Amid a debate on whether India should opt for full capital account convertibility of the rupee, experts and economists told Moneycontrol that it is early for the country to pitch for the internationalisation of the currency, considering the concerns over macroeconomic stability and high inflation.

“The most important prerequisite for internationalisation of a currency is price stability as that builds the confidence of international investors in the domestic currency. That in itself remains a big if, given India’s tryst with inflation,” said Kunal Kundu, India economist at Societe Generale.

State Bank of India’s economic research wing said on July 7 the Reserve Bank of India (RBI) should make a “conscious effort” to internationalise the rupee. The payment disruptions caused by the Russia-Ukraine war offer a good opportunity to insist on export settlements in rupees, starting with the smaller export partners, SBI group chief economic adviser Soumyakanti Ghosh said in a note.

Another concern is that internationalisation can potentially limit the ability of the RBI to control domestic money supply and influence interest rates as per domestic macroeconomic conditions, said Kundu, adding that such a phenomenon is still “multiple years away” for India.

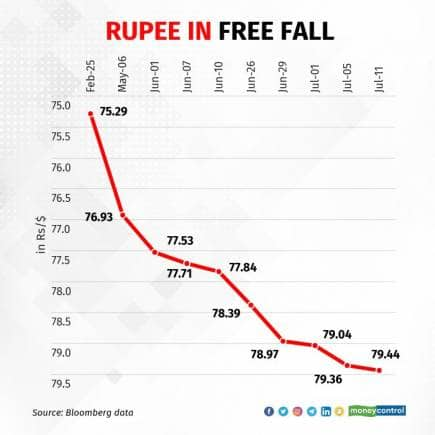

The discussion on whether India should move to a fully convertible capital account has been going on for decades. The depreciation of the rupee in the wake of the Russia-Ukraine war has ballooned India’s import bill and forced it to look for alternative payment mechanisms. An explicit rupee-rouble trade arrangement between India and Russia to settle dues in rupees instead of dollars is yet to materialise.

India has a partially convertible capital account. This means the rupee can be converted into foreign currency and vice versa for restricted purposes. Over the years, steps have been taken to increase capital account convertibility such as the introduction of the Fully Accessible Route for foreign portfolio investors (FPI) in government securities and allowing banks to access non-deliverable forward markets.

For Indians looking to invest abroad, the cap on how much they can invest overseas every year has been raised gradually under the Liberalised Remittance Scheme and now stands at $250,000 a person per year.

What internationalisation of the rupee means

According to the Tarapore Committee on Fuller Capital Account Convertibility, an “international currency” is a currency that is widely used for global transactions such as the US dollar, the euro, the British pound, the Swiss franc and the Japanese yen. The “internationalisation” of a currency is an expression of its external credibility as the economy integrates globally.

The capital account tracks the movement of capital between two countries via investments and loans. A fully convertible capital account, or internationalisation of the rupee, would mean there is no restriction on the amount of rupees one can convert into a foreign currency to buy an asset overseas. Similarly, there would be no restraints on overseas investors to bring in dollars or acquire assets in India.

If the rupee capital account is made fully convertible, it is advisable that the exchange rate be freely floating or one determined completely by market forces. At present, the RBI intervenes in the forex market to prevent volatility in the rupee’s exchange rate against the dollar.

The concept of internationalisation of the rupee has been talked about by even the RBI. The central bank, in its currency and finance report for 2020-21, said the emergence of the rupee as an international currency appears “inevitable.”

However, while greater internationalisation of the rupee can lower transaction costs in cross-border trade and investment operations by mitigating exchange rate risk, the RBI argued that it can also complicate the conduct of monetary policy.

Internationalisation of a currency makes the simultaneous pursuit of exchange rate stability and a domestically oriented monetary policy more challenging, unless supported by large and deep domestic financial markets that could effectively absorb external shocks, said the central bank.

China experience

China has sought to internationalise the renminbi (RMB) since 2010 but has not succeeded in replacing the dollar.

According to a paper authored by RBI staffers Rajiv Ranjan and Anand Prakash in 2010, progress towards renminbi internationalisation depends on China’s own cost-and-benefit calculations and the need for its share in the world economy—in terms of gross national product (GNP) or foreign trade—to be fairly substantial.

Secondly, the global markets must possess sufficient confidence in the value of the renminbi.

Thirdly, China must have a well-functioning financial market that can freely and transparently accommodate foreign exchange trading and capital transactions and its domestic financial market must be equally accessible to residents and non-residents, according to the paper.

An especially onerous obstacle to renminbi internationalisation is a set of strict restrictions on capital transactions that is currently in place, the paper said.

Gradual approach

Experts said that given the current volatile global environment, it would be prudent to stick to a gradual approach of easing restrictions and simultaneously deepening the domestic markets rather than opt for full capital account convertibility.

“It is paramount for the fiscal scenario and financial system to be better placed before we move towards a full capital account convertibility,” said Rajani Sinha, chief economist at CARE Ratings. “In the given backdrop, RBI’s gradual move is a better idea.”

Additionally, Sinha said the RBI has been using various tools to control the impact of capital inflows on its inflation-targeting monetary policy while ensuring a stable foreign exchange rate. Hence, uncontrolled capital flows will definitely increase the challenges for the central bank in targeting inflation, added Sinha.

Full capital account convertibility would imply greater linkage with global financial conditions and greater exposure to changes in capital flows. A consequence of this could be that pursuing exchange rate stability and domestic-oriented monetary policy could become more difficult.

Assuming there is a large demand for dollars because of such measures, it could put pressure on the rupee and, in turn, lead to inflation. Currently, the RBI is not comfortable with both.

Continued pressure on the exchange rate would cease if Indians could pay for their foreign purchases in rupees. While such a mechanism is being explored in trade with Russia, the rupee isn't a widely accepted currency in international transactions.

According to Gaura Sen Gupta, India economist at IDFC First Bank, by internationalising the rupee, the ability of the central bank to influence interest rates as per domestic conditions becomes limited.

Experts agreed with Sen Gupta.

“Full-fledged capital account convertibility will open the doors for FPIs to invest into Indian markets without any cap. This will lead to massive turbulence during a global tightening phase amid the disruption in global supply chains,” said Arnob Biswas, head of forex research at SMC Global. “Arguably, we need to develop our financial markets—notably less intervention on the currency front as well as deepen the swap and bond markets.”

Way ahead

Experts said the process of internationalising the rupee and fuller capital account convertibility should be gradually attempted, given the expectations that monetary tightening will be faster in the US than in India over the next three to six months. This is to prevent further capital outflows from India’s debt and equity markets. However, this has to be a gradual process, said experts.

“A prerequisite before adopting full capital account convertibility is putting in place tools which can increase the sterilisation capacity of a central bank during periods of capital influx,” said IDFC FIRST Bank’s Sen Gupta. “The recently introduced Standing Deposit Facility does exactly this as it is uncollateralised. For dealing with periods of capital outflows, deepening domestic financial markets will be key.”

A crucial step in that regard is likely to be inclusion in the global bond index, which would support FPI inflows into the debt market.

“Currently, FPI ownership of government securities has reduced to 1.56 percent as of Q4 FY22 from 3.2 percent as of Q4 FY19 and 4.35 percent as of Q4 FY18,” Sen Gupta said. “We don’t expect index inclusion to take place in FY23 but the possibility remains open in FY24 onwards.”

Finrex Treasury Advisors’ forex head Anil Bhansali said the RBI probably wants to ensure that there are sufficient forex reserves before we go for full capital account convertibility.

“However, these reserves should come from exports and not by borrowing. Otherwise we will keep increasing our liabilities and any amount of reserves will not then suffice,” said Bhansali. “Hence, we need exports to grow faster than imports so that we become fully convertible.”

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.