Adani Group stocks - Adani Enterprises, Adani Total Gas, and Adani Transmission - are expected to be a part of the MSCI Standard Index in its review for May 2021 despite a sharp rally in these stocks, said Edelweiss which has a high conviction on these stocks.

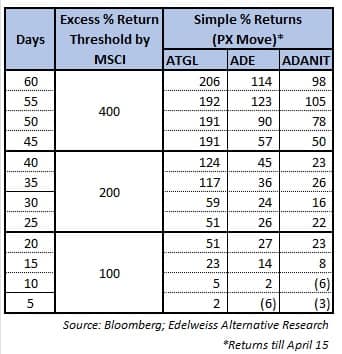

The brokerage had predicted the inclusion of these stocks in the MSCI index on April 1, and since then they have rallied sharply. In the last 15 days, Adani Total Gas, Adani Enterprises and Adani Transmission gained 23 percent, 14 percent and 8 percent respectively. In the last 30 days, these stocks rallied 59 percent, 24 percent and 16 percent respectively, while the gains stood at 206 percent, 114 percent and 98 percent respectively in the last 60 days.

"The Adani Group of stocks which we highlighted in our potential MSCI Standard Index Inclusion names on April 1, which has run up a lot are still qualifying to get included in May Review," said Edelweiss.

MSCI has given an excessive returns threshold for inclusion and even after considering simple returns (without excessive returns to benchmark stocks), the price move in Adani Total Gas, Adani Enterprises and Adani Transmission are far lower than the threshold set by the Index provider, the brokerage added.

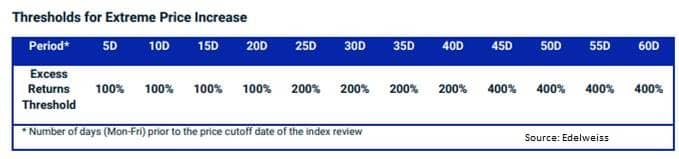

- Securities that exhibit extreme price increase will not be eligible for addition into the Standard Indexes but will continue to be considered as part of the market investable universe. Such securities would be re-evaluated for Standard Index inclusion in the subsequent Index Review using Standard Index inclusion criteria, including the return-based thresholds for the extreme price increase.

- MSCI will evaluate the 5-day to 60-day excess returns, in increments of 5 days, as of the price cut off date of the index review, for additions to the Standard indexes. As shown in the table below, securities with excess returns above 100 percent for any of its 5-day to 20-day excess returns, or above 200 percent for any of its 25-day to 40-day excess returns or 400 percent for any of its 45-day to 60-day excess returns are considered to exhibit extreme price increase.

- Excess return is calculated as the difference between the return of security for the relevant period and the average return of IMI constituents belonging to the same country-sector where the security is classified (in terms of country of classification and GICS classification at the sector level). For country-sectors that have five or fewer IMI constituents, the relevant country IMI return is used instead.

MSCI is expected to conduct its semi-annual review of its MSCI Standard Index on May 12, 2021.

Edelweiss has considered $50 billion as the MSCI benchmarked assets under management (AUM) for its analysis and the adjustment date would be May 27, 2021.

"As per our best understanding, the cut-off date which MSCI index will consider to filter the stocks for the purpose of rebalancing should be any day between April 19-23," said the brokerage.

Cholamandalam Investment is also expected to be added to the MSCI Standard Index, though the conviction is medium to low. On the other side, Zee Entertainment Enterprises is likely to be excluded from the said index.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.