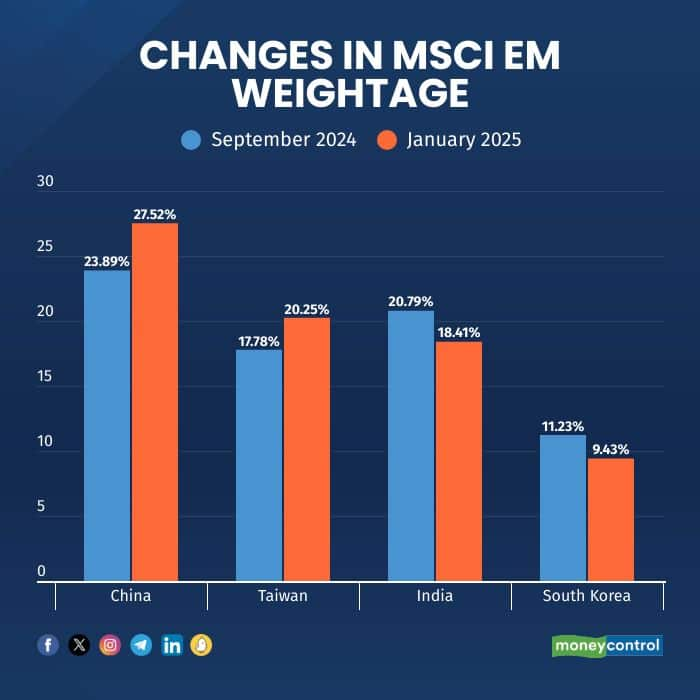

India has slipped to the third place in the MSCI Emerging Market index, falling under China and Taiwan. The country's weightage has also tumbled under the key 20 percent mark amid the ongoing correction.

India's weighting in the MSCI EM and the MSCI EM Investable Market Index (IMI) - both indices that see flows of up to half a trillion dollars from foreign investors - has been been on a steady downtick as China and Taiwan's equity markets outperform the domestic blue-chips.

In September 2024, as India's frontline indices surged to record highs, the country's weightage in the MSCI EM index hovered around 20.8 percent, making up the second spot. However, as the rout in the domestic markets wiped off almost $1 trillion in wealth, the stocks in the index saw their share prices fall, causing India to slip to the third spot in the index, with a weight of 18.41 percent by January 2025.

India had overtaken China in the MSCI EM Investable Market Index (IMI) in August to become the largest weight, and was nearing the threshold to surpass China as the top weight in the broader MSCI Emerging Markets index as well. But amid the domestic sell-off, China reclaimed the poll position in the index in October and by January 2025, India's weight has pared down to 19.7 percent, down from 22.3 percent reported in September.

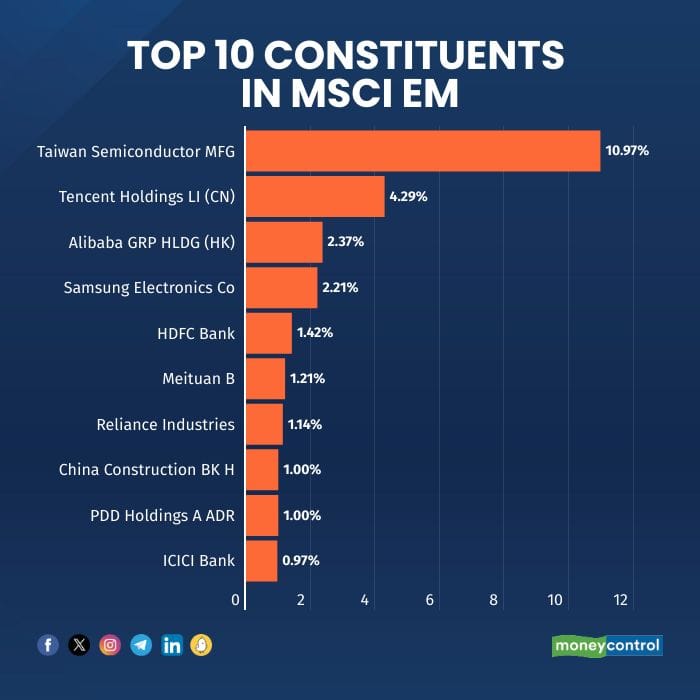

Three Indian companies feature on the list of the largest 10 constituents in the MSCI EM index: HDFC Bank, Reliance Industries, and ICICI Bank.

On a positive note, India's weightage in the index is likely to see an uptick, rising to 19 percent after MSCI's quarterly rejig, which would lead to passive inflows between $850 million and $1 billion, according to domestic broking house Nuvama Alternative & Quantitative Research.

The brokerage predicted that the inclusion of recently listed auto player Hyundai Motor India would lead to inflows of around $257 million itself, while IndusInd Bank is likely to see passive flows of $264 million during the upcoming rebalancing, which will take effect after market close on February 28.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.