The saying is that dreams come true, but on D-Street investors are wondering what if the deal comes true!

Sure, the market is always full of chatter, sometimes idle, about hot deals being in the works, but at the centre of the speculation this time are three powerful logistics companies.

Delhivery, one of India’s largest Business-to-Business and Consumer-to-Consumer logistics providers, is said to be in talks to buy Allcargo Logistics’ stake in express distribution and supply chain solutions company Gati.

Delhivery and Allcargo Logistics have denied that they were in any discussions for such a buyout, in separate statements to stock exchanges.

Now, investors are debating what a deal, if it actually happens, would mean for the three logistics players.

What to keep an eye onMarket watchers are watching three things with a hawk’s eye: deal valuation, timeline and when the synergies will kick in.

A deal could trigger an open offer as well, said an analyst from a foreign brokerage firm who did not want to be identified.

Read more | MF romance with logistics deepens with Delhivery, but fizzles out for GatiAwanish Chandra, Executive Director at SMIFS Ltd, said investors would be very interested in knowing the kind of synergy benefits that would flow in from the deal for both Delhivery and Gati.

Delhivery has a strong presence in the air cargo and E-commerce space, whereas Gati's strength lies in surface logistics. So a combined entity can become a formidable logistics player, he said.

“Maybe, this deal materialising could trigger buying interest in the stocks,” Chandra added.

Share price surgeIn the past three years, Allcargo Logistics’ stock has given a stellar return of over 320 percent. Gati has made investors happy by rallying over 220 percent during the same period.

Delhivery, on the other hand, listed at Rs 493 on the BSE in May last year, and the stock is now trading at Rs 363.

What could happen if the deal comes trueIf this deal goes through, it would certainly benefit all players involved, market participants say.

Financials of Allcargo

Financials of AllcargoIf the rumoured deal actually materialises, it would be interesting to observe how Gati's strength in express logistics and robust fleet fits in with Delhivery's efficient pincode mapping, hyperlocal coverage and effective last-mile delivery, said Nirav Karkera, Head of Research at Fisdom.

“While Gati remains an important component of AllCargo Logistics' overall operations, any divestment would need to happen at a significant premium to Gati's current contribution to AllCargo's overall business and value yet to be unlocked.”

Growth trajectory of Allcargo

Growth trajectory of AllcargoGati can be expected to aid Delhivery's ambitious roadmap to scale operations and emerge at the top of the expected, steep growth in e-commerce, including logistics endeavours reaching beyond geographic borders, he added.

A buyout would be a huge positive for Gati, several market participants said.

“Gati will get a better end-mile delivery, that would be a big boost for it,” said Anmol Das, Head of Research at Teji Mandi, a subsidiary of Motilal Oswal Financial Services.

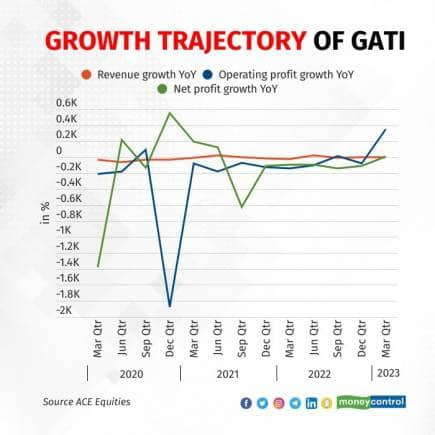

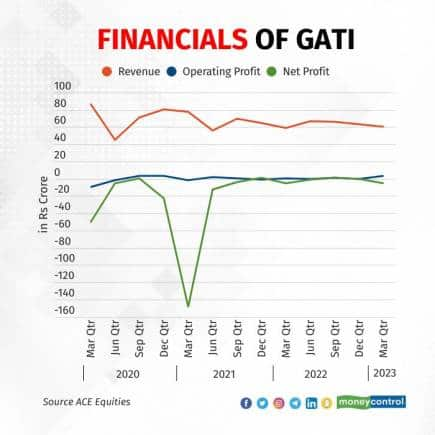

Financials of Gati

Financials of GatiA competent competitor like Delhivery buying out Gati would certainly be a positive for the Allcargo Group because not only will it help in business expansion but also help improve services, said the analyst from a foreign securities firm cited above.

High reverse logistics cost has been a challenge for Gati and with Delhivery in the picture, this issue could be resolved and the express distribution company would be able to lower costs and expand margins, he explained.

Rohan Mehta, Chief Executive Officer and Portfolio Manager at Turtle Wealth, says Delhivery shares are expensive but Allcargo Logistics has been a super value creator for him, which makes him believe the stock could be still be accumulated. In fact, Allcargo Logistics has been among his top holdings.

Financials of GatiChallenges

Financials of GatiChallenges To be sure, some experts believe surface logistics players may face hiccups. Das pointed out that with the rise in toll collections across India with new highways getting commissioned more often over the last year, surface logistic players were facing issues with margins. Growth has been hampered by last year’s global supply chain issues and the dent in exports.

Even so, some fund managers and analysts believe one can jump on the bandwagon to invest in any of these stocks. Provided the deal comes true!

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.