The balance sheet is one of the three fundamental financial statements and is key to both financial modelling and accounting. The balance sheet gives us the financial information of a company for a particular year (i.e. the last day of the financial year on which the balance sheet is made).

The balance sheet is a measure of the solvency of the business. It gives us the information on the asset, liability and shareholders equity on a particular day. It is the report card of the company.

Assets = Liability + Shareholder’s equityAssets represent the value of ownership that can be converted into cash (although cash itself is also considered as an asset).

Types of assetsAssets can mainly be classified in two types- tangible and intangible asset.

Tangible assets contain various sub-classes, including current assets and non current asset. Tangible Assets are one which can be seen like plant and machinery, land, etc.

Intangible assets can be only felt like patent, goodwill, etc.

Types of liabilitiesLiabilities are anything that a company has to pay back either within a year or after a few years.

Liabilities can again be subdivided into two parts- current and noncurrent liabilities.

A very important term while evaluating the balance sheet is equity.

Stockholder’s equity is the value left over for shareholders if a company (or any entity) would utilize its assets to meet its liability obligations. The leftover is termed as equity.

These were basic definitions of the terms. Now let us go into a little in-depth understanding about the break up under assets, liabilities and shareholder’s equity. Thus let us understand the whole balance sheet by dividing it into further parts.

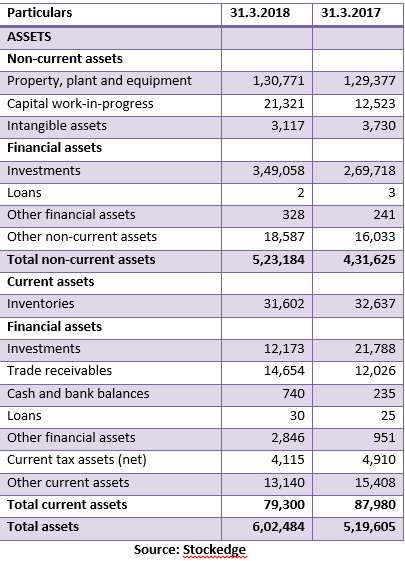

The following is the balance sheet of Maruti Suzuki as on March 31, 2018. We will understand the jargons keeping in view this balance sheet.

In the asset side, we can see the asset is divided into two parts- current and non-current asset.

Current asset refers to those assets which are expected to be converted to cash within a year. Current assets consist of items like inventories, cash and bank balances, debtors, loans, etc.

Whereas assets that take more than a year to be converted to cash are referred as non-current asset. Non current asset consist of items like property, intangible assets, work in progress, financial asset, etc.

What we find from the above comparison of non-current assets is that the CWIP of the company has doubled and the long term investments have also risen significantly YoY. The company has invested into new land and building plant and machinery. The company has also invested in debt mutual funds.

In the current assets, short term investments have reduced and the short term financial assets have increased significantly. The company has invested for short term into debt mutual funds which can be liquidated easily. The company has debtors, number of which has risen.

Thus both of these data - current and non - current points to significant investments by the company which may play out in the next few quarters or a year.

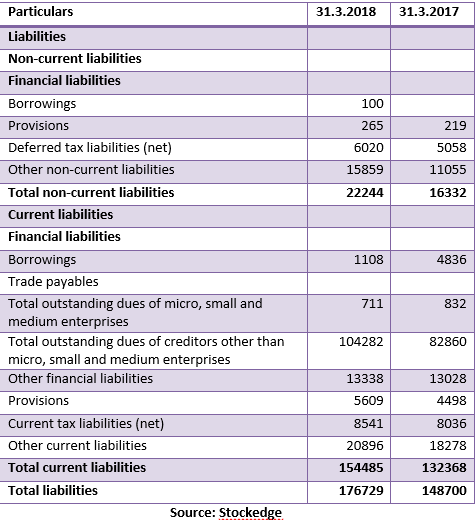

The liabilities also like the asset can be divided in two parts- current and non-current liability.

Current Liability can be referred to as those liabilities which will arise in the next one year. Current liabilities include short-term borrowings, trade payables, provisions, etc.

Whereas non-current liabilities are those that need not be settled in the next one year. Non-current liabilities include long-term provisions, other long term liabilities, etc.

The above data shows that the company has taken a long term borrowing for the first time. Its other long term liabilities have also increased.

The short term liabilities have decreased but its creditors and provisions have risen simultaneously. Provision is for legal disputes, deferred revenue and an increase in trade payables led to surge in current liabilities.

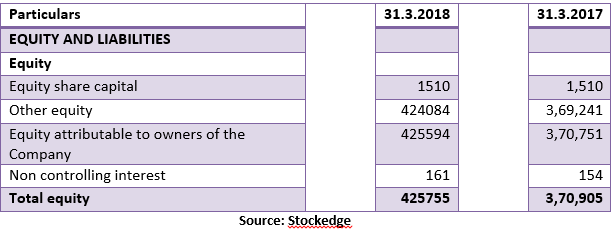

The last part of the balance sheet that needs an understanding is equity. Equity basically represents the ownership part of the company. By equity, it refers to the authorised, issued, paid-up capital of the company (as the case maybe). Shareholder’s equity also contains other equity that mainly comprises of reserves, securities premium reserve, retained earnings, etc. Above is the equity portion that is contained in the balance sheet.

The reserves or retained earnings of the company have risen.

Conclusion:Thus, from all of the above data, we can infer that the assets have risen not on the back of increased debt but from internal accruals. Thus the company’s financial health looks good based on the balance sheet performance data.

Thus this is how we can read a balance sheet - like a story to understand whether the good or bad assets have increased or the good or bad liabilities have increased. Accordingly, we can infer from the balance sheet the financial strength of any company.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.