The market performance in the first half of 2019 was fairly better than the same period last year. Sensex and Nifty rallied around 8 percent each in H1CY19 against the rise of 4 percent and 2 percent, respectively, in the first six months of 2018.

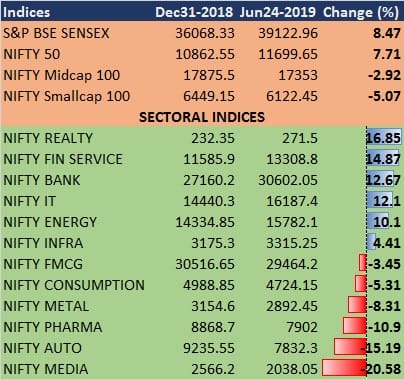

Similar to 2018, banks and IT stocks were at the driving seat of the rally in the January-June period of 2019. Realty was the biggest gainer surging 17 percent on hopes of demand revival. Nifty Bank gained nearly 13 percent and Nifty IT index jumped 12 percent in the same period. Energy and infra stocks also helped the benchmark reach record heights.

However, there were six sectors—auto, consumption, FMCG, metal, pharma and media—that could not keep up with the rally in benchmark indices and fell flat on their faces because of heavy sell-off in respective constituent stocks.

Nifty Auto index fell 15 percent, Consumption 5.3 percent and FMCG 3.5 percent in the first half of 2019, largely affected by the slowdown in economic activity, rising cost, liquidity crisis in NBFCs and revised emission norms.

Metal (-8.3 percent), Pharma (-11 percent) and Media (-20.6 percent) were the other three indices that lost the most in H1CY19. Pharma sector has been under pressure for several quarters now, largely due to US pricing pressure and USFDA issues. Metals have been hit by global trade war concerns, weak global prices and some moderation in domestic demand.

Table: Returns of 12 sectoral indices in the January-June period of 2019.

After a mixed sectoral performance in the first half of 2019 in which the rally was driven was select stocks, the second half is also likely to be the same, experts said, adding earnings, Union Budget and global factors will direct market.

"A revival in corporate earnings and private capex expected in the second half can give the much-needed fillip to the market and a strong justification for premium valuations the market is factoring," Mayuresh Joshi, Portfolio Manager, Angel Broking told Moneycontrol.

"To fight the impending global slowdown, the global central bankers have suggested a loose monetary policy that shall ensure ample liquidity for risk on asset classes like equities. So budget announcements, liquidity tightness easing off, demand coming back in the second half of this fiscal and respite from the US-China trade wars might bring relief," he added.

So, how should an investor play this market? One way could be to adopt a phased approach rather than investing a lump sum. Banking & financials and infra will be key drivers in July-December period in 2019, experts said.

"The sectors that are more likely to do well include banking, quality NBFCs, infra and cement. Consumption may be weak on performance," Bhavesh Sanghvi, CEO, Emkay Wealth Management said.

This is the third instalment of the six-part half-yearly review series. You can read the first and second part here.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.