The divergent performance in frontline stocks and mid-cap stocks is prompting traders to take to mid-cap derivative products. Hitherto, traders were hooked largely to Nifty and Bank Nifty, which were seen as the main indices to take bets on market direction. But with mid-caps showing no sign of slowing down and large-caps continuing to be in slumber, traders are getting hooked to mid-cap derivatives.

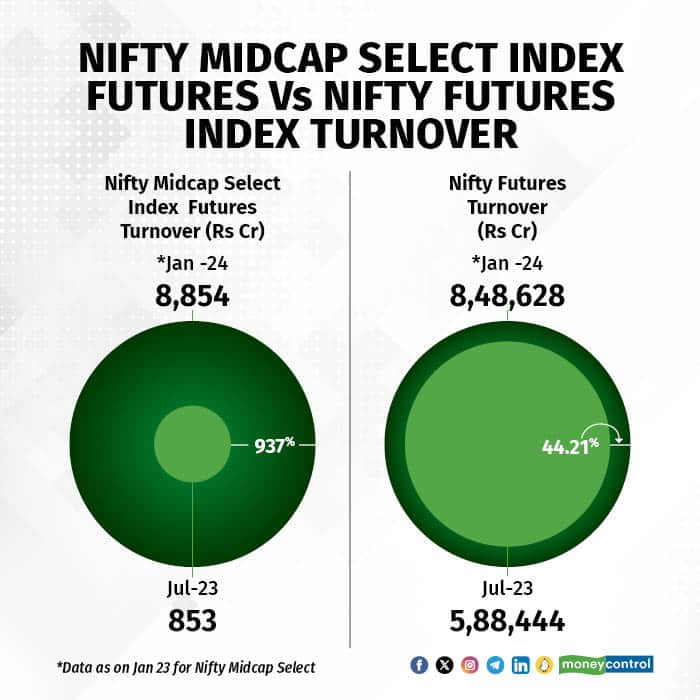

Turnover in the futures segment of Nifty Midcap Select, the only index for which derivatives contracts are available for trading in the mid-cap space, has jumped by nearly 1,000% for the period July 2023 to January 2024. During the same period, index options premium turnover jumped by over 600 per cent, NSE data shows.

938 per centThe number of futures contract traded in January 2024 jumped to 1,12,800 from 13,600 in July 2023 leading to turnover of Rs 8,854 in January 2024 from Rs 853 crore in July 2023. The number of index options contracts traded in January 2024 jumped to 50 crore from 10 crore in July 2023. The option premium turnover grew to Rs 46,349 crore in January 2024 from Rs 6,293 crore in July 2023.

Follow our live blog for all market action

Follow our live blog for all market action

Nifty Midcap Select index is the only index derivatives available for trading in mid-caps on Indian exchanges. Nifty Midcap Select index (MIDCPNIFTY) futures and options expire on Monday of the expiry cycle. The Nifty Midcap Select index aims to track the performance of a portfolio of 25 liquid mid-cap stocks. Stocks are selected from the Nifty Midcap 150 index based on availability for trading in the F&O segment, market cap and average daily turnover. Stock weights are based on free-float market capitalisation.

PFC, Indian Hotels, Coforge, Persistent System, and AU SFB are the top index constituents. Financial services, Capital Goods and Information Technology are the top three sectors represented in the index.

Why is derivatives trade rising in this index?Participation in the derivatives market is on the rise in India with the derivatives to cash ratio at 400x as on July 2023, the highest in the world. Volumes in Nifty futures have jumped by 44 per cent since July 2023, however, the volumes is Nifty Midcap Select index have jumped much higher, also owing to the low base. Market experts say that in an environment where the derivatives volumes are increasing in India and the midcap index is outperforming the key benchmark index, it should not be surprising if there is rising participation in the only index derivative product on mid-caps. Besides, this may also be necessitated by a need to have a closer hedge for mid-caps in case of a correction. Darpan Patil, Rupic Consultancy Services said: "We have seen divergent performance in midcap stocks and largecap stocks in recent times. Midcap have been outperforming for sometime. If one has to hedge the midcap exposure, a derivatives contract representing midcap stocks is certainly a better option than Nifty. However, the volumes in Nifty Midcap Select index futures is no match to that of Nifty."

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.