Dear Reader,

The Panorama newsletter is sent to Moneycontrol Pro subscribers on market days. It offers easy access to stories published on Moneycontrol Pro and gives a little extra by setting out a context or an event or trend that investors should keep track of.We have been sounding like a broken tape recorder for some time bemoaning how markets have run ahead of fundamentals with valuations reaching the stratosphere. This exuberance has reached the primary markets.

This week five companies are launching their new share sales - Kalyan Jewellers India, Craftsman Automation, Laxmi Organics, Suryoday Small Finance Bank and Nazara Technologies. (You can read our recommendation on the Kalyan Jewellers IPO here.)

Once upon a time, the companies that used to float new share sales were dour firms who had been around for quite some time and could be easily classified as FMCG or pharma or financial services. Now, the variety of companies that are hitting the market to raise money and provide an exit to their promoters/investors is dazzling. From obscure chemicals companies to mobile gaming firms to waste management firms, you can now buy shares in them all.

If you are a serious investor, you will probably have to tweak your valuation models to account for the idiosyncrasies of new age companies. But in the IPO market, it is all about the opening day pop, not only in India, but around the world. The chase for IPO stock is such that an analysis pointed out that 200 HNIs (High net worth individuals) compete for one share.

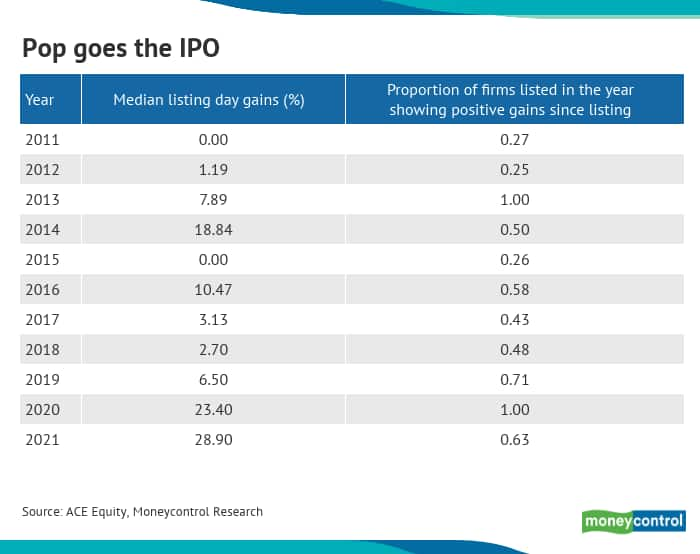

The frenzy seen in stock market valuations is being reflected in the opening day pop for new share listings. As the chart below shows, the median listing day gain of the eight debuts of 2021 is 28.9 percent. For 2020, this was 23.4 percent. These numbers are the highest in a decade.

But how many of these companies do well in the long term? The second data point in the chart looks at the proportion of firms that still trade above their issue price. Of course, this data will be biased in the sense that firms listed in more recent times are mostly still riding the wave.

But the numbers are telling. Roughly, only one of out of every four firms that listed in 2011 and 2012 are still trading above the issue price.

That’s not all. At a time when credit growth is yet to gain significant pace, banks and non-banking finance companies have started chasing HNI investors to finance IPO subscriptions. This is adding further to the IPO frenzy and is not really helping investors. As my colleague Shishir Asthana points out, it is only the lender who is enjoying the party. You can read his piece here.

Here are today’s investment insights from our research team:

Bajaj Consumer Care: Can it sustain the double-digit growth?

MTAR: Good long-term play despite strong listing

What else are we reading today?

Taking the ESG bull by the horns

Economic Recovery Tracker | As COVID-19 cases rise, pick-up in economic activity falters

WPI spike in manufactured products: Have firms regained the pricing power?

TechM strengthens enterprise business, but telecom still key to growth revival

Mohamed El-Erian writes: How to overcome the uncertainties of the Fed and market psychology (republished from the FT)

Technical picks: Bharat Electronics, Apollo Hospitals, Tata Seel and Mahanagar Gas (These are published every trading day before the markets open and can be read on the app)

Cheers,

Ravi Krishnan

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.