Just a year ago, DeHaat was the poster boy of all things agritech. The startup, backed by top investors such as Sequoia Capital and Naspers, had emerged as a darling in a promising industry.

The rapid pace of its expansion and strong backing from marquee investors meant it was only a matter of time before the ‘soonicorn’ became a unicorn — a private firm with a billion-dollar-plus valuation. When that happened, DeHaat would be the first unicorn from the agritech space.

But instead, DeHaat today looks more like a cautionary tale, epitomising the challenges encountered by startups solving for the agriculture sector. The company’s coffers, a source close to DeHaat told Moneycontrol, are fast depleting in the midst of a funding drought.

The bleak funding prospects and runway concerns aside, inefficiency in its high-volume operations, and the pressure to grow rapidly are hindering DeHaat’s relentless march, the sources said. Meanwhile, soaring employee costs have forced it to institute layoffs.

And to cap it all, the company has been rapped for weak internal processes.

Records show that DeHaat’s former auditor had raised questions over its inventory management practices for three years in a row, flagging poor internal controls in two of those audits. Investors, sources close to the company told Moneycontrol, have now stepped in to monitor its operations in a bid to tighten governance.

To be sure, DeHaat has a lot going for it. In an interview with a news agency early in March, CEO Shashank Kumar said the loss-making company’s FY23 revenue was set to rise by over 80 percent to Rs 2,300 crore and that it would be operationally profitable (EBITDA positive) by the end of this calendar year.

Assuming its new auditor finds those FY23 numbers to be kosher, an operating profit this year certainly would be good news. But it won’t be a silver bullet that ends DeHaat’s problems, said the sources cited above.

Moneycontrol spoke to stakeholders, industry watchers, and experts to get a closer look at the troubles that are dogging the agritech ‘soonicorn’.

The business model

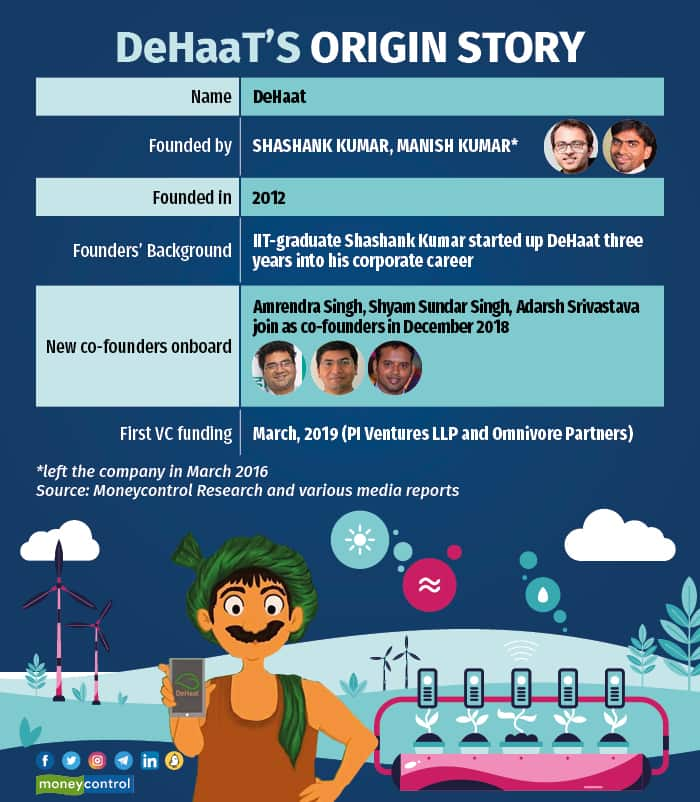

DeHaat, which means rural in Hindi, was founded in 2012 by CEO Kumar, with co-founders Shyam Sundar Singh, Amrendra Singh, Adarsh Srivastava and Abhishekh Dokania joining the venture later. The company, which was initially headquartered in Patna, follows a two-pronged business model, selling inputs to farmers and then purchasing their produce and selling it to bulk buyers. Of late, it has also started exporting this produce.

DeHaat also provides farmers services such as soil testing, crop advisories, weather forecasts and access to credit.

On the input side, the company sells seeds, fertilisers and pesticides to farmers at its DeHaat centres. There are over 11,000 such centres in the country today, acting as a local touchpoint for farmers in the areas they service. These centres are run by micro-entrepreneurs — small-business owners — on a franchisee model.

DeHaat's Agri-input model

DeHaat's Agri-input model

Once a farmer places an order through DeHaat’s mobile app, the inputs, which are stored at the company’s warehouses, are moved to the DeHaat centre closest to the farmer. On the output side, these centres collect produce from farmers, which is later transferred to its warehouses and sold to institutional buyers.

DeHaat's Agri-output Model

DeHaat's Agri-output Model

In startup parlance, DeHaat has a full-stack, hub-and-spoke model.

Auditor red flags

Filings with the Ministry of Corporate Affairs (MCA) reveal that in FY20, before the pandemic overwhelmed the country (the nationwide lockdown affected only the last eight days of that fiscal year), DeHaat’s auditor raised a red flag on the record and management system used by the company to track inventory — the inputs going to farmers and farm produce brought in by them.

“The company has not adequately maintained records with respect to quantitative details pertaining to opening balances of inventory and movement of inventory during the year ended March 31, 2020,” read the note by the auditor, MSKA and Associates.

The auditor also said it could not comment on how the issue affected inventory and purchases of traded goods, revenue from operations and other expenses for the fiscal year, as reported in the company’s profit and loss statement.

In FY21, the auditor raised another red flag and said DeHaat did not have a proper internal control system to compare and reconcile the inventory records at its warehouses. “This may potentially result in the material misstatement in the company’s financial statement,” it said.

According to Ajay Rotti, founder and chief executive officer (CEO), of Tax Compaas, an internal control failure could be a red flag indicating a lack of transparency in the inner workings of a company.

“Imagine an automobile company that manufactures 10,000 cars per month. Internal controls help ensure that when a car is sent to a dealer, there’s a foolproof process to confirm its departure. However, without these controls, it becomes as easy as pie for any employee or back office staff to stroll into the showroom and drive away with a car,” said Rotti.

In DeHaat’s case, this would be farm produce or inputs.

Yet again, in FY22, MSKA and Associates reiterated that DeHaat lacked appropriate systems to verify inventory movement and records. “This may potentially result in material misstatement in the company’s financial statement,” the auditor’s note stated.

Moneycontrol has seen a copy of the audit reports for FY20, FY21, and FY22. For the three years in question, MSKA and Associates had given a ‘qualified opinion’ in its audit report.

“A qualified report indicates that the auditor is not satisfied with the balance sheet, profit and loss statement, and accompanying disclosures prepared by the management. They question the accuracy and fairness of the presentation, suggesting it may not be entirely truthful and unbiased,” said the founder of a corporate law firm, requesting anonymity in order to speak freely.

Moneycontrol reached out to MSKA and Associates seeking an interaction but could not elicit a response. MSKA and Associates no longer audits DeHaat and is not relevant here.

The startup has appointed EY as the auditor for its FY23 financials, said multiple sources close to the company. The reason for the change is not clear.

Queries sent to EY are yet to elicit a response.

“DeHaat has reasonable confidence that it will not see any qualified opinion from next year,” said a source close to the company, who did not want to be identified.

Moneycontrol reached out to DeHaat with detailed queries about the issues swirling around the company’s operations, on May 10, two weeks prior to publishing the story.

Declining to respond to specific questions raised by Moneycontrol, a spokesperson said, “The questions shared by you are completely baseless and pertain to internal matters of the company which we do not want to discuss publicly. We decline the truthfulness [SIC] of all of the questions”

Moneycontrol also sent individual requests to the company's co-founders, but they declined to comment.

However, DeHaat reached out to Moneycontrol later on May 26, and said that there was no “incident or evidence” towards any governance lapses or lack of control.

“The matter of weak internal process around inventory count is related to FY 22 ~ almost 2 years old. As on date, the 100% inventory within the company across functions/ regions are live on SAP since Sep 2022. With this confidence, Auditor has been upgraded to one of the Big 4. Along with, an independent internal auditor has been actively working with the company since last more than a year,” a DeHaat spokesperson said.

DeHaat’s defence and what experts think of it

In its commentary on the auditors’ reports for all the three years cited above, DeHaat said that it had provided additional information enabling the auditor to reconcile and physically verify the inventory. The comments are in the financial statements filed with the MCA. However, despite this clarification given by DeHaat, the auditor did not retract its qualified opinion.

Also, in its response to MSKA and Associates’ comments in FY22, DeHaat said it needed time: “Due to the accounting practices followed in the past, the company could not switch to Inventory Management Software, where inventory records are integrated with the accounting records in such a short period,” the response stated.

Curiously, the company had provided an identical explanation for the qualified opinion on its internal financial controls in FY21 as well.

“They said in a short period we could not switch, in both FY21 and FY22. If you said I don’t have time to move into a new internal control platform in one year, you could have done it in the next,” said Rotti of Tax Compaas.

Rotti highlighted that companies generally respond to the auditor’s opinion by stating that they have either resolved the matter or are currently working on it as there is a gap of three to four months between receiving the auditor’s report and publicly releasing the financial statements. “Very rarely would they say ‘these are correct, but won’t have an impact on our financials’ and ‘time was too short for us to resolve the issue’. And that, too, for two years, which is extremely strange and worrisome,” he added.

Anirudh Damani, investor and managing partner of Artha Venture Fund, concurred with that view. “Companies cannot use rapid growth as an excuse for not establishing proper internal controls. This is a substantial red flag. Moreover, such an excuse is unacceptable for any firm operating for over a decade and is at a series E and F funding level. If true, the allegations point towards a systemic issue,” he said.

Shriram Subramanian, founder of InGovern, a proxy advisory and corporate governance advisory firm, said that in their thirst for growth, many startups fail to set up robust processes and controls. Operations often focus solely on sales without establishing effective mechanisms to track inventory and maintain clear records of goods coming in and going out, which increases the likelihood of pilferage or fraudulent activities, he said.

“These are problems that come with the pressure to grow too fast,” said Subramanian.

Indeed, both Rotti and Subramanian said that the absence of a proper internal monitoring mechanism could be an indication of the lack of effective corporate governance in the company.

Investors step in

Since 2022, India has seen at least four major instances of corporate governance lapses, at startups BharatPe, Zilingo, Trell and GoMechanic.

Coincidentally, all of these companies have Sequoia Capital on their cap table.

To be sure, there were allegations of wilful fraud at BharatPe and GoMechanic, which does not seem to be the case with DeHaat, where the lapses revolve around weak internal processes.

In DeHaat’s case, the VC firm is the biggest shareholder with a stake of about 14.1 percent, as of September 2022, according to data sourced from Tracxn Technologies.

DeHaat’s Cap Table as of September 2022

DeHaat’s Cap Table as of September 2022

A source aware of the matter said that Sequoia Capital has been made aware of the lapses and is now taking measures to tighten governance at the company, and also at other startups in its portfolio.

Sequoia did not respond to queries sent by Moneycontrol.

A source confirmed that investors have been keeping a very close watch on the company over the last year. “There is a recently constituted finance committee through which investors are engaging with the company on areas that require attention. They are aware of the issues, and they are handholding the company, helping it resolve those issues,” said the source cited above.

In August 2021, DeHaat appointed its first official Chief Finance Officer, Natwar Aggarwal, from HealthKart, another Temasek-backed firm. Earlier, the CFO’s responsibilities lay with the head of finance.

A year after Aggarwal took charge, DeHaat shifted all its management functions to Gurgaon from where Aggarwal was operating. The company still maintains an office in Patna, where it has done well.

“Even the head of output Abhishekh Dokania recently shifted to Gurgaon from Patna, the primary source of revenue from the output trade. The management feels that with everything in one place, decision-making is easier both from the control and business aspects,” said a source.

“The new CFO was appointed when only six months would have been left before the FY22 accounts’ closing. So, the real test will be the FY23 accounts,” said Rotti.

DeHaat investors Temasek, Omnivore and Lightrock declined to comment on the story. The other investors named above did not respond to Moneycontrol’s queries.

DeHaat’s origin story

Funding Woes

To date, DeHaat has raised approximately $221 million, most of it in the last 18 months. In November 2021, it raised about $115 million, one of the largest funding rounds in India’s agritech space. That money came in from the likes of Sequoia Capital, Sofina, Lightrock, Naspers, Omnivore and Temasek.

DeHaat’s last funding infusion was in December 2022, where it raised $60 million from existing investors, in a round that valued it at $695 million.

But the money has been running out fairly quickly, with DeHaat burning cash to fund its costs.

According to multiple people aware of the matter, the company has about Rs 650-750 crore (less than $100 million) left in the bank after the last fundraise in December 2022 gave it a lifeline. Separately, a source close to one of the company’s investors confirmed this.

Going by the company’s statements, its expenditure more than tripled to Rs 1,438 crore in FY22 from Rs 407 crore in FY21. It also had a non-cash expense of Rs 1,446 crore, which was included in other expenses incurred during the fiscal year.

Employee expenses contributed heavily to the cash burn, amounting to Rs 110.56 crore in FY22, having grown almost four-fold from Rs 29.05 crore on the back of aggressive hiring over the year. Between May and December 2022, the company laid off a number of staff to slash the wage bill.

However, DeHaat said that it has been recognized as a “Great Place to Work” for the last two consecutive years, in its statement.

Apart from ballooning employee expenses, the cost of goods sold alone amounted to Rs 1,351.93 crore.

Currently, the company has a negative gross margin of 6 percent. The gross margin is the percentage of money that a company has left over from sales after it has paid the cost of the goods that were sold. Simply put, DeHaat’s costs exceed its total sales.

Based on the company's cash flow, its operational monthly burn in FY22 stood at approximately Rs 31 crore.

However, DeHaat added that based on its monthly burn of the last 6 months at PBT (Profit before tax) level and its current free cash, it has a runway of 35 months.

“On top of this, Company has been progressing towards better unit economics on a quarter-on-quarter basis. Because of the scale DeHaat has achieved in the last few years and unique model of full stack approach, monthly burn has already been improved by 50% w.r.t. to Aug’22,” added DeHaat, in its statement.

DeHaat also said, "This trend would be continued and will be reflected in our FY24 plans; showcasing a clear path to profitability in next 12-13 months. There is no fundraise dependency for DeHaat in its journey ahead."

As per Moneycontrol's sources, DeHaat’s founders are attempting to raise another round of funding to extend its runway. However, industry watchers say that will prove challenging amid the overall funding downturn in the startup ecosystem.

“The whole buzz around agritech was that it is a sunrise sector. But right now everybody is questioning DeHaat’s low margins despite high volumes, especially at a time when fundraising is scarce for most sought-after sectors,” said the agritech executive cited earlier.

“Until a company shows double-digit margins or a high-single-digit margin, it will keep getting tougher,” she added.

As things stand, DeHaat appears confident of reporting an operating profit by the end of this calendar year.

“The company is progressing absolutely in right direction & hence that’s the reason of 70-80% growth with a clear path to profitability. Almost 1000 unique agribusiness institution have collaborated with DeHaat & actively working. With the same reason, network of DeHaat has grown to 11,000+ micro-entrepreneurs & 1.8 mn farmers who are getting benefitted on day to day basis for a better livelihood,” DeHaat said in its statement.

If the company is close to an operating profit, as projected, that would give it a shot in the arm at a time when investors are increasingly reducing exposure from high-growth ventures and seeking sustainable and profitable investments.

If DeHaat can make the promised EBITDA leap, address governance lapses and become operationally efficient, it may well get back on the road to becoming a one-horned horse-like creature.

For now, however, it is in a tight race to turn profitable as its cash burns steadily amid a challenging funding environment.

(Edit 2: This story has been updated to add DeHaat’s official responses that were sent to Moneycontrol on May 26, two days after the story was published. Edit 1: This story has been updated to reflect a clarification on DeHaat’s monthly operational cash burn in FY22, which stood at Rs 31 crore approximately. An earlier version estimated the monthly cash burn to be Rs 131.55 crore in FY22, erroneously including a non-cash expense in its books.)Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.