Till the end of October 2023, i.e., for the first 10 months of the year, the US Aggregate Bond Index was down almost 2.8 percent for the year.

As of last Friday, i.e., November 3, 2023, it was down just 0.5 percent year-to-date.

So, what happened in just 3 days?

After all, a 2.3 percentage points move in half a week is significant even for equity indexes, let alone a supposedly stable US bond index.

Before getting into the details, let me broadly explain what caused long-term bond yields to decline.

Also read: US bond yields dip despite better-than-expected flash PMIAs you know, when bond yields (or interest rates) go down, bond prices go up. Therefore, the upswing in the bond index actually reflected the decline in yields, especially for the 10 and 30-year bonds.

And why did these yields go down?

Because a number of macroeconomic indicators on economic activity and the labor market showed signs of a slowdown.

This was considered good news, as the Federal Reserve had desired this outcome. So if the economy slows down, the Federal Reserve (the Fed) was unlikely to raise rates and might cut interest rates sooner than expected. That's how the markets' logic went.

However, macroeconomics is a reflexive science, where things move in endless feedback loops.

Actions undertaken by central banks affect what happens in the economy and the markets, which, in turn, influences what central banks like the Fed do. And on and on it goes.

During last week's meeting, the Fed was considered less hawkish on raising rates than before.

But what it actually said was this: They may not need to raise rates much because the market was doing the job for them by raising long-term yields, and other financial market indicators also showed tightening.

However, this statement itself brought long-term yields crashing down, which may, in turn, cause the Fed to become more hawkish.

The rates coming down and bonds rallying were also accompanied by rallies in other asset classes. In the past week, ETFs tracking stocks, government bonds, and corporate credit recorded their biggest weekly cumulative gain since November 2022. Even Emerging Markets, which have been relative underperformers, rallied.

Recently, correlations across asset classes have been positive not only during sell-offs but also in rallies, limiting diversification benefits.

Here's a snapshot of the recent performance: Source: Bloomberg, First Global; Data as of November 3, 2023

Source: Bloomberg, First Global; Data as of November 3, 2023In the first three days of November 2023,

* Global equities, represented by the ACWI, saw an impressive gain of 4.2 percent. The Eurozone, EM ex-China, and Latin American markets posted gains of 4 percent to 7 percent. Notably, MSCI Japan recorded a robust 5.2 percent jump while MSCI South Korea soared 8.6 percent.

* In the bond market, high-yield bonds surged by 2.4 percent, while investment-grade bonds (IG) saw an increase of 2.2 percent. Real Estate Investment Trusts (REITs) experienced a strong 6.3 percent rebound from near 1-year lows.

* In the currency markets, the US dollar (DXY) depreciated by 1.5 percent to a 1-month low while the J.P. Morgan emerging market currency index strengthened by 1.5 percent.

What drove the rally?Let’s dive into the sequence of events that led us to this wave of buying across assets:

* Monday, October 30: The US treasury department indicated that it would borrow $776 billion in the fourth quarter (Q4) of 2023 i.e. $76 billion less than it had anticipated in July.

For context, in the prior quarter i.e. Q3 2023, the treasury increased its net borrowing estimate to $1 trillion, well up from the $733 billion amount it had predicted in early May. The issuance jump for Q3 had pushed 10-year treasury yields higher by 100 basis points (bps) to 4.93% in 3-months.

While the drop in bond issuance from that high a level was taken as a positive sign, it still remains very elevated relative to history.

* Wednesday, November 1 (7 PM IST): Two days later, the US treasury department said that the issuance of longer-term securities, particularly 10-year notes, in Q4 of 2023 and Q1 of 2024 would not balloon as much as feared because it would shift issuance from longer-term securities to T-bills (1 month to 1 year) and to 2-year notes. Thus, long-term bond yields dropped, as markets expected a larger increase in supply, which could have pressured bond prices.

* Wednesday November 1 (7:30 PM IST): The US ISM Manufacturing PMI (Purchasing Managers Index), which is a monthly gauge of the level of economic activity in the manufacturing sector in the United States versus the previous month, contracted sharply in October, falling to 46.7, lower than the estimate of 49.0. This prompted a further drop in bond yields. Any reading below 50 indicates an anticipated contraction.

*Wednesday November 1 (11:30 PM IST): The US Federal Reserve left interest rates unchanged. Fed Chair Powell's remarks appeared dovish relative to market expectations. His reference to higher longer-term rates as a reason to withhold further tightening created an awkward interdependency with the market.

Consequently, we witnessed a 10 bps drop in 2-year treasury yields to 4.84 percent, the lowest level since August 11 as the market moved to price in 100 bps of rate cuts by the end of 2024.

* Friday November 3: The highly anticipated US Non-Farm Payroll (NFP) report revealed that only 1,50,000 jobs were added in October (versus 1,80,000 expected). The September number was also revised lower to 2,97,000 from 3,36,000 earlier. Wages grew 0.2 percent month-on-month, below the expected 0.3 percent. The unemployment rate rose to 3.9 percent (vs 3.8 percent expected).

All these indicators showed that labour market was not as robust as earlier thought.

Since labour market tightness was one of the reasons for the Fed to raise interest rates, the cooling down reinforced expectations of a looser monetary policy, subsequently boosting prices in equities, bonds, and credit.

The all-important question: What's next?The combination of the above-discussed data points has sparked hopes for a "Goldilocks" period -- a scenario where the possibility of ending rate hikes is considered in light of softer economic data, all while avoiding a full-fledged recession in the US economy.

Additionally, the size of the move in a fairly short period suggests a decent amount of short-covering as well.

Still, two key risks remain.

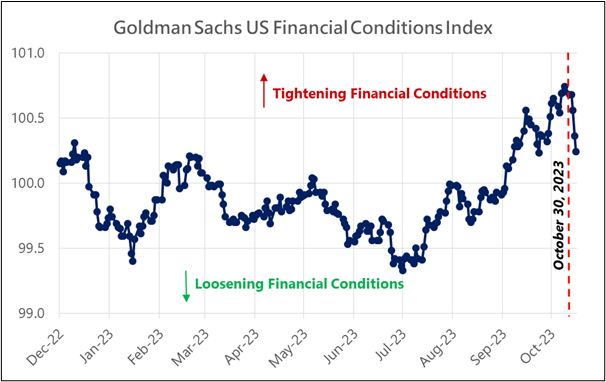

The Reflexivity TrapFed Chair Powell explicitly mentioned that he closely monitors multiple financial conditions indices. These indices take into account the movement in stocks prices, bonds yields, and credit spreads among others.

In his earlier press conferences, he stated that if the markets and financial conditions tighten, the Fed may need to raise rates by a much smaller amount because the macroeconomic consequences of tightening financial markets or the Fed increasing rates are the same.

If the current cross-asset rally continues, financial conditions could substantially loosen, potentially altering the Fed's policy stance and keeping rate hikes on the table.

Source: Bloomberg, First Global

Source: Bloomberg, First GlobalTherefore, there is an implicit cap on the rally that can be expected from risky assets such as equities and corporate credit.

A greater than expected Economic Slowdown or RecessionLogically, the only way the Federal Reserve may refrain from considering any additional rate hikes or even potentially cut interest rates starting in the first half of 2024 is if the softer economic data does not stabilise and, in fact, deteriorates significantly.

But that will be bad news for corporate earnings and corporate credit.

Currently only scenario building and probabilities are possible. Making a firm prediction on how things pan out is not.

(Devina Mehra is the Founder, Chairperson and Managing Director of First Global, an Indian and global quant Asset Manager. She tweets at @devinamehra. The website is www.firstglobalsec.com)

(Harsh Shivlani also contributed to this article.)

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.