The market remained range-bound as traders were cautious ahead of the first quarter earrings of key companies. Analysts have expected a wild ride with several sectors facing the prospects of a downgrade in earnings.

As of 11.30 am, the Nifty 50 index was up 0.06 percent or 12.15 points to 19,451.55. Nifty Bank performed better, rising 0.28 percent to 44,868.45.

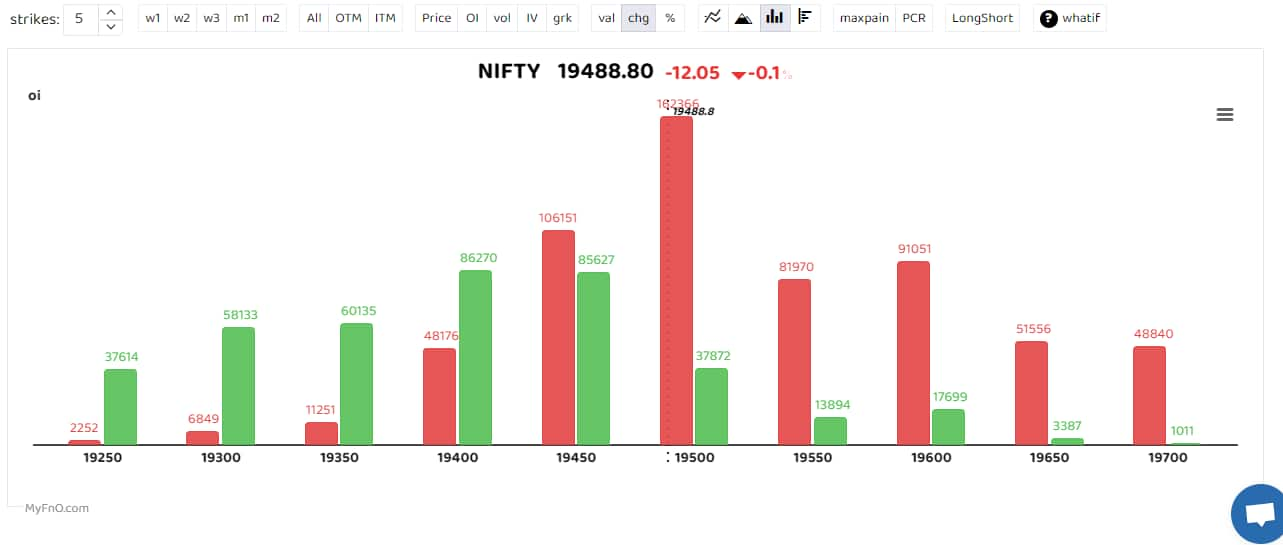

Option data shows 19,500 remains the biggest hurdle for Nifty for now. 19,450 was seeing Straddle trades, which is a neutral strategy employed by traders. Put writings at 19,400 and lower levels continued to provide support to the index.

Rahul K Ghose, Founder & CEO – Hedged, said the Nifty derivative data is hinting towards an expiry above 19,300 for both this weekly expiry and the July monthly expiry.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

Bars reflect change in OI during the day. Red bars show call option OI and green put option OI.

“On the upside, Nifty will have to cross and close above its previous high around 19,520 to start its next up-move. This leg of the up-move however will be slow, and not as fast paced as the move above 18,700. On the Bank Nifty, the level to break on the upside is 45,200 for a further up-move to happen,” he said.

Among individual stocks, Bata India saw short build-up. Traders also took bearish positions in LTI Mindtree, Hindustan Aeronautics and Coforge, among others. Delta Corp saw massive long unwinding.

Ashok Leyland, Aditya Birla Capital, Sun TV and HDFC AMC were those that saw long build-up.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!