Indian stocks are poised to rebound from a rough stretch, as market watchers pin hopes on a potential trade deal with the US and consumption tax cuts to support a recovery ahead.

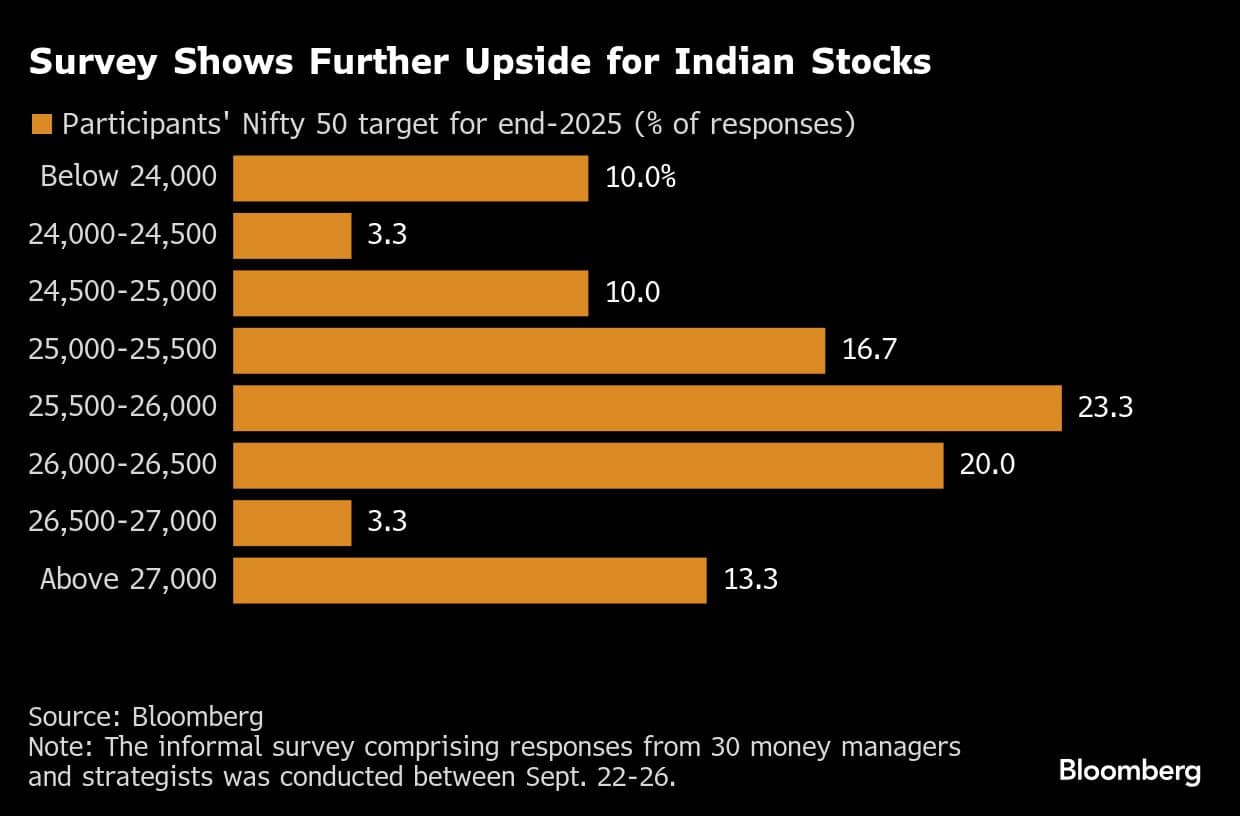

The NSE Nifty 50 Index may reverse its decline of 3.6% in the three months to September, according to a majority of the respondents in a Bloomberg survey of 30 strategists and fund managers. More than a third of the participants see the gauge rising at least 5.5% by the year-end to surpass its previous peak.

That will help the index narrow its underperformance to regional peers and also put it on course for a 10th straight year of advances. Only Nikkei has done better historically, with its 12-year rally about four decades ago.

The informal survey, conducted last week, signals a shift in investor view on India. A separate survey showed a recent momentum in Chinese stocks may cool, with the CSI 300 Index likely to post a modest 1.2% rise by the year end.

Investors are betting on lower consumption taxes and interest-rate cuts by the Reserve Bank of India to turn the tide in the market’s favor, especially as some analysts point to a crowded AI trade in the region. India has also resumed trade negotiations with the US to strike out a deal after it was hit with a 50% tariff.

“Any positive outcome on the US tariff could act as an immediate catalyst for the market,” said Karim Al-Mansour, managing director at Amanah Capital, a London-based hedge fund. “Even the fundamental outlook suggests a recovery is likely to begin in the final quarter of the year, with more gains in 2026.”

Nearly half of the survey respondents said the benchmark index will perform in line with other Asian gauges in the current quarter, while more than one-third of them expect it to outperform peers. Even though fresh US duties on patented drugs and a hike in H1-B visa fee hit investor sentiment, survey participants expect Indian equities to rise further next year on improvement in earnings.

The benchmark gauge has risen just about 4% this year, its smallest gain since 2022, trailing most Asian peers. That might be an opportunity for some investors to buy Indian stocks, with HSBC Holdings Plc strategists upgrading their stance on local equities to overweight, citing attractive valuations relative to peers.

The Nifty 50 is trading at 19.8 times its 12-month forward earnings, down from a multiple of 21.3 a year ago, according to data compiled by Bloomberg. In September, the gauge posted its first monthly gain since June, signaling a turnaround.

Risks still hang over Indian equities, survey respondents said, including a potential breakdown in trade talks with the US, lackluster urban consumption, and continued foreign outflows.

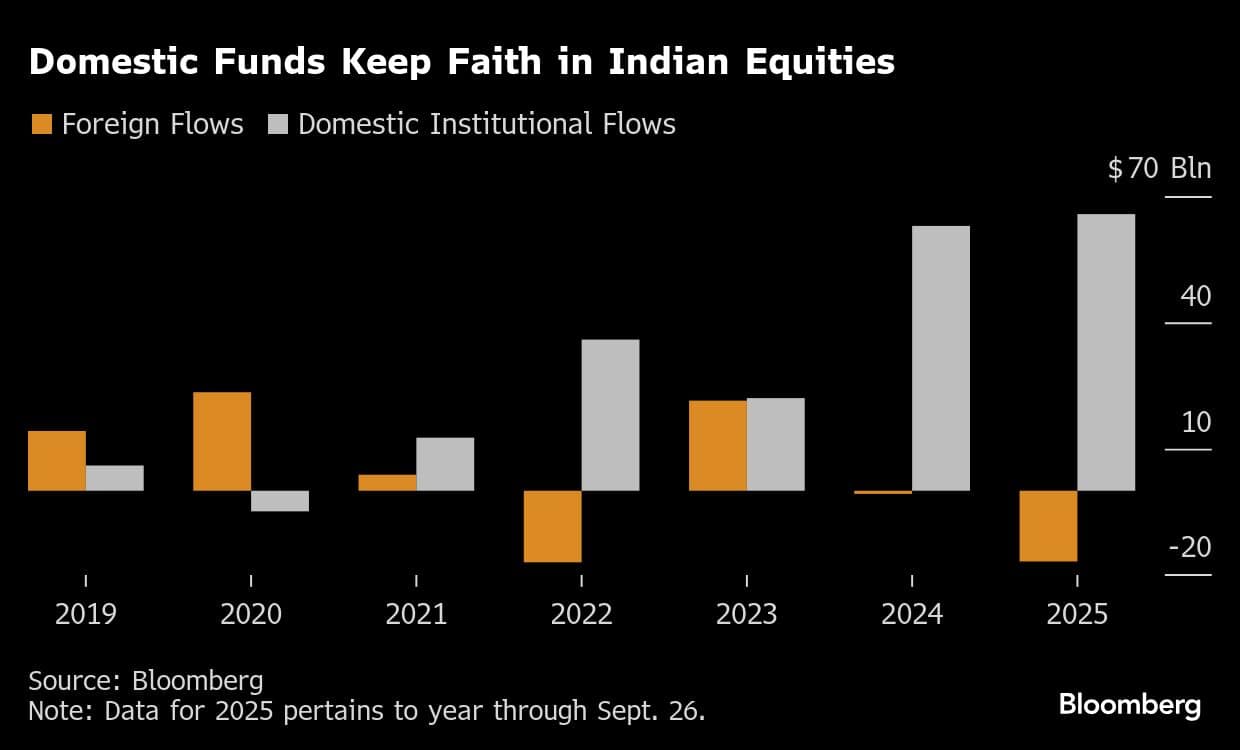

Overseas investors have pulled nearly $17 billion from the nation’s stocks this year. The impact of outflows, however, has been offset by record purchases by local institutions. Passive buyers are also stepping in, with US-listed India exchange-traded funds seeing inflows for a fourth straight week.

“Most negatives are priced in and we are set for a bounce-back,” said Jimeet Modi, founder of Mumbai-based Samco Securities. “Any reversal in foreign selling could lead to a significant upside.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.