For a party that rode to power promising to usher in 'Achhe din' (good days), it would not be statistically incorrect to say that the Narendra Modi-government has largely kept the inflation genie bottled up since May 2014.

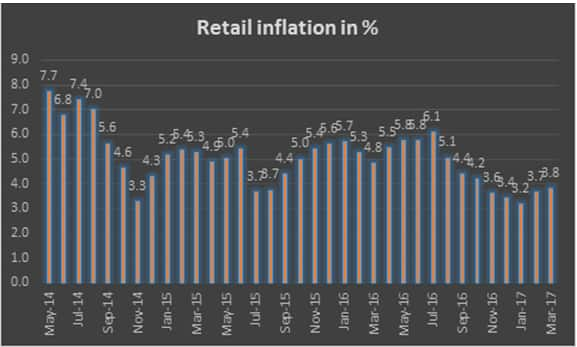

Monthly retail inflation has averaged 5.02 percent in the last three years. Measured by the consumer price index (CPI), it is the broadest cost of living metric in India as it captures shop-end price changes.

It also serves as the Reserve Bank of India (RBI’s) main guide for interest rate decisions and fitting trends in economy-wide price movements. The RBI and the government have set a retail inflation target of 4 percent for the next five years with an upper tolerance level of 6 percent and lower limit of 2 percent.

Price movements over the last five months show that inflation levels have remained well within the 4 percent range, partly aided by a benign international commodity price cycle and partly due to the RBI’s steadfast focus on not letting the guard down on cooling prices even if it meant keeping interest rates high on many occasions.

Food inflation, a proxy to measure changes in household kitchen budgets, has broadly followed the headline inflation rate, primarily due to efforts by the government to hammer down pulse prices, a common source of protein for most Indians.

In 2015, prices of pulses skyrocketed to a five-year high in some parts of the country on the back of weather-induced supply shocks.

Arhar or tur dal was retailing at about Rs 200 a kg in some parts of the country as lentil output fell to 17.38 million tonnes in 2014-15 crop cycle, which usually starts in July and end in June, from 19.25 million tonnes in the previous year.

Hailstorms during March and April 2015 and back-to-back drought had hit pulse production resulting in a sharp spike in prices.

India does not produce enough pulses and relies on imports to meet domestic demand. In a good farm year, the country manages only about 18 million tonnes while demand usually hovers between 22-24 million tonnes.

Supplies had fallen further, battered by a drought in 2015, presenting the Modi government with a challenge to contain inflation in pulses, which was threatening to snowball into a political issue.

The government addressed this issue by announcing a string of administrative measures that record stocks built up through domestic procurement by offering significantly higher minimum support prices (MSP), as an incentive to wean farmers towards pulses ahead of other crops.

Separately, the government also bolstered stocks through greater imports. The results followed, with arhar retailing at less than Rs 80 a kg currently.

According to the food ministry, state procurement has helped farmers get remunerative prices for (summer-sown) kharif pulses. State agencies, the food ministry has said, will continue to procure from farmers at support prices as an incentive to grow more pulses.

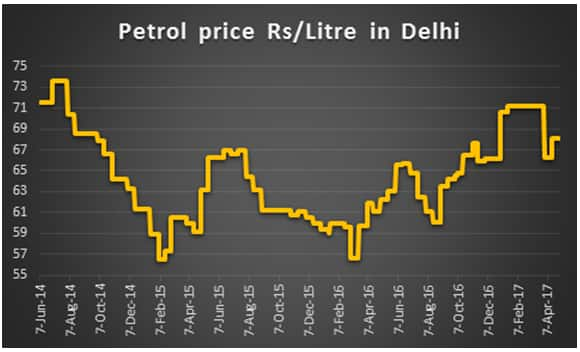

Cheap Crude, Not-so-cheap FuelWhile the government has scripted a success story by securing a firm grip on pulse prices, it may have been guilty of standing in the way of lower petrol and diesel prices.

It began with the right intent, when in October 2014, in a bold reformist move it lifted state controls on diesel prices allowing oil companies to fix the fuel’s pump-gate prices based on global crude oil costs.

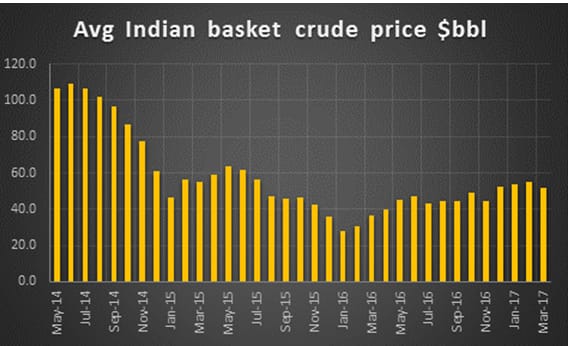

India imports two-thirds of its energy need, making oil prices a key factor for inflation.

Crude prices have been falling because Organisation of Petroleum Exporting Countries (OPEC), a cartel of 12 oil producing nations that control 40 percent of the world’s oil output, has decided to keep supplies high enough. This, along with a low demand from a slowing China, has made more oil available to the world’s pool for countries like India to import at lower prices.

The persistent fall in crude prices for the better part of the last three years offered an opportunity to help end consumers reduce their fuel bills.

That, however, hasn’t played out, primarily because the government has raised taxes on the two transport fuels that have kept oil companies from passing on cheaper crude oil benefits to the end consumer.

Trends in petrol and diesel prices haven’t mirrored the crude oil price patterns, offsetting the gains that millions would have enjoyed from a market-determined price regime.

Six months into office, the Modi-administration’s move to free up diesel prices from government control was hailed as an audacious move to reform the single most complex piece of India’s complex political economy.

Thirty months later, it may well seem like a case of an opportunity lost.

Watch: The 37-year journey of the BJPFull coverage: Three years of Modi government

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.