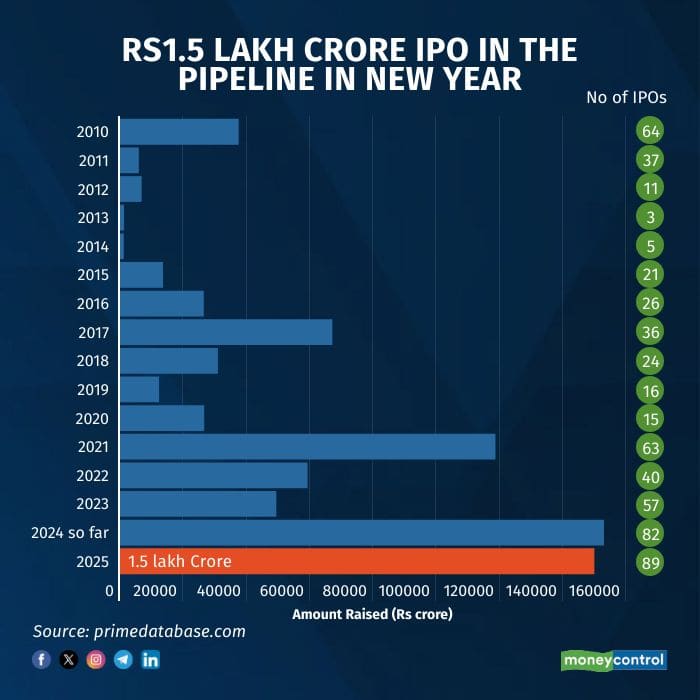

Despite significant Indian market volatility following an 18-month dream run, the momentum for companies going public remains strong, with an IPO pipeline exceeding Rs 1.5 lakh crore planned for the upcoming year.

For 2025, 34 companies have already secured the requisite Securities and Exchange Board of India (SEBI) approval for IPOs, targeting a combined Rs 41,462 crore. Additionally, 55 firms await regulatory clearance, intending to raise about Rs 98,672 crore. A company gets a one-year window from the date of SEBI approval to launch the IPO.

Rajesh Palviya of Axis Securities expressed confidence that these IPO targets are achievable. He says that despite negative market sentiment, domestic investor inflows remain robust and while foreign investors are net sellers in secondary markets, they continue to actively participate in primary market issuances.

So far in 2024, foreign investors have sold over Rs 1.02 lakh crore in secondary markets while they bought over Rs 1.11 lakh crore in primary markets.

The strong pipeline comes close on the heels of a robust 2024 when 75 Indian companies raised over Rs 1.5 lakh crore through mainboard IPOs, according to data from Prime Database. This marks a record-breaking year compared to Rs 49,435 crore raised via 57 IPOs in 2023 and Rs 59,301 crore from 40 IPOs in 2022.

Notably, a record 143 draft red herring prospectuses (DRHPs) were filed with SEBI in 2024, compared to 84 in 2023 and 89 in 2022. Upcoming IPO filings are expected from major players like Zepto, Flipkart, Indira IVF, and HDFC Credila among others. Reports also indicate that Indira IVF plans to raise $400 million, while Zepto, Flipkart, and HDFC Credila aim to raise over $1 billion each.

This record-breaking surge in IPO draft filings comes on the back of strong market performance. In 2024, both the Sensex and Nifty have climbed nearly 13% year-to-date, following a robust 20% gain each in 2023. Meanwhile, broader markets have outperformed, with the BSE MidCap and BSE SmallCap indices soaring 30% in 2024 and an impressive 45% in 2023.

Meanwhile, the pipeline includes well-known names like HDB Financial Services (Rs 12,500 crore), LG Electronics India (Rs 15,000 crore), NSDL (Rs 4,500 crore), Dr Agarwal's Health Care (Rs 3,500 crore), Hexaware Technologies (Rs 9,500 crore), Ather Energy (Rs 4,500 crore), JSW Cement (Rs 4,000 crore) and Hero Fincorp (Rs 3,600 crore).

Experts acknowledge that while short-term headwinds, including geopolitical tensions, weak corporate earnings, a slowing economy, and continued foreign outflows in secondary markets continue, the long-term fundamentals of the Indian market remain strong. While low-quality IPOs may face challenges, well-established companies with strong profitability and clear business visibility are expected to secure robust subscriptions, they say.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.