Calendar year 2018 was quite strong for technology companies, which reflected in stock prices as well, thanks to strong IT spending by clients, and rupee depreciation.

These stocks rallied in the range of 12-39 percent in last one year with biggies like TCS, Infosys, Wipro and Tech Mahindra climbing the maximum 32-39 percent. However, correction seen in these stocks in December quarter was largely due to overvaluation, rupee appreciation and weak market conditions.

"The December 2018 quarter was strong courtesy a solid IT spending environment and was powered by execution of deal wins of the earlier quarters. Consistent with expectations, total contract value (TCV) and deal pipeline are strong," Kotak Institutional Equities said.

Increased onsite cost structure was visible though cost rationalisation helped many companies mitigate it, it added.

Revenue growth was strong across companies. Tier-1 IT companies reported constant currency revenue growth in the range of 1.8-5.6 percent on sequential basis and 7-13 percent YoY on constant currency basis.

Companies reported record TCV wins with growth in excess of 14 percent on YoY (trailing twelve months) basis in many cases.

Digital continued as a major growth driver during Q3FY19 with a growth of 30-50 percent YoY for most companies. Managements of most companies are seeing positive demand for FY20 as digital transformation journey.

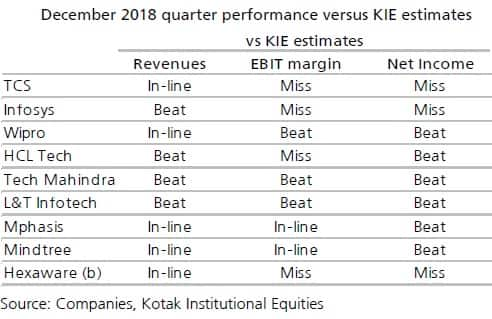

Out of top nine companies, six beat Kotak's estimates on profit front — of the six, three beat on margin front and three on revenue. Only two companies, Tech Mahindra and L&T Infotech, surpassed expectations on all parameters.

"Performance on margins was a mixed bag with decline reported by TCS and Infosys and increase by Wipro and Tech Mahindra. The pressure point on profitability is resulting largely from shortage of talent in the US combined with challenges on procurement of fresh visas and even renewals of existing ones," Kotak said.

The research house expects the headwind (increase in reliance on subcontractors in the US to fulfill demand, inflating costs in the process) to continue in FY20.

Analysts largely expect steady growth in the fourth quarter as well, but after strong exit from FY19, FY20 is not expected to be strong one due to challenges of likely slowdown in the US, and China-US trade war concerns. In addition, movement in USD-rupee rate is the biggest risk.

"FY20 growth will be a function of two factors — (1) external headwinds emanating from slowdown in the US, uncertainty around Brexit and trade wars, and (2) tailwind from increasing digital deal sizes and accelerated deal momentum courtesy clarity on simplification of the core," Kotak said.

Admittedly a strong exit to FY19, bulging order book and positive commentary on demand should translate into a far better FY20, but the downside of a slowing market and the margin implications of the same cannot be ignored either, it added.

All said, the research house expects FY20 growth to be broadly in line or marginally lower than FY19. "Within this, certain companies will report higher growth and some other lower in FY20E over FY19."

Niharika Ojha, Analyst at Narnolia Financial Advisors also believes demand looks robust but the industry is grappling with supply-side constraints to cater to the demand.

"In order to meet the skill to aggressively capture the demand, companies are moving towards subcontracting to fulfill their needs resulting in margin contraction due to higher cost involved. Also, companies are making investments into training employees and adding workforce. Infosys, which captured the early sign of these challenges, should be the first to start bearing fruits of its early investment," she said.

According to her, attrition remains a key concern as the shortage of talent is giving the skilled employees a higher advantage across the market.

Experts largely feel majority of positives seem to have been priced in but there are stocks, where valuations are still attractive on expected growth in revenue and margin front, which can still give good return going ahead.

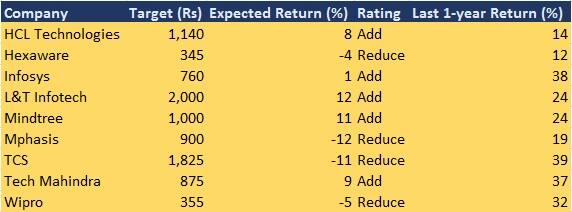

Table: Ratings and target prices on IT companies by Kotak Institutional Equities

Kotak advised adding HCL Technologies, L&T Infotech, Mindtree and Tech Mahindra which could return 8-12 percent. The research house prefers stocks that trade at inexpensive valuations and have potential to surprise either on revenue growth and margins.

"Tech Mahindra meets the criteria effectively with potential for revenue growth acceleration and available at reasonable valuations of 14X FY20 earnings. Infosys has scope for revenue growth acceleration though the post-result multiple expansion and closure of valuation gap with TCS could potentially limit meaningful returns in the near term," it explained.

Niharika Ojha said Narnolia's top picks are Infosys, HCL Technologies and Tech Mahindra.Centrum, which believes a strong exit revenue run-rate in Q4FY19 could help momentum for the sector in FY20E, expects TCS/Infosys to outperform

on USD revenue growth, expecting 9.5-10.5 percent growth for both vendors in FY20.

"Wipro is also likely to show marked acceleration in FY20 and we expect Wipro to deliver 5.4 percent organic USD revenue growth for FY20," it said, adding Tech Mahindra is also likely to pivot in FY20 with 7.5 percent USD revenue growth rate, led by revival in the telecom vertical.

The research house prefers Infosys, Tech Mahindra and Wipro among Tier 1 IT companies. NIIT Tech and Mindtree are its preferred midcap picks while Sonata Software is its top pick among small caps.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.