Akash Jain

Can factor indices replace market-cap-weighted indices?

Both – factor and market-cap-weighted – indices play a different role and both are relevant to the market participants. Factor indices are not designed to replace market-cap-weighted indices.

Broad-based or market-cap-weighted indices represent the entire investable opportunity set for market participants. They aim to capture long-term equity risk premium with low portfolio turnover, high trading liquidity, and large investment capacity.

Factor indices look to capture targeted risk premia following a rules-based and transparent index methodology. Not only is the stock selection for these indices based on specific factor criterion, but the stock weights are also related to the stocks’ factor scores, which are used to create factor tilts within the index portfolios. In contrast to passive products based on broad-based indices, factor-based strategies can provide an opportunity for market participants to express their active views away from market-cap-based portfolios.

What are the advantages of multi-factor investing?

Despite some single-factor portfolios outperforming the market over the long term, they experienced periods of underperformance in different macroeconomic conditions depending on their defensive/cyclical characteristics.

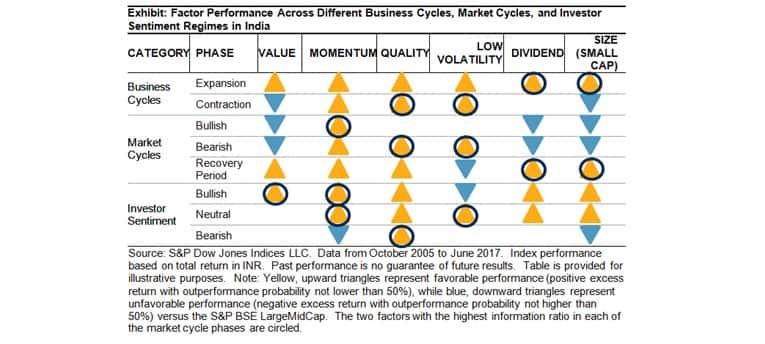

For example our study observed that in the Indian context, Quality and low volatility factors tended to be more defensive, while the dividend, value, and size factors displayed pro-cyclical characteristics across different macroeconomic regimes.

In the table below, yellow upward triangles represent favorable performance (positive excess return with outperformance probability not lower than 50 percent), while blue downward triangles represent unfavorable performance (negative excess return with outperformance probability not higher than 50 percent) versus the S&P BSE LargeMidCap. The two factors with the highest information ratio in each of the market cycle phases are circled.

Blending a number of desired factors with low correlations is a potential way to attain a balanced and diversified portfolios.

Do factors deliver higher risk-adjusted returns than other benchmark indices?

Over the period from October 2005 to June 2017, portfolios for all factors, (low volatility, momentum, value, quality, dividend, and size) outperformed the S&P BSE LargeMidCap (see Exhibit below).

However, only low volatility, quality, and momentum delivered better risk-adjusted return (return per unit of risk) than the S&P BSE LargeMidCap.

Among the six factors, low volatility and quality recorded lower return volatility than the benchmark and had the highest risk-adjusted return, while value, dividend, and size showed much higher return volatility than the benchmark.

Which have been the two most overweight and underweight sectors, on average, over the last few years and going ahead?

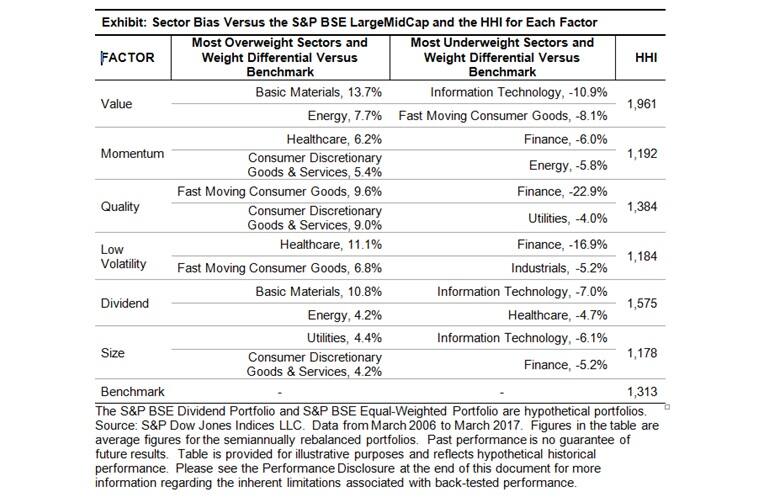

Sector bias typically exists in factor portfolios, and the sector concentration in the factor portfolios could differ substantially from market-cap-weighted benchmarks. Historically, based on the Hirschman-Herfindhl Index (HHI), size portfolio tended to be the most diverse in terms of sectors, while the value and dividend portfolios had the most concentrated sector exposures.

Exhibit below highlights the two top and bottom most overweight and underweight sectors, on average, for each factor over the period from March 2006 to March 2017. Value and dividend were overweight in basic materials, whereas momentum, quality, and size were overweight in consumer discretionary goods & services.

The finance sector was most underrepresented in the momentum, quality, low volatility, and size portfolios, and the information technology sector was underweight in value, dividend, and size portfolios. The differentials on sector exposure across factors were strongly associated with the unique cyclical nature of the various factor performances.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.