June 30, 2023 / 16:25 IST

Amol Athawale, Technical Analyst (DVP), Kotak Securities

There is a clear picture emerging that India has been showing strong resilience in all the growth parameters and are poised to do well going ahead. With most global economies, including China, witnessing degrowth, India has emerged as a green shot in a bleak scenario, hence investors are reposing strong faith in local stocks.

Technically, a breakout continuation formation on daily charts and a long bullish candle on weekly charts support further uptrend. For bulls, 19050 and 19000 would act as key support zones while 19300-19400 would be crucial resistance areas. However, below 19000, traders may prefer to exit from the long positions. For Bank Nifty, as long as it is trading above 44300 the breakout texture is likely to continue and could move up till 45000-45300.

June 30, 2023 / 16:17 IST

Rupak De, Senior Technical analyst at LKP Securities:

The bulls continued to dominate the market as the Nifty, reached a new all-time high. This surge in the Nifty followed a breakout from a period of consolidation, indicating strong bullish reversal. The overall trend appears positive in the near term as the index has consistently remained above its moving average.

Furthermore, the momentum indicator RSI has shown a bullish crossover on the daily timeframe, suggesting strong momentum.

Looking ahead, there is potential for the index to move towards 19450 in the short term, indicating further upward movement. However, on the downside, there is support at 19000. Overall, the market is currently exhibiting bullish characteristics, with the Nifty reaching new highs as long as it sustains above 19000.

June 30, 2023 / 16:00 IST

Ajit Mishra, SVP - Technical Research, Religare Broking

Markets extended the momentum on Friday and gained over a percent, in continuation of the trend. After the initial uptick, Nifty gradually inched higher as the day progressed and finally settled around the day’s high at 19189.05 levels. All sectors, barring metals, participated in the surge wherein recovery in the IT majors combined with continued buoyancy in banking, financial and auto heavyweights played a crucial role. The broader indices also followed suit and gained nearly half a percent each.

Participants are taking comfort from stability in global markets amid mixed cues and we expect the prevailing tone to continue. We are now eyeing the 19350+ zone in Nifty. Since all sectors are now contributing to the move, the focus should be on stock selection and the same holds for the midcap and smallcap pack as well.

June 30, 2023 / 15:49 IST

Vinod Nair, Head of Research at Geojit Financial Services

The lack of global support had restrained the Indian indices from pursuing their record highs earlier, despite the presence of a resilient domestic macroeconomic background. With positive surprises assisting buoyancy in the global market and the advance of the southwest monsoon, the domestic market succeeded in marching to new highs with renewed strength.

Global investor sentiments were uplifted by a favourable revision in Q1 GDP, a fall in jobless claims, and the positive outcome of the Fed’s US bank stress test.

June 30, 2023 / 15:32 IST

Rupee Close:

Indian rupee ended flat at 82.04 per dollar on Friday against Wednesday's close of 82.05.

June 30, 2023 / 15:31 IST

Market Close:

Benchmark indices ended higher on June 30 with Nifty around 19,200.

At close, the Sensex was up 803.14 points or 1.26 percentat 64,718.56, and the Nifty was up 216.90 points or 1.14percentat 19,189. About 1,865 shares advanced, 1,543 shares declined, and 132 shares were unchanged.

The biggest gainers for the day on Nifty were M&M, Infosys, IndusInd Bank, Hero MotoCorp and Sun Pharma, while losers included Adani Ports, Divis Laboratories, Adani Enterprises, Apollo Hospitals and Bajaj Auto.

All the sectoral indices ended in the green with Information Technology index up 2.5 percent and PSU Bank index up 2 percent. Auto, and capital goods indices rosenearly 2 percent each.

The BSE midcap and smallcap indices gained 0.5 percent each.

June 30, 2023 / 15:25 IST

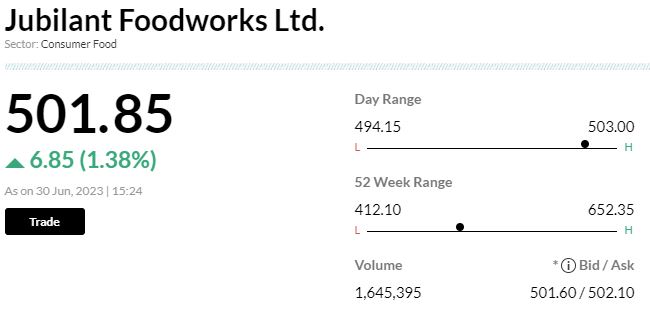

Stock Market Live Updates | Jubilant Food postpones completion deadline to restructure overseas arms to June 2024

Jubilant FoodWorks informed that the proposed internal restructuring of certain overseas subsidiaries of the company is now likely to be completed on or before June 30, 2024 due to certain regulatory requirements.

June 30, 2023 / 15:22 IST

Bharat Electronics Limited (BEL) has received new Defence and non-Defence orders worth Rs.2,191 crore

June 30, 2023 / 15:22 IST

Sesnex Today Live Updates | Dollar firm ahead of PCE numbers, briefly pokes head above 145 yen

The yen weakened past the closely-watched 145 per dollar level on Friday although traders' fears of intervention by Japanese authorities kept it in check, while the dollar was also strong more broadly ahead of U.S. inflation data.

Barring unexpected interventions, the day's main event for FX markets is the U.S. personal consumption expenditure price index, which will be released at 0830 EST (1230 GMT) and will give the latest indicator of whether prices are slowing in the world's largest economy.

June 30, 2023 / 15:18 IST

Stock Market Live Updates | Kotak Institutional Equities View On Voltas

-Sell rating, target cut to Rs 710 per share

-Cut FY24 EPS estimate by 8 percent to factor in summer season washout for room AC business

-Cut FY25 EPS estimate by 9 percent to reflect continued intense competition & margin pressures

Voltas was quoting at Rs 760.15, down Rs 1.40, or 0.18 percent.

June 30, 2023 / 15:15 IST

Stock Market Live Updates | Aurobindo Pharma subsidiary in Puerto Rico undertakes restructuring of facility to enhance production volume

Aurobindo Pharma's subsidiary Auro PR Inc based at Caguas, Puerto Rico, is undertaking a restructuring of its facility to enhance production volume, after completion of commitment for product supply to third party by early July 2023. As a result, Auro PR will not be conducting any manufacturing activity until the repairs / restructuring is complete. During the previous year, Auro PR Inc contributed 1.76% to the consolidated turnover of the company.

Aurobindo Pharma was quoting at Rs 727.50, down Rs 10.25, or 1.39 percent.

June 30, 2023 / 15:11 IST

Stock Market Live Updates | Canara Bank gains on board nod to Rs 7,500-crore fund-raising plan

Canara Bank shares were trading around 2 percent higher in the afternoon trade after its board of directors approved Rs 7,500-crore fund-raising plan for the current financial year.

Of the Rs 7,500 crore, Rs 3,500 crore will be raised through additional Tier I bonds and the remaining Rs 4,000 crore through Tier II bonds, the bank said in an exchange filing. The board met on June 28.

Additional Tier I (ATI) bonds are unsecured bonds with no pre-determined maturity rate and issued to raise long-term capital. These bonds typically carry a higher coupon but are considered risky instruments in the event of a bank collapse. Tier II bonds are perpetual in nature and used by banks for subordinate debt.