Equity markets are unpredictable but analyzing past trends could give us some insights on investor behaviours at a particular point in time. There is a very famous saying which goes – “History doesn’t repeat but it often rhymes” is very apt in the context of Financial Markets.

After falling 1.3 percent for the month of September all eyes are on October which could lend some stability to markets. Last 10 years data suggests that in the past 7 out of 10 years, Nifty closed in green with returns up to 17 percent.

The index gave 17.5 percent return in the year 2007, followed by 2011 in which it rose by 7.7 percent, and in the year 2013, it gave 9.8 percent.

While in 3 out of 10 years Nifty closed in the red. The index fell 26 percent in the year 2008, followed by 2009 in which it dropped by 7 percent and it slipped marginally in the year 2012 by 1.4 percent.

The Diwali month, October is considered auspicious by most traders but there is a perfect storm which is brewing in Indian markets with both local as well as global headwinds.

The geopolitical concerns are unlikely to get abated anytime soon with the fresh war of words between the US and North Korea, apart from that fears of another rate hike from the US Fed later this year had already pushed the dollar higher and rupee lower. The rupee depreciated by over 1 percent in the month of September alone.

Fears of fiscal slippage due to rising crude oil prices, talk of additional stimulus to support the economy, and state farm loan waiver schemes all pose an additional burden on the government.

The Indian market was one of the worst performing markets for the month of September thanks to stretched valuations and dwindling macros, but analysts tracking D-Street suggest that the Bull Run remains intact and any corrections should be used to buy into quality stocks.

“Market sentiment remained weak owing to negative global cues, concerns over domestic fiscal deficit situation as well as higher crude oil prices. Going ahead, we expect the focus to shift to RBI’s policy and upcoming quarterly results and globally on the unwinding of the balance sheet by Fed and oil prices trend,” Teena Virmani, Vice President - PCG Research at Kotak Securities told Moneycontrol.

“Benchmark indices are currently trading at around 17x FY19 consensus estimates. We believe that earnings revival is absolutely critical for such rich valuations to sustain. However, we continue to believe that the long-term India story remains intact,” she said.

The September quarter earnings from India Inc. will be crucial in determining the near-term direction for markets. After a lackluster June quarter, analysts do not see a double-digit growth for the quarter ended September.

The market might have to tone down its expectations because the lag effect cause by DeMon and GST is likely to play out for the next two-quarters.

“We do expect the earnings picture to be better for the September quarter, as the June quarter performance witnessed the exceptional impact of GST implementation. For Q2, we believe the corporate performance to improve on QoQ basis aided by the re-stocking across sectors post GST implementation on July 1st,” Hitesh Agrawal, EVP & Head – Retail Research, Religare Securities told Moneycontrol.

“With a preponed festive season this year, we expect the earnings to reflect the same to a certain extent. However, we believe, notwithstanding pockets of revision, the Q2 earnings season is unlikely to have a major impact on the full year estimates at an aggregate level,” he said.

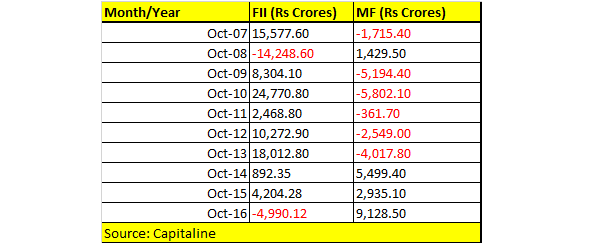

FII and MF activity in October:Last 10 years data suggest that foreign institutional investors have remained mostly net buyers in this month of October. They poured in over Rs 24,000 crore in Indian equity markets in the year 2010.

FIIs have only pulled out money in the year 2008 and then in 2016 when they turned net sellers pulling out nearly Rs 19000 crore cumulatively.

FIIs have turned away from Indian equity markets due to geopolitical concerns, a slowdown in corporate earnings, higher valuations as well as weak macros and better return prospects in other emerging markets such as China.

Foreign investors are turning their back on Indian shares as they pulled out over Rs 11,000 crore from stocks in September. The net outflow by foreign portfolio investors (FPIs) follows the withdrawal of Rs 12,770 crore from equities in August. Prior to that, they had pumped in over Rs 62,000 crore in the past six months (February to July).

“FPIs have been looking to rebalance their portfolios in search of better returns, hence shifting their money from the over-valued Indian stocks to some of the other under-valued emerging markets like Hong Kong,” Dinesh Rohira, CEO at 5nance.com, said in a report.

Mutual Fund managers usually booked profits in the month of October if history is anything to go by. Last 10 years data suggest that mutual fund managers pulled out money in 6 out of 10 years.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.