Aditya Birla Sun Life AMC, which has been ranked the largest non-bank affiliated AMC in India by QAAUM (Quarterly Average Assets Under Management) since March 2018, is set to launch its initial public offering (IPO) this week.

Here are 10 key things to know before subscribing to the IPO:1) IPO DatesThe public issue will open for subscription on September 29 and will close on October 1. The anchor book, if any, will open for one day on September 28.

2) Price BandThe price band for the offer has been fixed at Rs 695-712 per equity share.

3) Public Issue DetailsThe public offer of up to 3,88,80,000 equity shares is an offer for sale by the promoters. Aditya Birla Capital will sell up to 28,50,880 equity shares and Sun Life (India) AMC Investments Inc will offload up to 3,60,29,120 equity shares through the offer for sale.

The IPO includes a reservation of up to 19.44 lakh equity shares for the subscription by Aditya Birla Capital shareholders. The offer constitutes 13.50 percent of the post-offer paid up equity share capital of the company.

4) Fund-raising and Objectives of IssueThe company plans to raise Rs 2,702.16 crore at the lower price band and Rs 2,768.25 crore at the upper price band.

The main objective of the issue is to carry out this offer for sale. As it is an offer for sale, the company will not receive any money from the IPO. All the funds, excluding issue expenses, will go to the selling shareholders.

5) Lot Size and Category-wise Reserved Portion

Bids can be made for a minimum of 20 equity shares and in multiples of 20 equity shares thereafter. Retail investors can invest a minimum of Rs 14,240 for a single lot and a maximum of Rs 1,99,360 for 14 lots.

Half of the total offer size is reserved for qualified institutional buyers, 15 percent for non-institutional investors, and the remaining 35 percent for retail investors.

6) Company Profile and IndustryAditya Birla Sun Life AMC, which managed a total AUM of Rs 2,93,642 crore under its suite of mutual funds (excluding its domestic fund-of-funds), portfolio management services, offshore and real estate offerings as of June 2021, caters to a wide range of customers from individuals to institutions through its pan-India network and customer solutions.

The Aditya Birla Capital and Sun Life (India) AMC Investments Inc promoted company has been ranked as the largest non-bank affiliated asset management company (AMC) in India by quarterly average assets under management (QAAUM) since March 31, 2018, and is among the four largest AMCs in India by QAAUM since September 30, 2011, according to a CRISIL Report.

Since its inception in 1994, the company has established a geographically diversified pan-India distribution presence, covering 284 locations across 27 States and six union territories. Its distribution network is extensive and multi-channelled, with a significant physical as well as digital presence. The network includes over 66,000 know your distributor (KYD)-compliant MFDs (mutual fund distributors), over 240 national distributors and over 100 banks/financial intermediaries, as of June 2021.

As of June 2021, Aditya Birla Sun Life AMC managed 118 schemes comprising 37 equity schemes (including diversified, tax saving, hybrid and sector schemes), 68 debt schemes (including ultra-short-duration, short-duration and fixed-maturity schemes), two liquid schemes, five ETFs and six domestic fund of funds (FoF).

Its total QAAUM (excluding domestic FoFs), has grown to Rs 2,75,454 crore (as of June 2021), from Rs 2,46,480 crore in March 2019. Its monthly average assets under management (MAAUM) from institutional investors stood at Rs 1,50,304 crore as of June 2021, and was the fourth largest among its peers, according to the CRISIL report. Similarly, the MAAUM from individual investors stood at Rs 1,33,353 crore as of June 2021.

In addition, the company also provides portfolio management services, offshore and real estate offerings and managed a total AUM of Rs 11,515 crore as part of such services, as of June 2021.

Aditya Birla Sun Life AMC has maintained a market leading position in B-30 (beyond top 30 cities) penetration over the years, which has contributed to the growth of its individual investor base as well as the improvement in profitability. The AMC’s B-30 cities MAAUM was Rs 44,701 crore as of June 2021, and its share of MAAUM from the B-30 cities in total MAAUM as of that date was the second highest among the five largest AMCs in India, according to the CRISIL Report.

Mutual Fund IndustryMutual fund assets in India have seen robust growth, especially in recent years, driven by a growing investor base due to increasing penetration across geographies, strong growth of capital markets, technological progress, and regulatory efforts aimed at making mutual fund products more transparent and investor friendly.

Although mutual fund AUM as a percentage of GDP has grown from 4.3 percent in financial year 2002 to approximately 16 percent in financial year 2021, penetration levels remain well below those in developed and fast-growing countries.

The mutual fund industry's QAAUM grew approximately 19 percent year-on-year in financial year 2021. In the long term, i.e. between June 2021 and March 2026, the overall industry’s AUM is projected to sustain a high growth trajectory of between 11 percent and 13 percent CAGR, reaching Rs 57 lakh crore.

Growth is expected to be driven by (i) a pick-up in corporate earnings following stronger economic growth, higher disposable income and investible household surplus (iii) increase in aggregate household and financial savings (iv) deeper regional penetration as well as better awareness of mutual funds as an investment vehicle (v) continuous improvement in ease of investing, with technological innovations and an expanding internet footprint (vi) and the perception of mutual funds as long-term wealth creators, driven in part by initiatives such as the Mutual Fund Sahi Hai campaign.

The announcement in Union Budget 2021-22 taxing contributions over Rs 2,50,000 per annum in unit-linked insurance plans, which is in line with equity mutual funds, is also expected to partly aid inflows into mutual funds.

7) Strengths & Strategya) It is the largest non-bank affiliated asset manager in India.

b) It is a well-recognised brand with experienced promoters (Aditya Birla Capital and Sun Life AMC)

c) Its growing individual investor customer base has been driven by strong systematic flows and B-30 penetration.

d) It has a diverse product portfolio with fund performance supported by a research-driven investment philosophy.

e) It has established a geographically diversified pan-India distribution presence that is not only extensive but multi-channelled, with a significant physical as well as digital presence.

f) It has a history of innovation in the mutual fund area in the use of technology to service investors.

g) Its business is managed by experienced and stable management and investment teams.

Strategya) It intends to continue to increase geographic reach and strengthen relationships with distributors.

b) It intends to continue to focus on delivering a sustained investment performance and portfolio differentiation.

c) It intends to strengthen the employee value proposition to continue to attract and retain good quality talent.

d) It intends to continue to leverage digital platforms to increase customer acquisition and enhance customer experience.

e) The AMC intends to enhance its product portfolio by developing investment offerings.

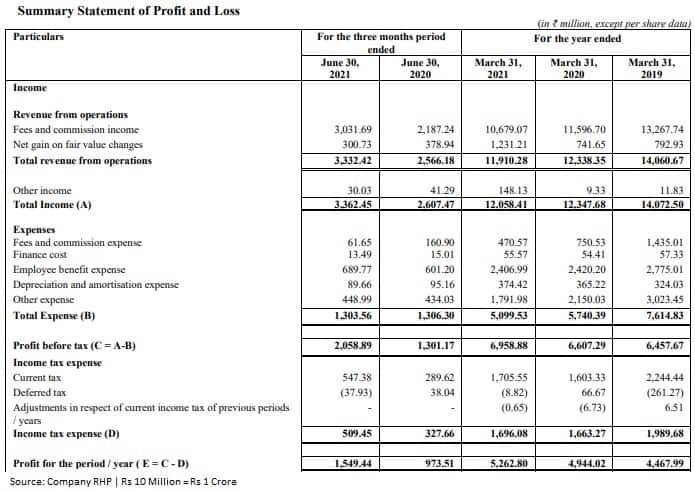

8) FinancialsIts leadership position, product mix, cost base and scale has contributed to its strong financial performance. Total income declined from Rs 1,407.25 crore in FY19 to Rs 1,205.84 crore in FY21, but increased significantly to Rs 336.24 crore in Q1FY22 from Rs 260.75 crore in Q1FY21.

Profit jumped to Rs 526.28 crore in FY21 from Rs 446.8 crore in FY19, and on a quarterly basis, rose sharply to Rs 154.94 crore in Q1FY22 from Rs 97.35 crore in Q1FY21. The company has maintained its ratio of total revenue to total mutual fund AAUM at 0.49 percent in Q1FY22 as well as Q1FY21 and also in FY21. The profit to total mutual fund AAUM ratio improved to 0.23 percent from 0.18 percent YoY in Q1FY22 and stood at 0.22 percent in FY21.

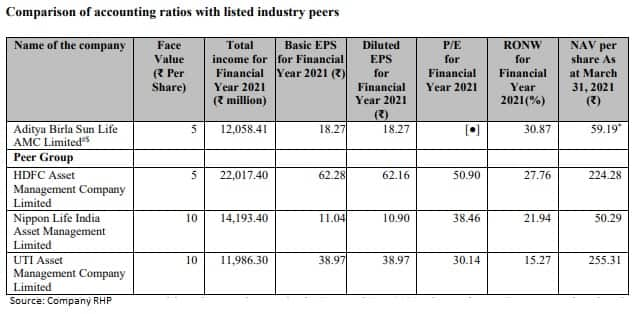

The company compares itself with listed players HDFC Asset Management Company, Nippon Life India Asset Management and UTI Asset Management Company. In terms of total income, Aditya Birla Sun Life AMC is the third largest company, but highest in terms of return on net worth in FY21 at 30.87 percent.

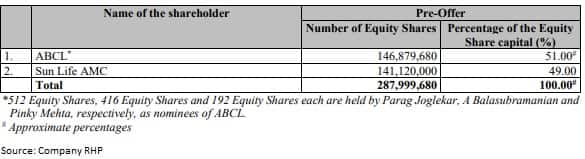

Aditya Birla Capital (ABCL) and Sun Life AMC are the promoters of the company, together holding 100 percent. In addition to ABCL, Sun Life AMC will also continue to share the roles and responsibilities of the sponsor after the offer.

A Balasubramanian is the Managing Director and Chief Executive Officer of the company and has been associated as an employee of the company since 1994. He has been the Chief Executive Officer of the company since 2009 and was the Chief Investment Officer from 2006 to 2009.

Kumar Mangalam Birla is the Non-Executive Chairman of the company.

Ajay Srinivasan, Sandeep Asthana, and Colm Freyne are Non-Executive Directors on the board, while Bobby Parikh, Bharat Patel, Alka Bharucha, Harish Engineer, and Navin Puri are Independent Directors.

Mahesh Patil is the Chief Investment Officer of the company. He has 31 years of experience and joined the company in October 2005.

Parag Joglekar is the Chief Financial Officer of the company.

10) Allotment, refunds and listing datesThe company will finalise the share allotment on October 6, as per the schedule available in the prospectus. The funds will be refunded to ineligible investors by October 7 and the successful investors will get shares in their demat accounts by October 8.

The equity shares will start trading on the bourses (BSE and NSE) from October 11. Currently Aditya Birla Sun Life AMC share price trades at Rs 757-772 in the grey market, a premium of Rs 45-60 or 6.3-8.4 percent over the upper price band of Rs 712 per share, IPO Watch and IPO Central data showed.

Kotak Mahindra Capital Company, BofA Securities India and Citigroup Global Markets India are the global co-ordinators and book running lead managers to the offer. Axis Capital, HDFC Bank, ICICI Securities, IIFL Securities, JM Financial, Motilal Oswal Investment Advisors, SBI Capital Markets and YES Securities (India) are the book running lead managers to the offer.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.