The year 2024 closed optimistically for Indian markets, marking the ninth consecutive year of positive returns for the benchmark Nifty50 index. With a solid 8.80% gain, it slightly lagged behind broader market indices like the Nifty500, which surged by 15.16%. But what truly stood out was the outperformance of the Nifty Microcap250, leading the pack at an impressive 34.20% return, followed by the Nifty Next50, which rose by 27.45%.

Given this market backdrop, one sector that is particularly positioned to carry forward this momentum into 2025 is the Data Center sector.

With the growth of digital services, e-commerce, cloud computing, and IoT, India’s data center industry is on the cusp of transforming. However, despite its increasing prominence, no dedicated sectoral index exists for data center-related stocks. To fill this gap, we have created the Definedge Data Center Index, an equal-weighted index comprising 21 stocks tied to the data center sector.

Let us analyse the chart of the Definedge Data Center Index and the two stocks that look most promising for investors: Voltas and Amber Enterprises India

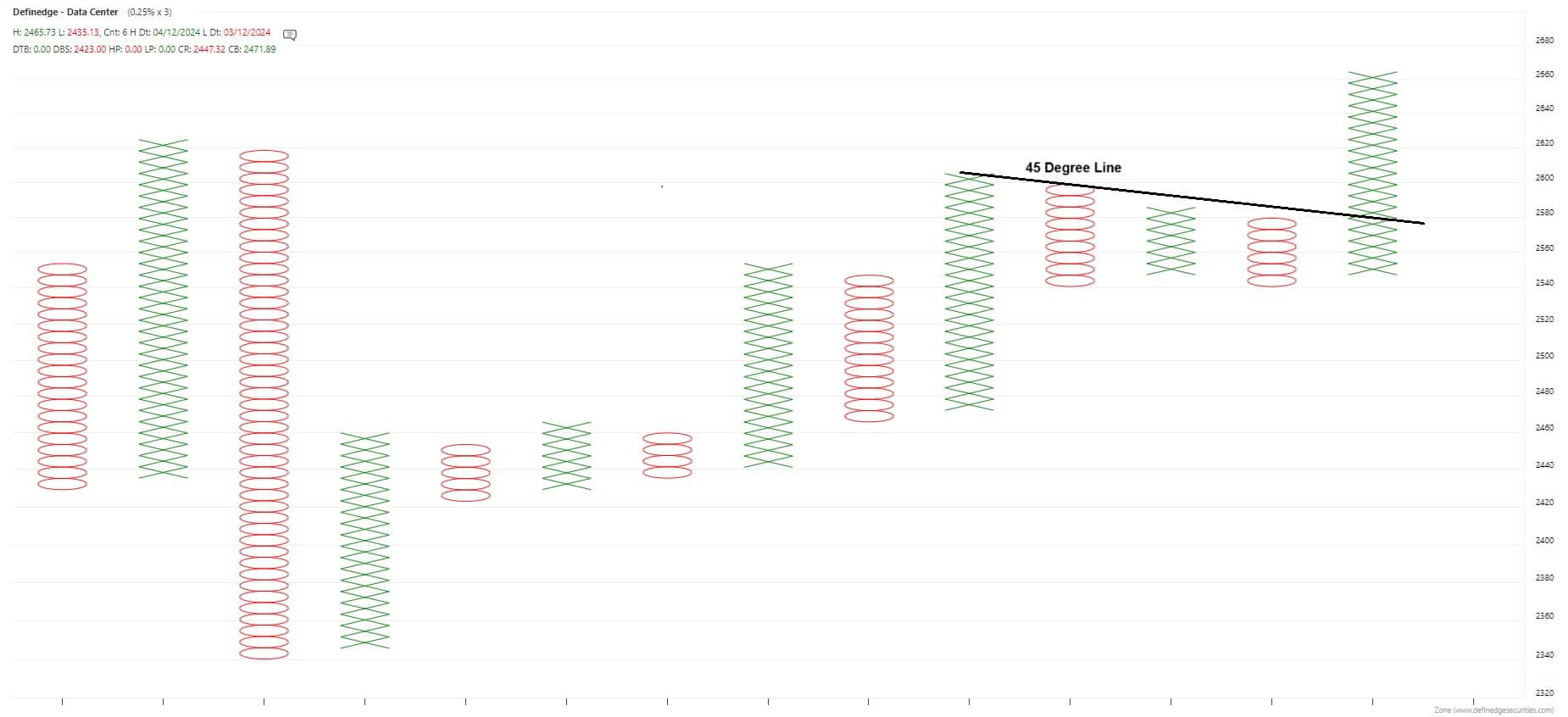

Definedge Data Center Index

The Definedge Data Center Index, constructed to track stocks tied to the data center ecosystem, shows remarkable strength. A look at the Daily 0.25% X 3 chart reveals that the index has broken out from a significant 45-degree trendline, an essential technical indicator in market analysis.

The Definedge Data Center Index, constructed to track stocks tied to the data center ecosystem, shows remarkable strength. A look at the Daily 0.25% X 3 chart reveals that the index has broken out from a significant 45-degree trendline, an essential technical indicator in market analysis.

In technical analysis, a 45-degree trendline is considered a breakout above this trendline, suggesting a change in momentum, often accompanied by accelerated buying activity. In the case of the Definedge Data Center Index, the breakout above this key trendline signals a potential continuation of the bullish trend in the sector.

The breakout was further validated by a strong rally, which saw the index surpass its previous Anchor Column—a pattern of vertical rally indicating a strong reference point for the market.

Let us look at two individual stocks from this sector that are currently showing bullish technical setups and could continue to outperform in the coming months.

Voltas —one of India’s leading cooling solutions companies—has long been associated with its air conditioning and refrigeration products. However, in recent years, Voltas has expanded its reach to the data centre sector, particularly in providing critical infrastructure, such as cooling solutions for data centres, a crucial component for their efficient operation.

On the Daily 1% X 3 P&F chart, Voltas has successfully broken out from a quadruple pattern (indicated by the black line), signalling a return of bullish momentum. This breakout occurred with a break above the 45-degree trendline, further confirming the continuation of upward price action.

The medium-term chart presents a clear support level of Rs 1,600. If the stock price moves below this level, it would negate the bullish pattern. However, should the stock price continue its upward trajectory, it has the potential to reach new highs, driven by both the growth in its cooling solutions business and its increasing exposure to data centers.

Amber Enterprises India Ltd is another key player in the Indian cooling solutions market, primarily providing air conditioning solutions for residential and commercial spaces. However, the company’s strategic focus on expanding into data center cooling and infrastructure services has positioned it well to capitalise on the burgeoning data center industry.

The Daily 1% X 3 P&F chart, a breakout following its Anchor Column was accompanied by a brief retracement, a typical price action pattern seen in stocks before they resume their upward trajectory.

More importantly, the stock shows signs of resuming bullish momentum, which could accelerate if the price breaks above the Rs. 7,915 level, triggering the Anchor Column Follow-Through (AFT) pattern.

This pattern signals a continuation of the upward trend and suggests that Amber Enterprises is well-positioned for growth in the coming quarters.

To summarise, the Data Center sector represents one of the most promising growth areas in the Indian market, driven by the expansion of digital infrastructure and increased data consumption. As the Definedge Data Center Index breaks out into new territory, stocks like Voltas and Amber Enterprises India Ltd are well-positioned to capture the benefits of this expanding sector.

Note: The purpose of this article is only to share interesting charts, data points and thought-provoking opinions. It is NOT a recommendation. This article is strictly for educative purposes only.Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.