Indian banks have written off Rs 34,428 crore in the first quarter of the current financial year (Q1FY24). This has aided banks to bring down the gross non-performing assets (NPA), according to a Moneycontrol analysis.

In the corresponding quarter last year, banks wrote off Rs 44,898 crore, data shows. Banks write off loans when there is no scope of recovering them from borrowers. Typically, banks need to set aside 100 percent of the written-off loan amount as provisions, which impacts profitability. The write-offs were both regular and technical.

“Banks had a net negative wherein their write-offs were higher compared to this year. Now, what we are looking at is stability in business with good flow,” said Anand Dama, Head BFSI, Emkay Global Services. During the reporting quarter, most banks have reported improvement with the gross NPA ratio falling up to 350 basis points (Bps) and net NPA ratio easing up to 100 bps. One basis point is one hundredth of percentage point.

Also read: Banks step up lending to aviation; sector seen safe in long term, experts say

The Numbers

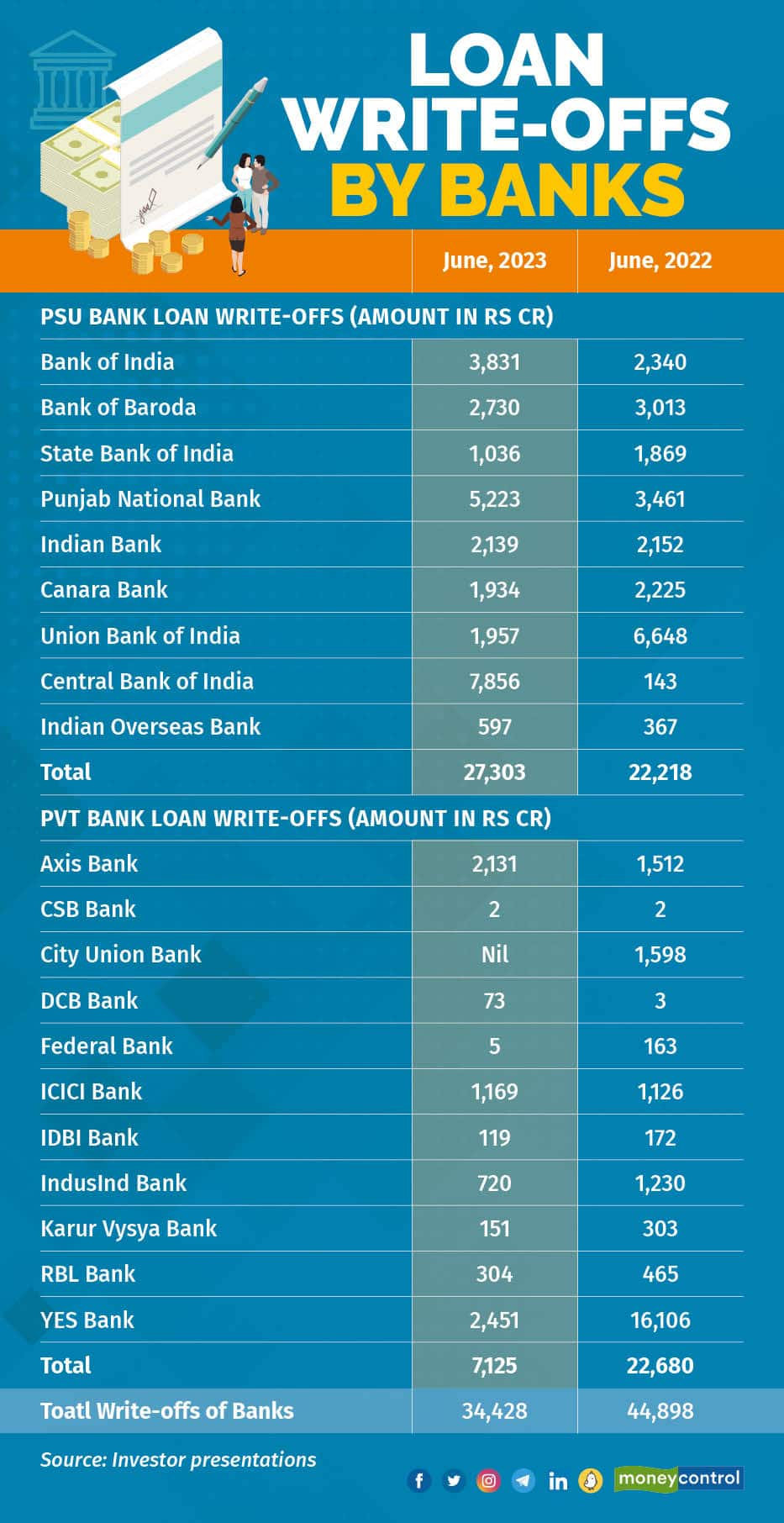

Of the total write-off in the April-June quarter, state-owned banks wrote-off Rs 27,303 crore and private banks wrote-off Rs 7,125 crore, as per data compiled by Moneycontrol from the banks’ investor presentations.

PSU banks account for 80 percent of the total write-off in the reporting quarter, the remaining were from private banks. Data further showed that the write-off in April-June was down 23.32 percent on-year.

The biggest write-offs

Among the state-owned banks, Central Bank of India, Punjab National Bank, Bank of India, Bank of Baroda, Indian Bank, and Union Bank of India accounted for the major part of the write-offs.

In the private banking space, YES Bank, Axis Bank, and ICICI Bank stood at the top of the table. Together, all these banks accounted for over 85 percent of the write-off in the reporting quarter.

M.V. Rao, Managing Director and Chief Executive Officer of Central Bank of India said during a call on earnings, that the major chunk was a technical write-off. Regular write-off was only a miniscule part of the write-off, he said.

Rao added that recovery by banks can be improved only if there is some resolution with the help of the National Asset Reconstruction Company Ltd.(NARCL) or the National Company Law Tribunal (NCLT).

Vijay Singh Gaur, Lead Analyst, BFSI, Care Ratings said that banks would need to work on their recoveries to balance their finances.

Also read: Banks’ gold loan portfolios get boost in April-June quarter from high yellow metal prices

Has asset quality improved?

In April-June FY24 asset quality of banks has improved sharply due to higher write-offs and provisions. Union Bank reported an improvement in asset quality. The gross NPA ratio of the bank fell to 7.34 percent, as on June 30, compared to 7.53 percent in the previous quarter, and 10.22 percent in the year-ago period.

Similarly, the net NPA of the bank decreased to 1.58 percent in the April-June quarter of FY24, as against 1.70 percent in the corresponding quarter a year ago.

The Bengaluru-headquartered Canara Bank’s asset quality improved in Q1FY24, with the GNPA ratio at 5.15 percent against 5.35 percent in the previous quarter and 6.98 percent in the year-ago period. The NNPA ratio stood at 1.57 percent, better than 2.48 percent in the year-ago period.

The Central Bank of India's GNPA improved to 4.95 percent from 8.44 percent last year. The lender's NNPA stood at 1.75 percent, improving from 1.77 percent in the corresponding quarter last year.

Among private sector lenders, HDFC Bank’s GNPA ratio stood at 1.17 percent, improving from 1.28 percent in the corresponding period a year ago. Its NNPA stood at 0.30 percent from 0.35 percent last year. The lender's net profit jumped from Rs 9,196 crore in the corresponding quarter last year to Rs 11,951 crore in Q1FY24.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.