The calendar year 2021 was among the most unforgettable years for the Indian equity market.

The average BSE-listed stock rose 22 percent suggesting that a random basket of stocks could make investors richer than in most years over the past decade.

That said, much of the exuberance of 2021 has met with the gloom of 2022. Sentiment on Dalal Street this year has been one of pervasive bearishness as aggressive interest rate hikes, slowing economic growth and soaring inflation have taken a toll on investors’ risk appetite.

A geopolitical crisis in Europe with the invasion of Ukraine by Russia in late February has further compounded the macroeconomic headaches for investors. The Nifty 500 index, the broadest gauge for the Indian equity market accounting for 90 percent of the market capitalisation, has fallen nearly 13 percent this year after the 30 percent bounce last year.

“Globally as well as domestically equity markets continue to worry over aggressive rate hikes and their impact on economic growth. We expect the market to remain under pressure with increasing fears of economic slowdown,” said Siddhartha Khemka, head of retail research at Motilal Oswal Financial Services.

Euphoria ZoneYet, in some corners of Dalal Street it’s raining multi-bagger stocks like it’s 2021 as the euphoric sentiments of the last year appear not to have dimmed to any extent. While the absolute number of multibagger stocks has fallen sharply in 2022 so far, the year has produced more 11-bagger stocks than the previous year.

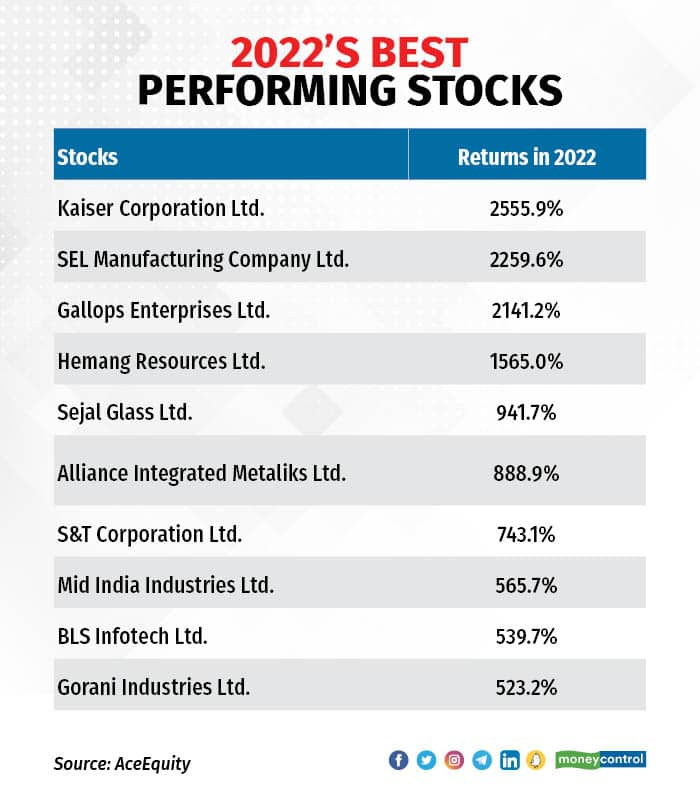

An analysis of 3,492 BSE-listed stocks showed that more stocks have given 11-bagger or 1,000 percent returns so far in 2022 than in the same period of 2021. In 2022, four stocks have given returns of more than 1,000 percent as compared to merely one in the same period a year ago, data on AceEquity showed.

Similarly, the top 10 most rewarding stocks on BSE in 2022 so far have on average given nearly twice the returns that the top 10 best performing stocks in the first six months of 2021.

A common theme among the strong performing stocks on BSE this year is that fact that six out of four of them were penny stocks at the beginning of the year while all 10 of them are microcap companies with low free-float.

Penny stocks are often associated with retail investors given the high holding such investors tend to have in this market segment. The strong performance of such penny stocks can partly be attributed to the continued inflow of retail money in the domestic stock market despite general downturn in market performance and sentiment.

Most of these stocks have none or negligible presence of institutional investors, a key criteria to judge a stock’s long-term prospects, corporate governance standards and authenticity of the price movement.

Narrative still rulesThe year’s best performing stock so far, Kaiser Corporation, has risen more than 2,550 percent driven by the euphoria around print and stationary stocks owing to reopening of schools and offices in the country after three grueling waves of the COVID-19 pandemic.

Similarly, SEL Manufacturing Company, second-best performer of 2022, has soared 2,259.6 percent so far driven by the optimism around textile manufacturers in the market.

In the case of both, Kaiser Corporation and SEL Manufacturing earnings performance has been suspect, if not, underwhelming despite the narratives.

SEL Manufacturing has been a loss-making entity in 11 out of the past 12 quarters notwithstanding that its net losses have narrowed over the past four quarters. At the same time, Kaiser Corp’s net profit nosedived 76 percent in the March quarter even though sequentially the company reported a net profit as against a loss in previous quarter.

Stocks like Kaiser Corporation and SEL Manufacturing show the power of narrative-based investing still being dominant in the domestic stock market much in the way it was through most part of 2021.

While 2022 has been dominated by headlines of risk aversion, capital protection and seeking haven in tried and tested stocks, in some corners of Dalal Street strategies of 2021 is still reaping eye-popping rewards for investors.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.