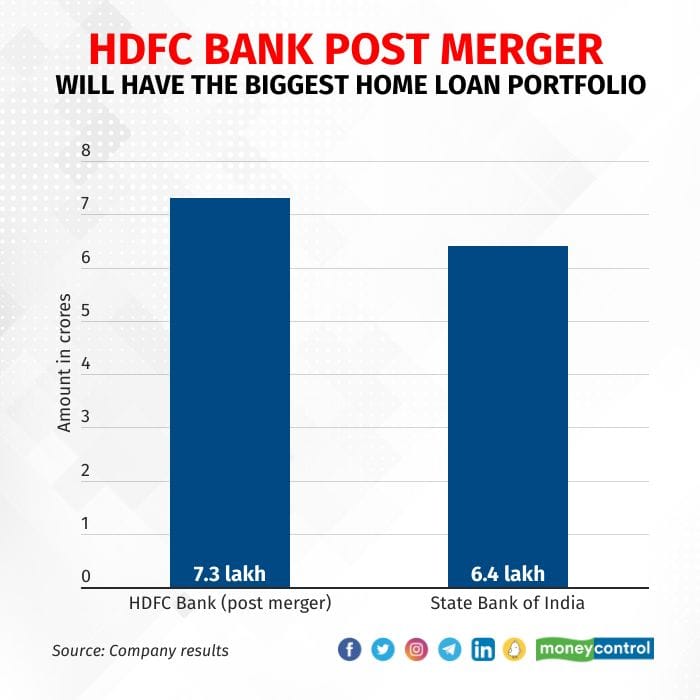

HDFC Bank will have the biggest home loan book in India after merging with parent Housing Development Finance Corporation by July, relegating State Bank of India, the country’s largest lender, to the second position.

The merged entity will have a total home loan book of Rs 7.3 lakh crore, compared with SBI’s portfolio of Rs 6.4 lakh crore as of March 2023, a Moneycontrol analysis showed.

HDFC’s home loan portfolio was Rs 6.25 lakh crore, whereas that of HDFC Bank stood at Rs 1.02 lakh crore. HDFC Bank’s relatively smaller home loan book was because the bank wasn’t active in the mortgage business and typically passed on home loan customers to the parent company.

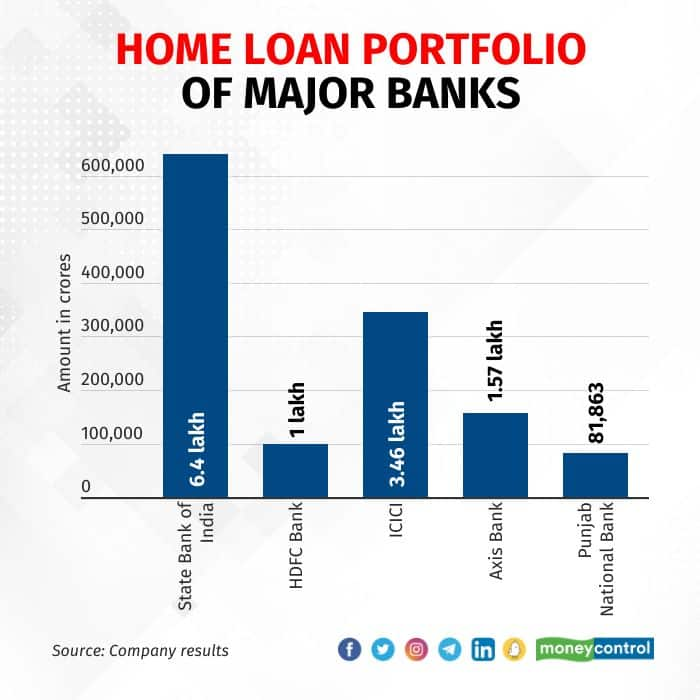

Also read: RBI allows HDFC Bank to hike stake in HDFC Life, HDFC ERGO to more than 50%Other banks with a significant home loan book include ICICI Bank with Rs 3.46 lakh crore as of March, Axis Bank with Rs 1.57 lakh crore and Punjab National Bank with Rs 81,863 crore.

The merger is only about a month away, Sashidhar Jagdishan, managing director of HDFC Bank, said on an analyst call on May 24.

“It's now just another four or five weeks before the big day that is going to be happening, which is the merger with HDFC,” Jagdishan said.

The combined entity will have a total balance sheet of Rs 18 lakh crore and market capitalisation of Rs 14 lakh crore.

Experts said the merger will boost the bank’s loan book and improve the net interest margin (NIM) too. NIM is the difference between interest income earned and interest paid by a bank.

According to Ashvin Parekh, MD of Ashvin Parekh Advisory Services, the NIM of HDFC Bank will improve by 175 to 200 basis points (bps).

Also read: HDFC to complete its merger with HDFC Bank by JulyHDFC Bank's current NIM stands at 4.1 percent.

“The quality of the housing loan portfolio will improve as HDFC will bring in a massive customer base. For a while, HDFC Bank will have the largest housing finance portfolio, but later we may see competition from other bigger players,” said Parekh.

“After the merger, HDFC Bank will be second to SBI in terms of market size. But with steady loan growth over the next five years, we can see HDFC Bank becoming the country’s largest bank,” said Aditya Shah, a banking analyst.

An analyst, who did not wish to be identified, said the Reserve Bank of India may look at reducing the repo rate, which could work in favour of the bank.

“The lowering of the repo rate will only work in favour of HDFC Bank as the deposit rate will come down,” the analyst said.

The RBI has increased the policy repo rate by 250 basis points since May 2022 and left it unchanged at 6.5 percent in April, suggesting that the central bank could start cutting rates soon. Some clarity may emerge after the RBI meeting this week.

Mortgage marketMany banks reported double-digit growth in their home loan portfolio for the quarter ended March 2023.

ICICI Bank reported an 18 percent growth in its home loan portfolio to Rs 3.46 lakh crore from Rs 2.96 lakh crore in March 2022. Axis Bank said its home loan portfolio grew 10 percent to Rs 1.57 lakh crore.

According to a report by SBI in August 2022, India’s home loan market is set to double by 2027.

“Post COVID-19, working from home has emerged as a dominant trend that is redefining the mortgage loan demand for the household sector,” SBI said.

In 2015, Deepak Parekh, chairman of HDFC, said his company could consider a merger with HDFC Bank provided circumstances were favourable.

HDFC Bank agreed on April 4 last year to take over the country’s leading mortgage company in a deal valued at about $40 billion, creating a financial services titan. The deal was termed the biggest in India’s corporate history.

HDFC has received approval letters from RBI, Securities and Exchange Board of India, Pension Fund Regulatory and Development Authority and Competition Commission of India, and BSE and National Stock Exchange of India.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.