I had just started investing in the equity market before the Harshad Mehta scam burst open in 1992.

Based on market tips, I had invested in two stocks viz., Asian Granites and Kirloskar Investments, and was fortunate enough to more than double my money within a few weeks.

Being new to the stock market, I borrowed and invested back 5 times my original investments in about 5 to 8 small-cap stocks, which were in favour of the markets at that time.

Then came the discovery of the scam and the market crash. My stocks fell about 90 percent in a few months and I had to return the borrowed money by selling my wife’s jewelry.

In the following few years, most of those stocks disappeared from the secondary markets or some changed registered office addresses (a very famous practice at that time with many small companies which had governance issues).

A friend of mine was very lucky to buy Mazda Leasing at about Rs 8 per share. This stock hit a peak of Rs 1,250 during the 1992 bull run.

We both went to a sub-broker's office to sell this physical share certificate. But the sub-broker strongly advised my friend not to sell this stock as, according to him, the market expectation was Rs 5,000 per share.

Since the sub-broker was so confident, my friend told him to buy it for himself. This broker, due to his confidence, obliged.

Later, the broker had to shut shop, as we learned that he had bought the same shares from many other clients also.

Even today, I see several retail investors buying stocks after they jump 5 to 10 times without knowing valuation multiples.

Post-1992 scam, the domestic equity markets fell badly thrice; in 2000, the Sensex fell nearly 25 percent due to the dot-com bust.

Then in 2008-2009, the Sensex saw the biggest fall of 62 percent from its peak due to the Lehman crisis.

In 2020, the Sensex saw the fastest fall of over 38 percent in just a matter of three months due to the COVID-19 pandemic.

I saw 4 major falls in three decades, which were caused by a scam due to an individual, a fall of a global institution, bust-up in a sector and then a virus-led global pandemic.

To me interestingly, causes and learning from these four bursts are common.

Apart from greed and fear, which were well articulated by many, I find that anxiety and ignorance also play a major role in explaining the huge losses in stock markets.

In 1992, I saw it in me. Even in 2020, I see it in many individual investors. Many individual investors still rush to buy stocks even after they rise 500 percent to 1,000 percent in just 6 months in their urge to make a quick buck while being completely ignorant about the underlying fundamentals.

Chasing stocks, which already ran up phenomenally in a short span of time without knowing underlying fundamentals, is like an individual chasing a running bus from the front entry for securing a seat – if he succeeds he secures a seat inside the bus, but if he slips down he has a chance of losing his life.

The overall market-cap was around Rs 2.50 lakh crore in 1992. Post the scam in 1992, the Sensex fell 40 percent.

There were some estimates, which say that only Rs 3,500 crore was withdrawn from the markets and it led to an erosion of Rs 1 lakh crore from the total market cap of around Rs 2.50 lakh crore in 1992.

In March 2020, foreign investors took out little more than Rs 52,000 crore from the markets – it led to an erosion of around Rs 52 lakh crore of overall BSE market-cap by March 23.

Last September, foreign investors sold a few thousand crore worth of Indian equities – in a matter of a few days our markets lost around Rs 11 lakh crore of market cap.

So, another learning is that the equity markets are like traditional “spinning top” toys – the needle at the bottom is the real fundamental, the bulging top is the market-cap supported by positive “perceptions”.

When perceptions get eroded and some significant size of liquidity is withdrawn, the fall in the perception-driven market-cap is as high as 10 times the real liquidity, which is withdrawn from the market.

So, never remain a perennially long-term investor– especially, in small- and mid-cap stocks - if perception-driven valuations of individual stocks hit the bubble zone.

Just recall the history – a large number of stocks like in granites and investment space which were fancied in 1992 completely disappeared from the markets.

Thus, never invest borrowed money in stocks; and stay for the long-term, but if valuations hit bubble zone don’t hesitate to book profits and exit.

Never invest in stocks that have multiplied several-fold in a short span of time without knowing underlying valuations.

Most of the time, bull runs in the markets played out in a thematic fashion – starting from 1992, the Indian markets have seen several themes (aquaculture, NBFCs, etc) being played out at bubble valuations. Always be wary of these thematic valuation bubbles.

Never test your ignorance (on valuations and quality of the stocks) in the stock markets with a big proportion of your hard-earned savings.

However, staying invested in quality (in terms of management and balance sheet) stocks with attractive valuation comfort for the long-term as the Indian equity asset class is proven to be an attractive wealth-creation tool in the long-term.

If you are investing in small-cap stocks, unless the managements are publicly well-known for their governance, try to invest in stocks that have more than 10 to 15 years of listing experience on the stock exchanges.

Such long experience on the secondary markets gives an opportunity to evaluate the commitments of the management and performance of the core operating business.

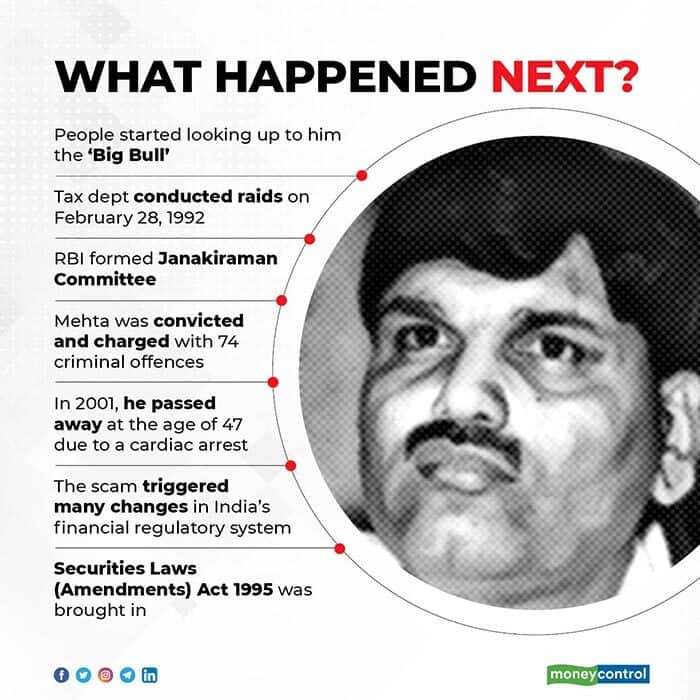

Read our entire coverage on Harshad Mehta here

(The author is Founder, Equinomics Research & Advisory Private limited)

Disclaimer: The views expressed by the author on Moneycontrol.com are his own and not that of the website or its management.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.