IIFL Research

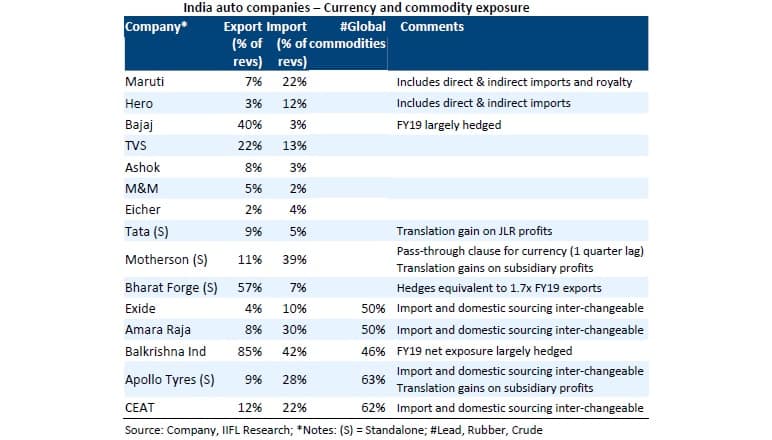

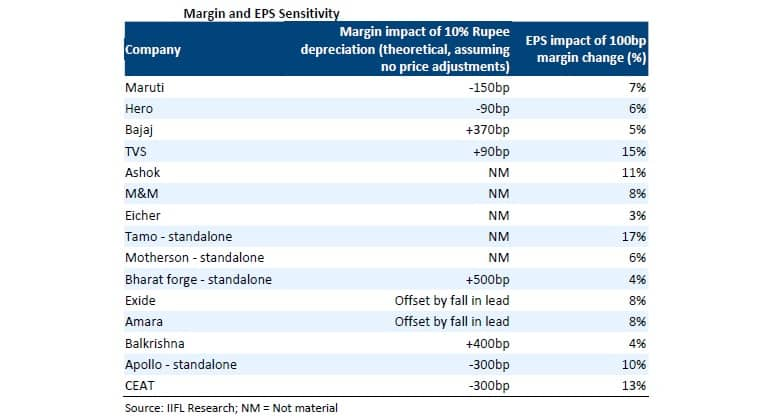

The sharp depreciation of the rupee versus US dollar and other currencies would impact earnings of auto companies. Net exporters namely Bajaj Auto, Bharat Forge and Balkrishna Industries would be beneficiaries, while net importers such as Maruti may lose out.

Users of global commodities such as lead and rubber would also be negatively impacted by rupee depreciation; however, the concurrent fall in dollar prices of these commodities would provide relief. Users of crude derivatives (tyre makers) would face a double whammy - of higher crude price and a weak rupee.

Revenue share of exports for Balkrishna (BIL) is the highest (at 85 percent) among all covered auto companies. Of this share, Europe contributes around 53 percent. However, net currency exposure for BIL is around 40 percent (mainly Euro), as raw material imports comprise 42-43 percent of revenues (USD-linked).

As per the FY18 Annual Report, the total value of hedges (in rupee terms) was around Rs 1,650 crore on March 31, 2018, which is equivalent to 36 percent of FY19 export revenue estimates and around 73 percent of the net exposure.

BIL uses fixed-rate forward contracts for hedging. As per management, more than 80 percent of FY19 net exposure is hedged at 81-82. Hence, the full benefit of the recent sharp appreciation in the EUR (versus Rupee) will flow through only in FY20.

Bharat Forge (BHFC)'s export revenue share is around 57 percent, of which 73 percent is USD-based. BHFC has the highest hedge ratio (percent of revenues covered) among all auto companies.

As per its FY18 Annual Report, BHFC's total outstanding hedges are equivalent to Rs 6,130 crore (all fixed-rate contracts), which is 172 percent of FY19 export forecast.

As a result, despite having a significant export contribution, the recent rally in USD (versus Rupee) will not benefit BHFC meaningfully for the whole of FY19 and a large part of FY20. The full benefit may be captured only in FY21.

Bajaj Auto has material revenue contribution from exports (around 40 percent), most of which are USD-denominated. As per its FY18 Annual Report, outstanding hedges stood at Rs 10,510 crore (86 percent of FY19 estimate).

However, two-thirds of these hedging contracts are range-forwards (options), which provide some upside potential if spot rate moves above the contract rate. Also, only 18 percent of total hedges are beyond one year.

Hence, we expect Bajaj to realise the benefit of the rupee depreciation sooner than BIL and BHFC.

As per management, Bajaj has hedged around 80 percent for FY19. The key issue is whether USD appreciation would impact the purchasing power of Bajaj's export customers.

Maruti would be negatively impacted by sharp rupee depreciation (versus Japanese Yen) due to its high-cost exposure to imports (around 22 percent of revenues).

These are only partly offset by exports. Maruti hedges only a small portion of the net exposure. As a result, fluctuations in forex rates impact margins almost immediately.

In addition to around 5.5 percent royalty outgo (mainly JPY); it has 4-5 percent direct and around 12 percent indirect imports (half in JPY). Yen has appreciated sharply (up 5.4 percent from Q1FY19 average), which should negatively impact Maruti in coming quarters.

As a result, we are trimming FY20-21 EBITDA margin by 50-60bps, leading to EPS cut of around 4 percent. The cut in FY19 EPS is 2 percent, as impact would be felt only in second half of FY19.

Battery-makers: Rupee depreciation more than offset by fall in lead price

Lead being a global commodity, domestic prices are closely linked to import parity. The rupee depreciation would have hurt battery-makers, given that lead cost is equivalent to around 50 percent of revenues.

However, a sharp fall in the USD price of lead implies that battery-makers are actually better off. Lead price (in Rupee terms) is about 8 percent lower than the average price in Q4FY18.

Tyre-makers: Rubber benign, but crude would hurt

The rupee price of rubber has not moved up substantially, with the weak rupee partly offset by softness in the USD price of rubber. However, tyre makers also consume crude-linked commodities (synthetic rubber, carbon black, chemicals etc.), which have been impacted by the weak rupee as well as the rise in crude price.

Tyre-makers have announced price hikes across segments, which may help offset a part of the impact. However, the hikes may not suffice.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions. The above report is for information only and not buy or sell recommendations.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.