Selling pressure continued for the third successive week as recession fears deepened in the West, with the Indian equity benchmarks falling more than 1 percent in the week ended September 30.

The losses were, however, curtailed by the stellar rally on September 30 after the Reserve Bank of India (RBI) as expected raised the repo rate by 50 basis points to 5.9 percent.

The central bank also maintained its full-year inflation forecast at 6.7 percent but lowered its growth estimates to 7 percent from 7.2 percent.

Given the volatility and subdued global environment, the domestic market would focus on global cues, September quarter earnings, monthly manufacturing and services data along with currency trends, experts said.

The Sensex plunged 672 points to 57,427, while the Nifty50 tanked 233 points to 17,094 during the week.

Broader markets also traded in line with the benchmark, as the Nifty midcap 100 and smallcap 100 indices declined 1.3 percent and 1.5 percent.

On October 3, the market will first react to monthly auto sales numbers released over the weekend.

"It’s going to be tough for markets to build on Friday's rebound amid feeble global cues. A lot would depend on how the banking and financial pack perform as other sectors majors are not offering any decisive signal," Ajit Mishra, VP-Research at Religare Broking said.

It will be a holiday-shortened week as the market will remain closed on October 5 on account of Dussehra.

Here are 10 key factors that will keep traders busy next week:1) Economic data pointsS&P Global Manufacturing PMI for September will be released on October 3, while S&P Global Composite PMI and Services PMI data for September will be shared on October 6.

S&P Global Manufacturing PMI had come in at 56.2 and Services PMI at 57.2 in August, which most experts expect to be at around 56 and 57 for September.

Also read: Suzlon Energy Founder and Chairman Tulsi Tanti passes awayBank loan and deposit growth for the fortnight ended September 23 will be released on October 7.

2) Foreign exchange reservesThe street will closely look at the foreign exchange reserves data for the week ended September 30 to be shared on October 7, as the last print was at the lowest since August 2020 with the RBI intervening to steady the rupee amid global volatility.

The forex reserves for the week ended September 23 declined by $8.13 billion to $537.518 billion due to a drop in the foreign currency assets that contributed the most to the reserves, RBI data shows.

3) The rupeeThe Indian rupee appreciated by 50 paise against the US dollar after the RBI move, the rally in equity markets and a drop in the greenback. On weekly basis, however, the Indian currency weakened by 36 paise to settle at 81.35 after slipping to a record low of 81.95 against the dollar during the week.

Also read: Eco Week | US jobs at cruising speed may keep up pressure on Fed

The rupee, which depreciated by 221 paise in the last two-and-half-week, is expected to remain within the broad range of 80-82 levels in the coming days.

"We expect the rupee to trade with a positive bias on a jump in domestic equities and rise in risk appetite in European markets. A weak US dollar and overall weak tone in crude oil prices may also support the rupee. However, concerns over global economic recovery may cap a sharp upside," Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas said.

USDINR spot price is expected to trade in a range of Rs 80.30 to Rs 82.50 in the next couple of sessions, he feels.

The US dollar index, which measures the value of the American currency against a basket of world's leading six currencies, fell from a fresh 20-year high of 114.78 to 112.12 during the week. The movement in DXY will be closely watched as several Fed officials are going to deliver speeches this week.

The US 10-year treasury yield will also be watched after it rose to 4 percent last week before cooling a bit to close the week at 3.829 percent. The run-up was seen from 2.57 percent levels in the last two months, especially after consistent aggressive policy tightening by the Federal Reserve which has intimated a rate hike as high as 4.6 percent in its battle to tame inflation.

4) FII flowWith rising bond yields and further policy tightening, foreign institutional investors (FIIs) have once again started withdrawing money from India. They net sold nearly Rs 15,900 crore worth of shares last week, taking the monthly outflow to over Rs 18,300 crore against Rs 22,000 crore of buying in the previous month.

Also read: World economy roiled by simultaneous shocks echoing 2007 anxiety

The mood at FII desk will be watched and if the outflow continues, the upside may be restricted in the coming weeks, experts said.

Domestic institutional investors managed to make up for the FII outflow, buying more than Rs 14,000 crore worth of shares in the passing month.

5) Oil pricesInvestors will also track crude prices, as oil traded below $100 a barrel in September and remained volatile amid rising recession fears, which raised concerns over the demand outlook. A Reuters report said OPEC+ may cut crude output at its meeting on October 5.

International benchmark Brent crude futures fell a $1 barrel during the week to settle at $85.14. The price corrected 26 percent in the September quarter.

"Overall market sentiments for crude oil remains bearish unless we see a significant output cut from OPEC+ next week. The Chinese economic data showed consolidation in manufacturing and services activities in September, the short-term volatility could see prices facing resistance around $85-$88 a barrel," Mohammed Imran, Research Analyst at Sharekhan by BNP Paribas said.

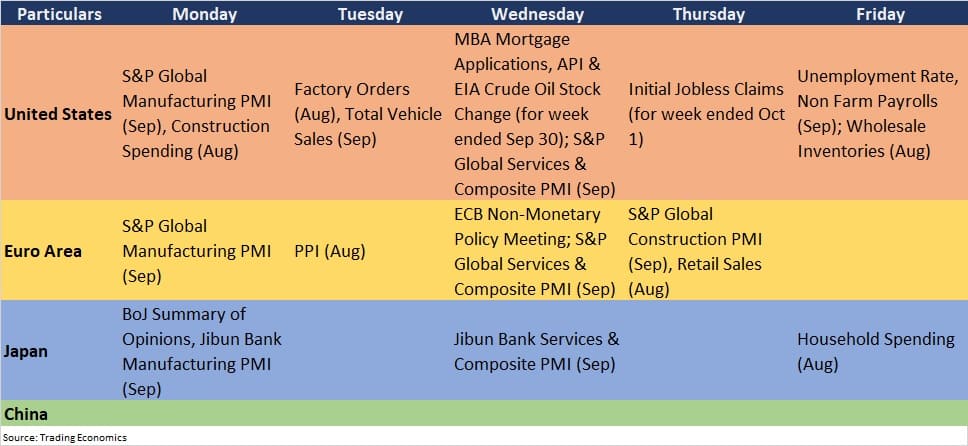

6) Global data pointsHere are key global economic data points to watch out for next week:

The Nifty managed to get back above the psychologically vital 17,000 mark as well as its 200-day simple moving average (around 16,990), with crucial support at 16,750.

The index formed a Bullish Engulfing candle on the daily charts on September 30, and a hammer pattern on the weekly scale, which is a bullish reversal pattern formed at the downtrend.

If the index holds 17,000, there is a possibility of it filling the bearish gap zone of September 26 and surpassing 17,300-17,500, experts said.

"Such weekly chart pattern after a reasonable decline calls for bottom reversal for the market. We observe a broadening type pattern, which is unfolding in Nifty as per weekly timeframe chart. As per this pattern, the upper trajectory comes around 18,100 levels, post confirmation of this pattern," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

The placement of important support and the overall chart pattern of daily and weekly signal a crucial bottom reversal at 16,747 levels. One can expect a follow-through upmove in the coming week.

The overhead resistances to be watched is around 17,200-17,300. A sustainable move above this hurdle is likely to open the doors for 18,100 in the near term, the market expert said.

8) F&O CuesThe options data indicates that the Nifty will see a broader trading range of 16,500 to 17,600, while in the immediate term, the range could be between 16,700 and 17,500.

The maximum Call open interest was seen at 18,000 strike, which can be crucial resistance for the Nifty in the October series followed by 17,500 strike, with Call writing at 17,100, 17,500 & 17,200 strikes.

The maximum Put open interest was seen at 16,000 strike, which can be significant support point in the current F&O series followed by 17,000 and 16,500 strikes, with Put writing at 17,100, 16,800 and 16,700 strikes.

Volatility remained high, though it cooled down in the later part of the week to settle below 20 mark at 19.97 levels. It was down 3 percent during the week.

If the volatility drops further, the possibility of Nifty inching towards 18,000 grows, experts said.

9 IPO BuzzThe primary market will remain active in the coming week too. Electronics Mart India, the first IPO for December quarter, opens for subscription from October 4-7, with a price band of Rs 56-59 a share. The bit lot size is 254 shares and in multiples of 254 thereafter.

The company aims to raise Rs 500 crore through the IPO.

10) Corporate actionSamvardhana Motherson International, Yug Decor, Asian Hotels (East), Anshuni Commercials, Jonjua Overseas, and Ruchira Papers will start trading ex-bonus next week.

Here are other key corporate actions taking place in the coming week:

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.