Indian IT services majors reported soft but broadly in-line Q4 results, with the outlook for FY25 not inspiring much confidence either. Hence, Moneycontrol's list of companies with maximum ‘sell’ calls or maximum pessimism features three IT stocks, including Wipro and LTIMindtree.

According to analysts at Kotak Securities, demand outlook and macro uncertainty continue to be weak in FY25. This has led to a reset of both growth and margin expectations, which in turn has led to muted growth guidance for all IT firms, and a weaker margin outlook for some.

"Recovery hopes have been pushed back to FY26," the brokerage said. However, stock price corrections in the past few months have made valuations more palatable, it added.

Follow our market blog to catch all the live actionMoneycontrol analysis shows that out of the 46 analysts that have coverage on Wipro stock, 24 have a 'sell' call, 13 have a 'hold' call, and only 9 analysts are bullish with 'buy' calls. The pessimism stems from the fact that Wipro has been underperforming compared to the rest of its large-cap IT peers.

Analysts do not expect this trend to reverse anytime soon as the company continues to face challenges from a subdued economic environment.

1. Weak guidance: The weak revenue growth guidance by Wipro's management for Q1FY25 at -1.5- 0.5 percent in constant currency (CC) terms was slightly disappointing, according to Sharekhan. Further the sudden change in CEO adds another layer of delay in recovery in the near-term before the potential turnaround in the medium- to long-term.

2. Demand, discretionary slowdown: Wipro's management said that the market has not changed fundamentally in terms of demand. Although it is witnessing some stabilisation in BFSI, the slowdown in discretionary spending continues, especially in smaller projects. It is said that near-term margins are likely to remain range-bound.

3. CEO change: In April 2024, Thierry Delaporte resigned as the Chief Executive Officer (CEO) of Wipro and he was replaced by Srinivas Pallia, a 32-year veteran of the company. Motilal Oswal expects its FY25 revenue growth to be one of the lowest among Tier-1 IT Services peers.

"We reiterate our Neutral rating as we look forward to: 1) the execution under the new CEO, and 2) a successful turnaround from its struggles over the last decade, before turning more constructive on the stock," the brokerage said.

4. Execution lag: Axis Securities said that Wipro lags in execution capabilities to capitalise on growth compared to peers, despite a strong deal pipeline and superior financial structure.

5. Deal conversion lag: The slower ramp-up in large deals, delay in executions, and lack of immediate mega deal alternatives would keep Wipro's top-line growth unstable, said Prabhudas Lilladher.

"The conversion from TCV to revenue remains a challenge, as the larger part of its portfolio has high concentration on discretionary spends which is weighing on its performance due to project ramp down, and in some cases, it is difficult to replenish the projects that are having similar size and scope," it said.

It is worth noting that while several brokerages have maintained a 'sell' or 'hold' rating on Wipro, they have raised the target price on the stock given in-line revenue, EBITDA Margin, PAT, and deal wins in Q4.

Also Read | Hindustan Zinc stock soars 11% to 52-week high as positive China data lifts zinc prices

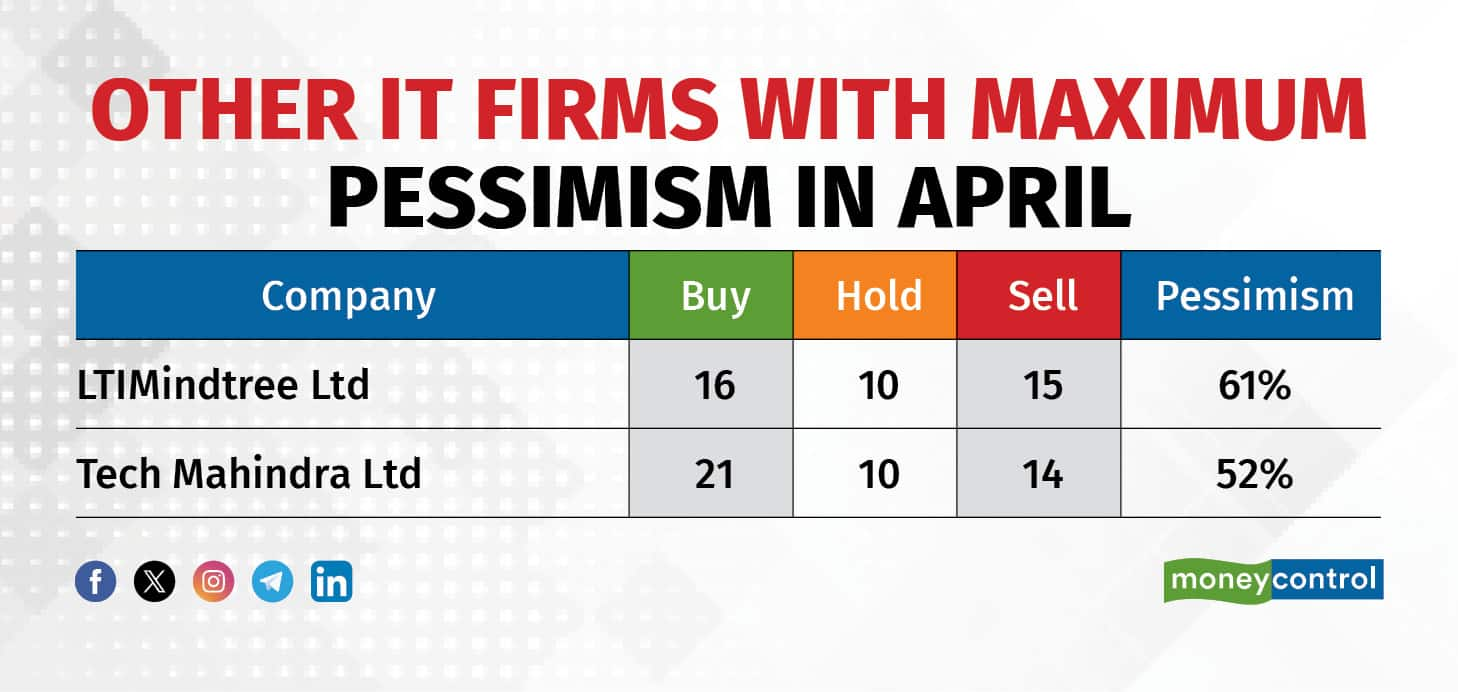

Other IT firms with maximum pessimism in AprilMoneycontrol analysis shows that LTIMindtree and Tech Mahindra are other IT stocks that saw maximum pessimism in the month gone by.

Out of the 41 analysts that have a coverage on LTIMindtree, 15 have a 'sell' rating, 10 hold, and 16 have a 'buy' call on the stock, translating to a 61-percent pessimism. As for Tech Mahindra, of the 45 brokerages, 14 have a 'sell' call, 10 hold, and 21 'buy' calls.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.