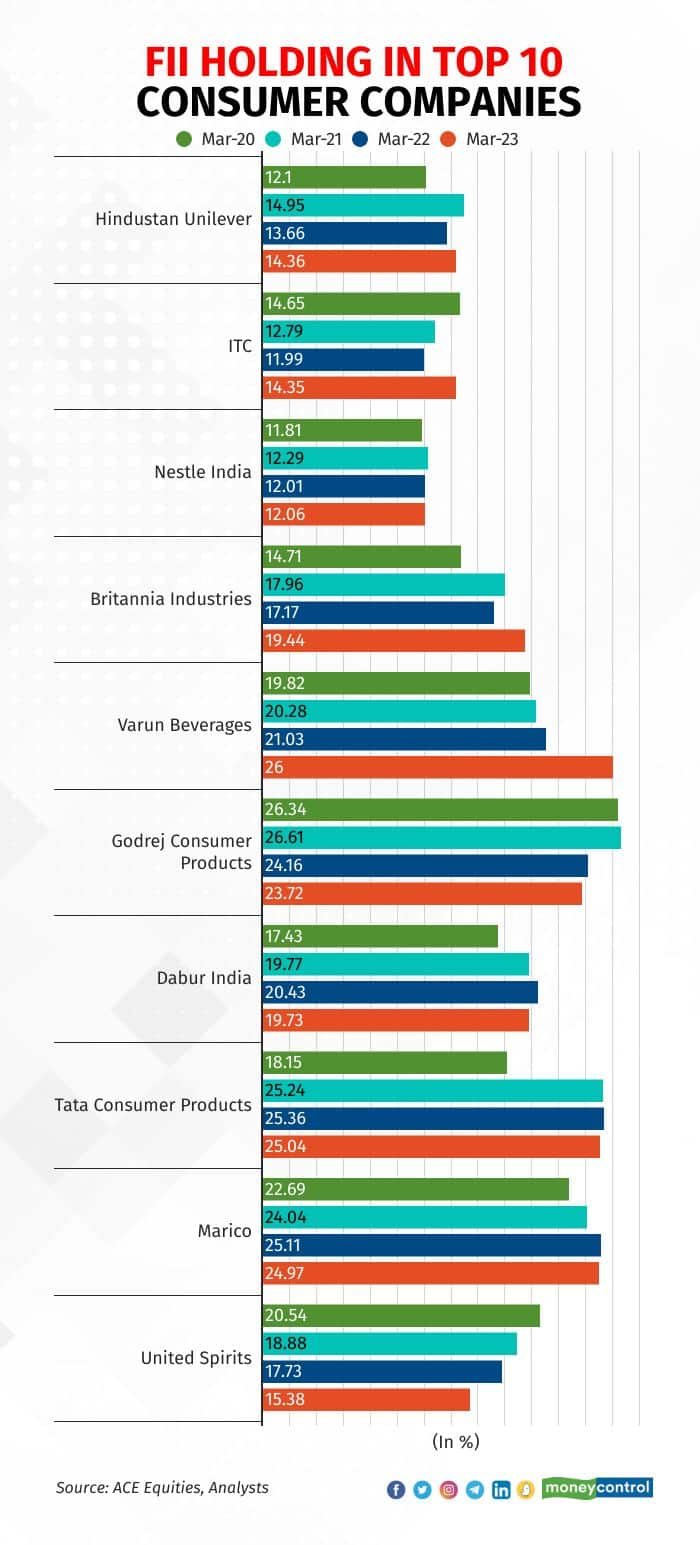

Ye dil maange more - That's what foreign institutional investors (FIIs) are saying to Pepsi bottler Varun Beverages. They don't want Pepsi; they want the shares. From 19.82 percent in March 2020, FII stake in this consumer stock increased to 26 percent by the end of March 2023.

According to a Moneycontrol analysis of the top 10 consumer companies by market capitalisation, FIIs have increased stakes in seven. The biggest jump has come in Varun Beverages, Britannia, and Tata Consumer Products.

For Varun Beverages, the optimism largely comes from the company expanding its high-margin businesses. One example is Sting. The energy drink Sting has been positioned at a favourable price point, attracting the masses.

Due to the higher mix of Sting, the company's net realisation per case came in at Rs 174 for Q1 CY23, up 10 percent year-on-year (YoY). Sting, along with other energy drinks, will soon be 15 percent of the portfolio, said Chairman Ravi Jaipuria in the latest earnings concall.

"VBL has seen 15 percent organic volume growth in the last three years, led by distribution expansion in underpenetrated territories and new launches (Sting, milk-based beverages, etc.)," according to ICICI Securities.

For Britannia, FIIs seem to have taken heart from the fact that the Good-Day biscuit maker managed to defend its margins during the pandemic. While the operating margins of most FMCG companies slumped due to high raw material prices, Britannia's remained consistent at 16-17 percent over the past three years.

Morgan Stanley, which has a ‘buy’ rating on the stock, with a target price of Rs 5,300, said Britannia's March quarter beat on estimates was entirely margin-led. The management’s focus is to build for the next 100 years, unlike investors who may overemphasise short-term margins, it added.

Moreover, consumer preference is towards large, trusted, and organised brands in times of hyperinflation.

"Investors with long-term bias and patience are likely to be rewarded as formalisation will be more visible in the food space, given a higher share of the unorganised sector, who are themselves grappling with supply chain challenges," according to analysts at Philip Capital.

Tata Consumer Products, too, saw a jump in FII stake over the past three years ― from 18.15 percent in March 2020 to 25.04 percent in March 2023. During this period, the stock gained over 150 percent.

While the company's international coffee business was reeling under inflationary pressure, its India food business held fort. The India business has a higher margin, especially the branded business at around 14 per cent and international business at 11 per cent.

Recently, the company's Chairman N Chandrasekaran said that they are open to acquisitions and expanding into new categories. "India’s business growth would continue to outpace that of the international market, with the percentage of revenue from the Indian market expected to increase," he said.

What about ITC?FII stake in retail favourite ITC has remained steady at about 14 percent, despite the 150 percent rally in the stock price over the past three years. While the company is firing on all cylinders ― cigarettes, FMCG, and hotels, the perception of a 'sin stock' is hard to shake off. That said, FIIs' stake in the company is at a historically high level.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.