State Bank of India (SBI), India's biggest lender, is expected to report a robust 39 percent increase in net profit, driven by strong loan growth and improved asset quality, when it announces the numbers for the July-September quarter on November 5.

The quarter-on-quarter growth for most operating metrics is likely to show a big jump, given that State Bank of India reported benign numbers in Q1FY23.

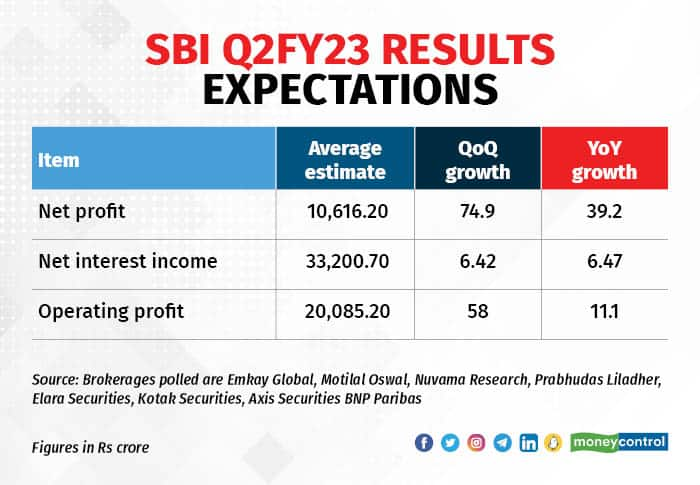

An average of the estimates of eight brokerages polled by Moneycontrol puts SBI’s net profit for Q2FY23 at Rs 10,616.2 crore.

That said, analysts expect net interest income to be Rs 33,200 crore, a modest increase of 6 percent year on year. That, along with a likely fall in non-interest income (NII) could keep operating profit growth at 11 percent to Rs 20,085 crore for the reporting quarter.

SBI’s core interest income growth has been under pressure for many quarters now owing to legacy bad loans that do not contribute to interest income. The low-interest rate regime following the coronavirus outbreak has also been a drag on income.

Yet another factor for lower NII growth has been faster growth in retail loans than corporate loans. Corporate loan growth has recovered but it still is far from pre-pandemic levels. Loans to companies fetch higher interest rates than retail. As such, loan growth is expected to be robust for the September quarter.

Analysts expect SBI to report a healthy 16-18 percent loan growth for the quarter led by sustained retail loan growth and recovery in corporate loan disbursals.

“Healthy growth, margin recovery and lower staff cost in the absence of impact of family pension would drive up profitability,” analysts at Emkay Global Financial Services Ltd wrote in a note.

The bank’s loan book expanded 15 percent in the June quarter, led by an 18 percent jump in retail loans.

Asset quality improvement

Most analysts expect SBI to show steady bad loan ratios. Slippages are expected to be under control for the September quarter. This would mean provision requirements could continue to be low .

Analysts at Elara Capital, however, note that small business loans have been a pain point and could contribute to slippages. For the three months ended June, SBI had reported slippages of Rs 9,740 crore and gross bad loans had formed 3.91 percent of the total loan book.

Analysts expect gross bad loans to remain around these levels for the September quarter as well. Recoveries and upgrades will also be watched and the performance of the restructured portfolio of about Rs 30,000 crore would be keenly monitored.

Margin mantra

SBI’s cost of funds is one of the lowest in the industry owing to the bank’s unparalleled access to low-cost deposits. Its current and savings account deposits have a large share of 46 percent of total deposits. CASA growth, however, has been benign and the bank has hiked term deposit rates too.

Analysts expect the net interest margin to be stable above 3 percent for the bank given the deposit heft. But the yield on advances may disappoint and put pressure on margins.

Nevertheless, the outlook remains positive for margins and management commentary on the same would be closely watched. Analysts at Motilal Oswal Financial Services expect the margin to improve to 3.1 percent for the September quarter.

At 2.03 pm, the share was trading ing at Rs 588.10 on the NSE, up 0.55 percent.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.