Finance minister Nirmala Sitharaman’s exhortation to the Indian industry earlier this week to step up investments was accompanied by bewilderment as to why investment was not picking up despite corporate tax cuts and government incentives.

"Since 2019, when I took charge of the finance ministry, I have been hearing the industry say that it doesn't think the environment is conducive (for investment)," Sitharaman said on September 13 while speaking at an industry event in the national capital. "We will do everything to get the industry to come invest here. I want to hear from India Inc.: what's stopping you?”

Despite the government seeking to trigger private investment by boosting its own spending, especially on infrastructure, private capital investment remains subdued.

In 2019, Sitharaman had slashed corporate tax rates. Over the last two years, India has also offered incentives on annual incremental sales to boost local manufacturing in a host of sectors ranging from automobiles, white goods, and pharmaceuticals, to solar photovoltaic modules.

The programme is part of New Delhi’s broader goal to help reduce imports and boost exports of manufactured products, in an attempt to secure a foothold in the global supply chain that is shifting from China following the pandemic.

The Indian economy has recovered back to pre-pandemic levels, corporate profitability has revived, and capacity utilisation is up.

| GDP at 2011-12 prices (year on year percentage change) | |||||

| (quarter ending) | Jun 2021 | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 |

| Gross domestic product | 20.1 | 8.4 | 5.4 | 4.1 | 13.5 |

| Private final consumption expenditure | 14.4 | 10.5 | 7.4 | 1.8 | 25.9 |

| Government final consumption expenditure | -4.8 | 8.9 | 3 | 4.8 | 1.3 |

| Gross fixed capital formation | 62.5 | 14.6 | 2.1 | 5.2 | 20.2 |

| Source: CMIE | |||||

Government capital expenditure hit Rs 1.75 lakh crore during the first quarter of this financial year, up 57 percent from a year earlier and nearly a quarter of the full-year budget estimate.

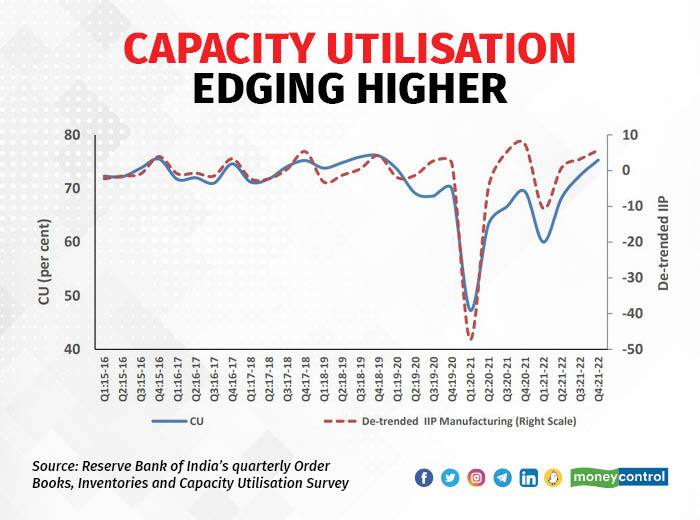

At the aggregate level, capacity utilisation in the manufacturing sector rose to 75.3 percent in the fourth quarter of 2021-22, from 72.4 percent in the previous quarter, an improvement for the third successive quarter, according to a Reserve Bank of India (RBI) survey.

This should augur well for fresh investments, given that the cost of capital still remains low compared with historical standards.

Still, the industry seems reluctant to spend more.

According to the Centre for the Monitoring of Indian Economy (CMIE), capital expenditure aggregates for new projects halved to Rs 4.31 lakh crore in April-June from Rs 8.18 lakh crore in the previous quarter, which had seen a substantial spike.

India also posted a sequential fall in proposals for adding new capacity in the industrial, infrastructural, and services sectors during April-June, according to CMIE. The quarter ended June saw proposals for investments totaling Rs 3.57 lakh crore, lower than Rs 5.91 lakh crore the previous quarter.

| Quarterly Capex Aggregates | ||||

| (Rs lakh crore) | Sep 2021 | Dec 2021 | Mar 2022 | Jun 2022 |

| New projects | 3.4 | 4.02 | 8.18 | 4.31 |

| Completed projects | 1.29 | 2.76 | 1.26 | 1.17 |

| Stalled projects | 0.28 | 0.08 | 0.43 | 0.25 |

| Revived projects | 0.39 | 1.98 | 0.32 | 0.28 |

| Source: CMIE (Data as on Sep 15) | ||||

While the spike in inflation hurts consumer sentiment, companies could be holding off fresh investment until global uncertainties abate.

Several developed economies are expected to slip into recession this year amid an energy crisis, and as central banks hasten to raise interest rates to control the cost-of-living crisis. China too continues to be a cause of concern given its Covid management strategy and the recent heatwaves.

To be sure, despite global headwinds, India’s finance ministry had exuded confidence in its latest monthly economic report that private investment would revive sooner than later.

“As and when the Indian private sector embarks on the long-awaited capital expenditure cycle, building on the government’s capital expenditure of recent years, India’s potential and estimated economic growth performance for the rest of the decade will inevitably be revised higher,” the ministry had said.

Meanwhile, senior members of the central bank were guarded in their prognosis.

“Private final consumption expenditure, the mainstay of the economy, is poised to surge in the upcoming festival season which should also buoy subdued rural demand, as shortfalls in kharif rice sowing abate with the recent revival of the south-west monsoon,” senior RBI members wrote in a recent article on the state of the economy.

“Investment demand is benefitting from the massive 54 percent increase in the central government’s capital outlay, but business investment remains tepid in spite of strong sales growth and increase in profits,” the article stated.

In another article, they expressed hope that the improved private corporate balance sheets, rising capacity utilisation, robust demand sentiment, higher government capex, and policy initiatives would revive the capex going ahead.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.