After a blockbuster September, primary markets will remain in the spotlight the month of October as well with 3 companies raising cumulatively raising over Rs 2,600 crore.

The month of September didn’t exactly go the way bulls would have imagined after hitting a record high but as many as 7 companies raised money in primary market worth over Rs 16,000 crore.

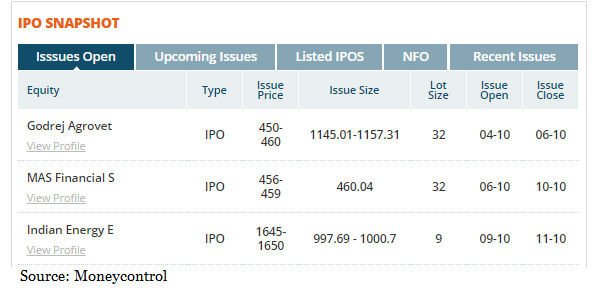

Three companies are scheduled to open their issue in the first 15 days of October which include names like Godrej Agrovet, MAS Financial Services, and Indian Energy Exchange.

In the first half of FY18, Nifty rose a little over 7 percent but there was plenty of action in the primary market.

Indian companies raised a record close to Rs 27,000 crore through initial public offerings (IPO) in the first half of the current fiscal and an impressive pipeline is already in place for coming months.

Adding to the depth of the IPO market, companies from diverse sectors like insurance, healthcare, education, bank, cable TV, and shipping have made their way to the IPO space during the period under review, said a report.

According to the latest data compiled from stock exchanges, 19 companies garnered over Rs 26,720 crore through their respective IPOs in April-September of the ongoing financial year, much higher than Rs 16,535 crore raised by 15 firms in the year-ago period, it said.

“We have seen good investor interest – retail, HNI, and institutional clients — in all marquee IPOs. We believe there is enough capital to match the supply of quality new papers,” Arindam Chanda, Executive Director, and Head, Broking, IIFL told Moneycontrol.

“If you see IPO performance, it is evident that fund houses are betting on the long-term prospect of these companies. There are pre-IPO funds which are banking on such opportunities,” he said.

Godrej Agrovet has set a price range of Rs 450-460 a share for its initial public offering to raise up to Rs 1,160 crore (USD 177.6 million).

A unit of Singapore's Temasek Holdings will sell up to 12.3 million shares, which at the upper end of the price range would be worth Rs 566 crore.

The animal-feed producer is selling new shares worth up to Rs 292 crore in the IPO, while its main shareholder Godrej Industries is selling secondary shares of up to Rs 300 crore.

MAS Financial Services aims to raise Rs 460 croreMAS Financial Services said it has fixed a price band of Rs 456-459 per share for its initial share sale offering, through which it is estimated to raise Rs 460 crore. The initial public offer (IPO) will be open to public subscription during October 6-10.

The company is a Gujarat-headquartered non-banking financial company (NBFC) with more than two decades of business operations and presence across six states and the NCT of Delhi.

Indian Energy Exchange plans to raise up to Rs 1,000 croreIndian Energy Exchange Ltd has set a price range of Rs 1,645-1,650 per share for its initial public offering that opens on October 9, to raise up to Rs 1,000 crore.

Shareholders of the electricity exchange are selling a little over 6 million shares, or 20 percent of the post-issue paid-up capital, in the IPO that closes for subscription on Oct. 11.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.