India’s monetary and fiscal authorities are finally acting in unison as spiking inflation is posing a threat to economic growth. Inflation might not have peaked but for the prolonged Ukraine war. Now, more action will be needed to rein it in as the poor get hurt the most.

“If you look at the bottom of the pyramid, their income level is pretty low,” said Soumyajit Niyogi, Director, Core Analytical Group at India Ratings & Research. “These guys have the least legroom available to absorb any kind of inflationary shock.”

Several developed and emerging economies are rushing to curb surging prices as the prolonged war continues to disrupt supply chains, pushing countries to restrict outbound shipments.

Central banks are quickening the reversal of pandemic-era stimulus and are seeking to shrink their bloated balance sheets, while fiscal authorities slash taxes and raise subsidies.

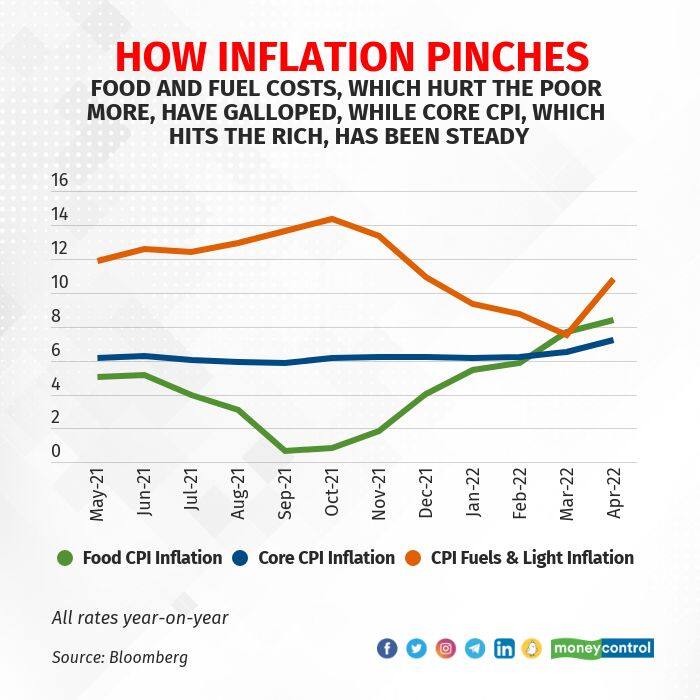

In India, the economically weaker sections carry a disproportionate burden of spiking food and fuel costs.

Rising food prices rural poor’s main enemyWhile the urban poor have borne the brunt of the price rise since the pandemic, the rural poor could face more pressure from rising food prices going ahead, CRISIL Research said this month.

“Rising food prices and elevated fuel inflation in fiscal 2023 will pinch the poorer population more,” CRISIL Chief Economist Dharmakirti Joshi said.

Food makes up the major share in expenditure for the bottom 80 percent percent of the population in India, according to the Consumer Expenditure Survey of the National Sample Survey Organisation.

The share of fuel in the consumption basket is also relatively higher for the bottom 20 percent. Core retail goods make up most of the spending for the top 20 percent.

India’s headline consumer price index (CPI)-based inflation rate accelerated to an eight-year high in April, while wholesale prices quickened the most in 30 years.

Retail inflation has stayed above the central bank’s target for over two years and the wholesale index has stayed in double digits for a year.

Globally, prices across the board – from food, commodities, metals and crude oil – have surged in tandem. Meanwhile, climate change has disrupted crop cycles, worsening seasonal food price spikes. Nearly two dozen countries have moved to curb outbound food exports.

In India, the central bank normalised its policy rate corridor to pre-pandemic width in April and sprang a surprise with an off-cycle rate hike in May as it pre-empted the inflation shocker. It has since warned that more rate hikes are in the offing.

New Delhi has announced a slew of measures over the last week, including a cut in taxes on petrol and diesel, curbs on wheat and sugar shipments as well as moves to cool edible oil and steel prices.

More steps will be needed to lessen the pain as wages have not risen in real terms even as household savings of India’s poor and lower middle class have been wiped off due to the economic and health costs of the pandemic.

Companies might find it tough to pass on costsMoreover, the impact of monetary tightening will take months to play out and fiscal measures like fuel tax cuts and free food grains will help only marginally.

“Given that inflation is basically originating from the external side, who will absorb this inflation? Either the end consumers or producers,” India Ratings’ Niyogi said.

The economic malaise that has set in among the weaker and informal sector will take time to repair, complicating matters for firms that cannot cut costs further and could also find it tough to pass on input cost pressures.

“For bigger companies, it will be difficult to pass on the entire cost push inflation. Local brands might see some temporary recovery in demand as people shift to lower-end products as they can’t afford higher value items. But that will help these firms to survive only, and it won’t be a big boost,” Niyogi added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.