The three-day meeting of the Reserve Bank of India's Monetary Policy Committee started on April 3. Headed by Governor Shaktikanta Das, the committee is scheduled to announce its decision at 10:00 am on April 6.

The MPC is widely expected to increase the policy repo rate for the seventh time in less than 12 months. Most economists expect the repo rate to be raised by 25 basis points to 6.75 percent.

One basis point is one-hundredth of a percentage point.

While voting on the interest rate decision, the MPC members will examine a range of data to assess the economy's situation. Moneycontrol reviews the movement of key economic indicators since the MPC met February 6-8, when it voted to increase the repo rate by 25 basis points to 6.5 percent.

The list is not exhaustive, but they are crucial in representing the state of the Indian economy.

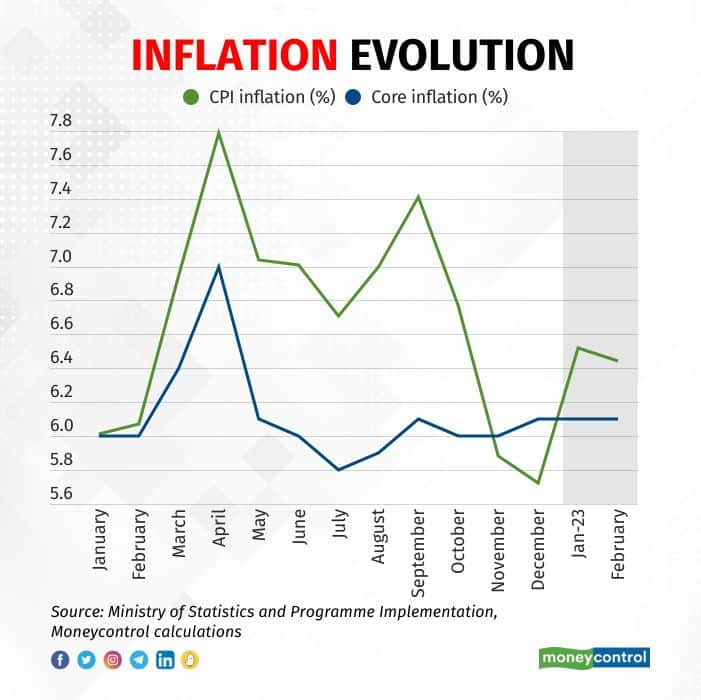

InflationThe past two months have been difficult from an inflation perspective, with Consumer Price Index (CPI) inflation jumping past the 6 percent upper limit of the RBI's tolerance band.

Headline retail inflation first unexpectedly rose to 6.52 percent in January before easing only marginally to 6.44 percent in February.

However, it is not a simple case of inflation accelerating, with the sharp increase in price pressures largely due to statistical reasons. Core inflation, meanwhile, remains sticky at just over 6 percent.

GrowthMatters are equally murky on the growth front. According to data released on February 28, India's GDP growth fell to 4.4 percent in October-December as the favourable base effect continued to fade. However, the government and the RBI have defended the economy's prospects, saying it is well-positioned going into 2023-24.

High-frequency data – particularly the services Purchasing Managers' Index – has been more supportive of the policymakers' assessment of growth.

Credit growthIn terms of financing, credit growth remains robust. Non-food bank credit was up 15.9 percent Y-o-Y in February, slightly lower than 16.7 percent in January. However, that was perhaps to be expected, given the rapid clip at which lending rates are rising.

As per latest data, the weighted average lending rate on outstanding loans rose by 9 basis points in February to 9.67 percent. The rate increase for fresh loans was an even greater 24 basis points to 9.24 percent.

Since the end of April 2022, the lending rate on outstanding loans has increased by 95 basis points, while that on fresh loans is up 173 basis points.

ExternalsA key determinant of India's external balance is global crude oil prices. The average price of India's crude oil basket in November fell to $78.54 per barrel in March, down from $82.28 per barrel in February – well below the $95 per barrel assumed by the RBI in its inflation forecasts.

The rupee's exchange rate, meanwhile, has displayed stability, averaging 81-82 per dollar over the past six months.

The difference between interest rates in India and in developed countries such as the US edged up. As of April 2, the difference between 10-year Indian and US government bond yields was 388 bps – up from 341 basis points at the beginning of March but below 483 bps at the start of 2022.

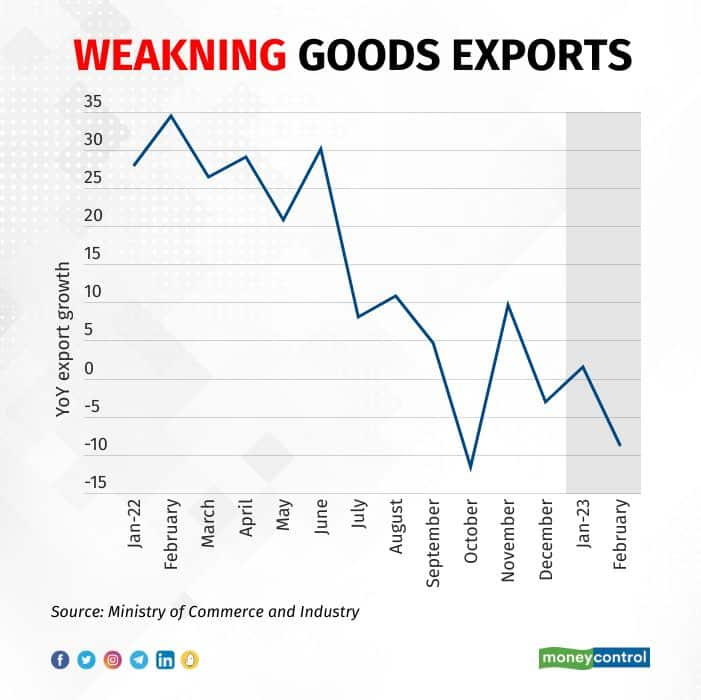

ExportsWhile India's external balance has improved in recent months, merchandise exports have been strained by weakening global growth.

In three of the past five months, India's merchandise exports contracted on a year-on-year basis, with growth in one of the other two months at an anaemic 1.5 percent. Over this five-month period, India's goods exports shrank by 2.5 percent on average.

Services exports, however, have performed increasingly well and hit record highs.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.