the highs and showed weakness in the mid to later part of the session.

A reasonable negative candle was formed on the daily chart that has formed within a high low range of 22600-22300 levels. Technically, this market action signals narrow range bound movement with negative bias.

A decisive upmove above the hurdle/upper range of 22600 could open renewed buying enthusiasm towards 23000 levels in the short term. However, any weakness below the lower range of 22300 could drag index down to the next support of 22000 levels.

Ajit Mishra – SVP, Research, Religare BrokingOn the weekly expiry day, markets remained range-bound and closed slightly lower. While positive global cues initially drove an uptick, selling pressure in heavyweight stocks across sectors pulled the Nifty into the red, eventually settling at 22,397.20.

The ongoing consolidation in the Nifty index has kept participants cautious, but a decisive breakout from the 22,250-22,650 range is expected soon. In the meantime, traders should maintain a stock-specific approach while managing position sizes carefully. We continue to advise against adding to loss-making positions, particularly in the midcap and smallcap segments, given the likelihood of sustained underperformance.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.