The Nifty Microcap 250 index has given over 47.45 percent returns in the last one year, compared to the Nifty50’s 20 percent. That’s not bad, given the uncertain macro environment and rising interest-rate scenario over the past one year. But only 4 percent of the mutual fund industry AUM (assets under management) is invested beyond the top 500 companies.

“That means investors who want to take a risk and invest in this segment don't have a chance to do so,” said Mahavir Kaswa, Head of Research, Passive Funds, Motilal Oswal AMC. That is why the fund house has recently launched India’s first Nifty Microcap 250 open-ended index fund.

“It enables investors to take an exposure to a targeted risk asset category,” he added. Globally, there are funds tracking the Wilshire 5000 and an even broader MSCI World Microcap Index with close to 6500 constituents.

Busting the mythFor starters, microcaps are not companies with less than Rs 1,000 crore of market capitalisation. In fact, the smallest microcap in the index – GRM Overseas - has a market cap of Rs 1,009 crore.

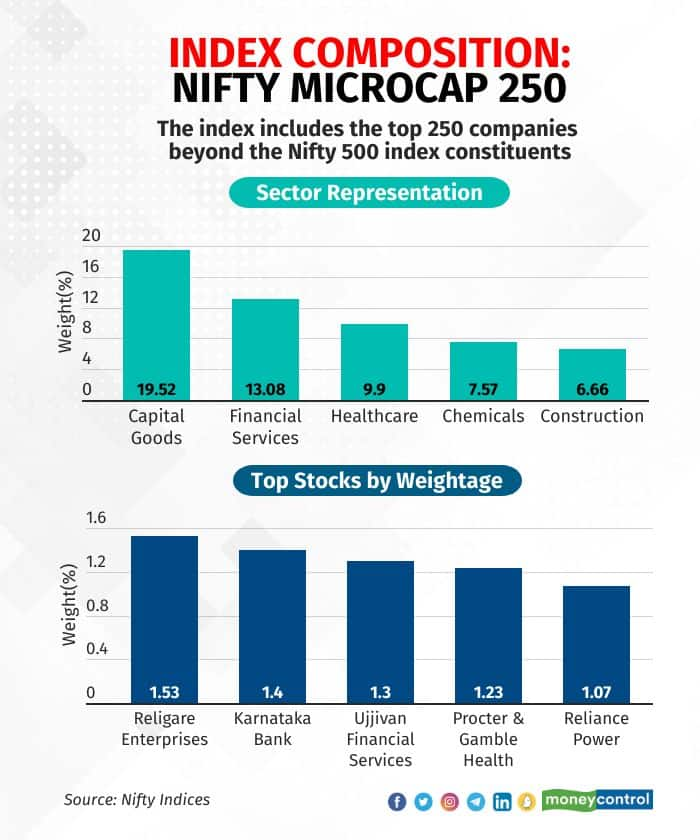

“According to NSE indices, microcaps are companies that rank below 500 and up to 750 in market capitalisation ranking. 1 to 100 are largecaps, 101 to 250 are midcaps and 251 to 500 are smallcaps. So, the largest microcap actually has a market cap of Rs 11,000 crore,” Kaswa said.

Several interesting names pop up in the index – like Karnataka Bank, Ramkrishna Forgings, Akzo Nobel and Mrs Bector Food Specialities. Newbies in the market could mistake them as smallcaps, but actually they are microcaps.

.

.This eliminates the risk of stocks being moved in and out of the ESM framework frequently. ESM or Enhanced Surveillance Measure has been recently introduced to monitor micro-small caps with market cap less than Rs 500 crore, that are illiquid and witness sharp price fluctuations.

Under-researched gems?Of the 250 stocks that comprise the microcap space, 31 companies have more than five analysts covering it, 112 companies have less than that and 107 companies have no coverage. The average number of analysts covering a microcap is just two.

“We thought this is an excellent opportunity, particularly because active management cannot be done here as much as we want,” Kaswa said. “These companies also cater to niche businesses, which are usually overlooked by largecap and midcap companies. They are also more agile in decision-making as bureaucracy is less.”

What about the churn?NSE rebalances the index twice every year – in March and September. Every time, about 40-50 companies are thrown out and replaced by new names. This is because liquidity is low and company-specific risks are plenty.

“Unlike the largecap indices where the churn happens on the bottom, here the churn happens on both ends. Some companies might migrate to the smallcap index while some might cease to be in the top 750 companies,” he said.

Such high churn also means high tracking error. Tracking error is essentially the divergence between the price behaviour of a position or a portfolio and the price behaviour of a benchmark.

Motilal Oswal’s Nifty Midcap 150 Index Fund and Nifty Smallcap 250 Index Fund have a one-year tracking error of 0.15 percent and 0.16 percent, respectively. This fund will definitely have a higher tracking error than that, agrees Kaswa, but the number “won’t be horrible”.

All said and done, the fund has set a benchmark and other fund houses might follow suit. It also gives an investor higher exposure to industrial and consumer discretionary stocks, compared to IT and financials in Nifty 50. “But, investors need to bear in mind that it is a risky proposition and maybe a 5-10 percent portfolio allocation is good enough to be rewarded handsomely,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.