India's largest information technology (IT) company-- Tata Consultancy Services (TCS) is all set to kickstart the October-December earnings season with its results on January 9. While revenue for the IT giant is widely expected to remain muted due to higher furloughs in Q3, a depreciation of the Indian rupee is seen aiding margins.

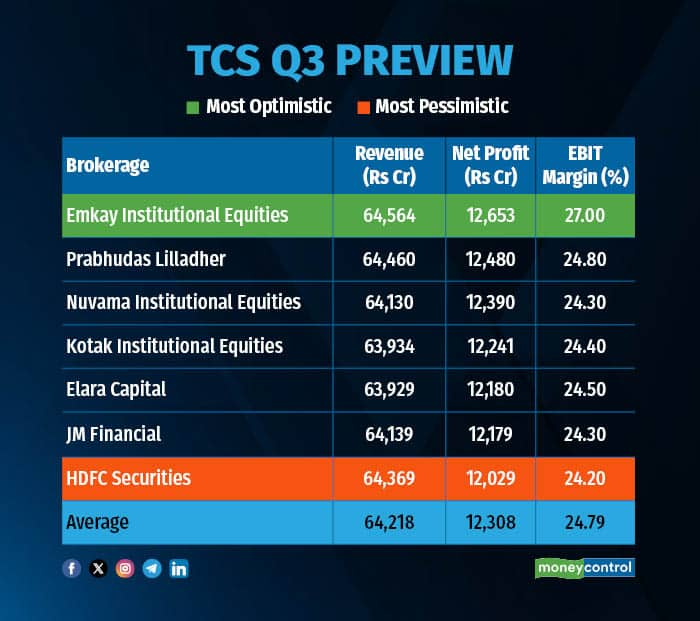

According to a Moneycontrol poll of seven brokerages, TCS is likely to post a less than one percent sequential decline in revenue to Rs 64,218 crore, down from the Rs 64,259 crore that it clocked in the last quarter.

Despite the marginal fall in revenue, average estimates of the seven brokerages peg consolidated net profit to grow 3 percent on quarter to Rs 12,308 crore. The IT major had recorded a net profit of Rs 11,909 crore in the preceding quarter.

The profit growth is expected to be driven by an improvement in EBIT margins on the back of a rupee depreciation and better operational efficiencies. Meanwhile, it is also worth noting that Q3 is a seasonally weak quarter for the IT industry.

In addition, earnings estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price.

Among the brokerages polled by Moneycontrol, Emkay Institutional Equities rolled out the most bullish projections while HDFC Securities forecasted the weakest growth for TCS.

What factors are driving the earnings?The third quarter is a seasonally weak quarter for IT companies due to higher furloughs on account of Christmas and New Year holidays. Furloughs in the IT sector refer to temporary leaves of absence, typically unpaid, that companies implement for their employees and are common, largely towards the end of the calendar year.

Higher furloughs: Analysts across the board expected muted revenue growth for TCS due to seasonal weakness from higher furloughs in Q3. In addition, analysts at Kotak Institutional Equities expects weak revenues from developed markets and stronger growth in emerging markets.

Ebbing BSNL revenues: Following the peak revenue contribution from the BSNL deal in Q2, revenue from the deal is likely to moderate in Q3, hampering overall topline growth. However, the absence of BSNL deal-related costs which hit Q2 margins will aid EBIT margin expansion in Q3, Elara Capital stated. TCS and BSNL are working together on a Rs 15,000 crore deal to establish data centers and 4G sites across India.

Lack of mega deal wins: Analysts at KIE expect muted deal wins of around $9-10 billion due to a lack of mega-deal activity for TCS as well as the entire IT industry.

Improved margins: Despite weakness in revenue growth, analysts expect EBIT margins to improve for TCS in Q3. With the company having undertaken wage hikes back in Q1, the absence of additional costs on that front, coupled with currency tailwinds due to the rupee's depreciation as well as improved operational efficiencies are expected to aid margin expansion.

What to look out for in the quarterly show?The quarterly results of TCS will also set the tone for the entire information technology segment. Stocks from the sector may also react to the company's earnings performance and management commentary as investors attempt to gauge the future outlook for the industry.

Market participants will watch out for the management's outlook for revenue and demand growth in the coming quarters. Focus will also be on customer behavior post-Fed rate cut, demand trends in Europe and the UK, deal wins, and hiring plans.

Some clarity on the reasons behind the revenue growth underperformance of the company as compared to the rest of the IT industry, excluding its BSNL revenues would also be welcomed.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.