India's largest lender, State Bank of India, is likely to clock solid set of July-September quarter (Q2FY25) earnings due to healthy loan as well as deposit growth. The public lender will report the second-quarter performance on November 8, 2024.

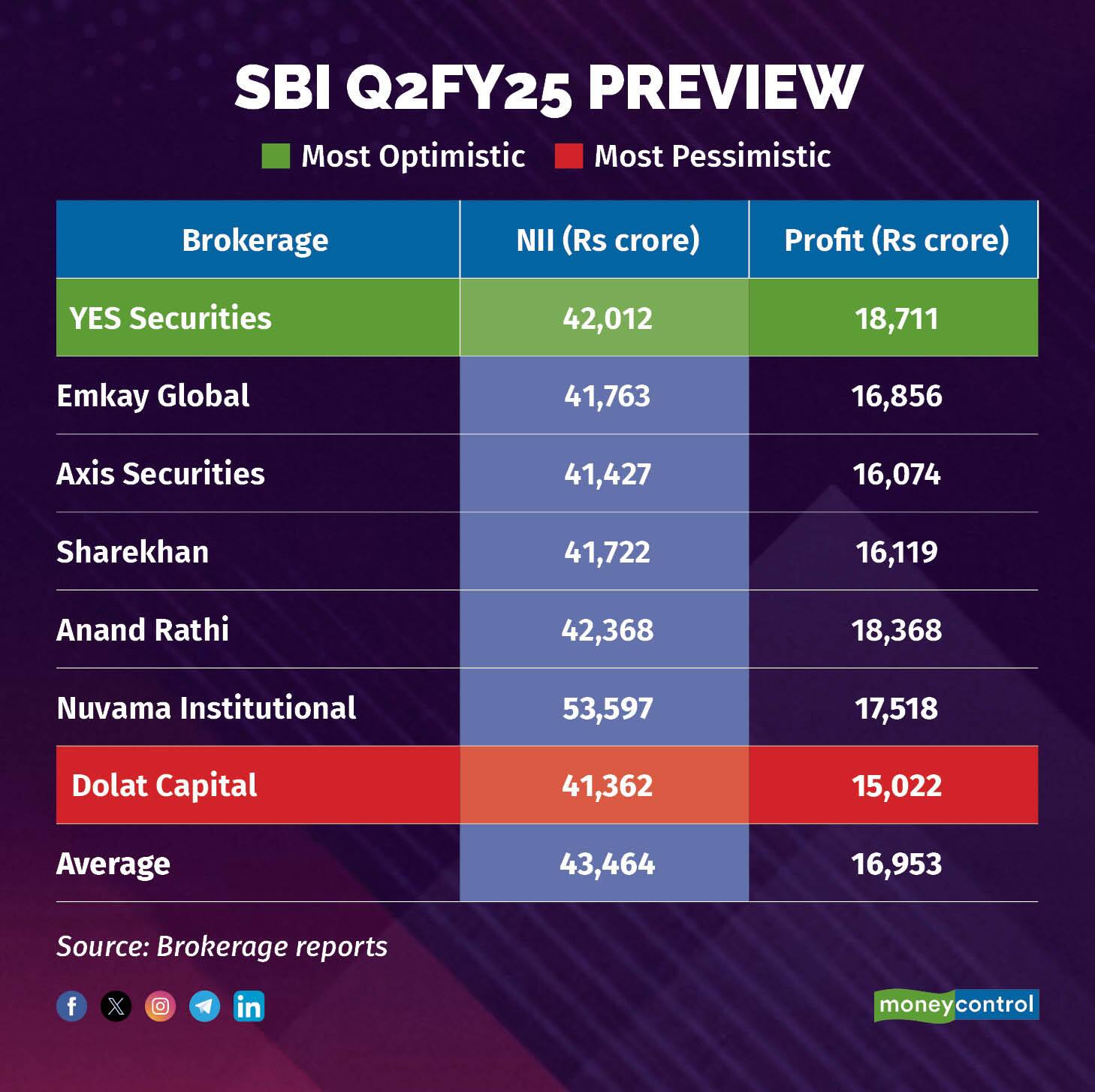

According to Moneycontrol's poll of 7 brokerage estimates, SBI is expected to register healthy 10 percent year-on-year (YoY) growth in net interest income (NII) to Rs 43,464 crore in Q2FY25 from Rs 39,500 crore in the year-ago period. Profit is pegged to grow by 18 percent YoY to Rs 16,953 crore in Q2FY25 versus Rs 14,330 crore in Q1FY25.

Stable CD ratio: Brokerages expect credit-to-deposit ratio to be largely stable amid healthy loan and deposit growth in the second quarter. According to Motilal Oswal analysts, loans are expected to grow 16 percent YoY to Rs 38 lakh crore in Q2FY25, whereas deposit is expected to grow 9 percent YoY to Rs 51 lakh crore.

Improving asset quality: SBI's gross non-performing assets (GNPA) is projected to improve to 2.16 percent in Q2FY25 from 2.55 percent in the year-ago period, said Motilal Oswal analysts. Its net NPA is also expected to improve to 0.55 percent in Q2FY25 versus 0.64 percent in Q2FY24.

Margin moderation: Analysts at Emkay Global expect SBI's net interest margins (NIMs) to remain largely flat at 3.2 percent in Q2FY25 versus 3.3 percent in the year-ago period.

What to look out for in the quarterly show?Management's commentary on capital adequacy, outlook on loan book growth, and return ratio will be keenly watched out by market participants.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.