India’s exports grew about 15.5 percent in April-September 2022 to $229.05 billion while imports expanded 37.9 percent to $378.53 billion, at a time when global growth was slowing due to policy interventions to cool the rapid rise in inflation.

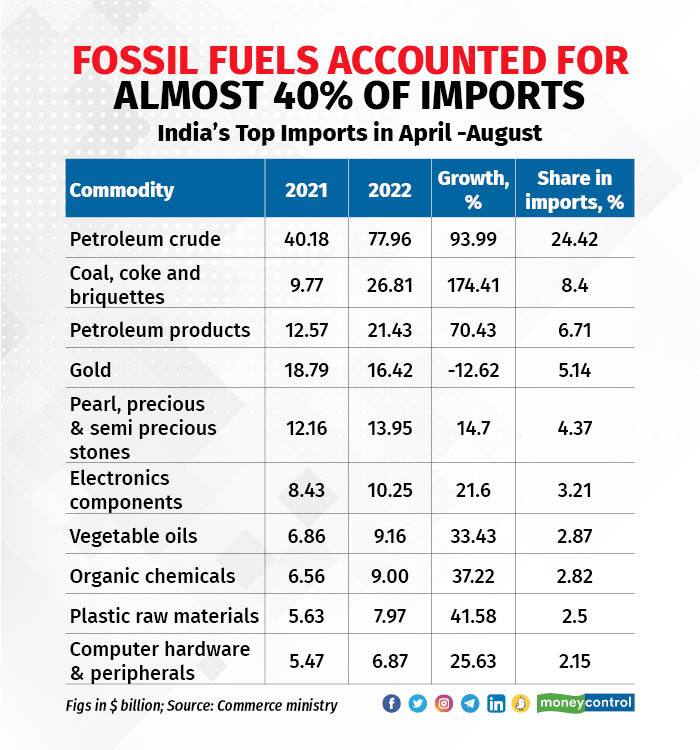

As growth slowed, India’s exports contracted 3.5 percent in September to $32.6 billion, provisional trade data show. Imports grew 5.4 percent to $59.3 billion, thanks to the rising domestic demand for petroleum products, coal and electronic goods and components.

The change in the commodity cycle, the war in Ukraine and policy interventions of the Union government, such as higher export and import tariffs on some commodities and lower or nil tariffs on some others, had a direct bearing on India’s external trade.

Here are five broad trends that emerged from the disaggregated commodity and country-level data published by the Commerce Ministry for the April-August period.

While the provisional data is for April-September, the disaggregated commodity and country-level data is for April-August. Since disaggregated data is published with a lag, the April-September data will be available only by the end of October. The provisional data is revised mid-month.

The trending five

This contraction in gold imports led to a 35 percent fall in the total value of India’s imports from Switzerland. Gold is the primary trade item between the two countries. About a third of gold imports originated in Switzerland in the first five months of the current financial year, down from about 50 percent in the corresponding period last year.

The contraction in gold imports saw Switzerland tumble 10 places to the 14th position as a source of imports.

Exports to China, however, contracted by almost 36 percent as growth slowed in the second-largest economy.

In comparison, trade with the US was relatively robust. Imports from the US grew more rapidly than from China. Exports to the US also rose, but at a slower pace than last year’s. As a result, the US widened its lead over China as India’s largest trading partner.

These imports included petroleum crude worth $11.4 billion, petroleum products worth $1.2 billion and coal worth $1.8 billion. About 14.7 percent of India’s crude imports, by value, during April-August originated in Russia compared to 2.2 percent a year ago. Fertiliser imports from the nation also grew.

Exports to Russia, however, were hit by sanctions. The value of trade with Russia was similar to trade with Iraq and Indonesia.

The agreement also helped the continent-country to muscle its way into the top 10 sources of imports.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.