Anubhav Sahu

Moneycontrol Research

Navin Fluorine, the leading player in the fluorine value chain of chemicals, posted another quarter of business transition. A sequential jump in specialty chemicals and improved order book from the pharma end market are key takeaways. While the key market of agri-chemicals continues to remain lacklustre, elevated raw material prices remains a key challenge.

Q1 FY19 result update Q1 sales were up 20 percent year-on-year (YoY) aided by 27 percent value growth in legacy business (inorganic fluorides and refrigerants). High value added business, including contract research and manufacturing services (CRAMS) and specialty chemicals, were up 13 percent. While the CRAMS witnessed a sluggish Q1, there was a sharp jump (52 percent YoY) in specialty chemicals revenue.

Standalone quarterly result

Earnings before interest, tax, depreciation and amortisation (EBITDA) margin was broadly at the same level as last year but sequentially there was an improvement aided by product mix (higher specialty chemicals contribution) and better export realisation in refrigerants exports. On account of lower other income, majorly due to mark-to-market losses, net profit declined 19 percent.

Business under transition

Refrigerants business gained from exports, wherein price realisation has increased. The same was offset by slowdown in the domestic business, with original equipment manufacturing (OEM) shifting to other non-ozone depleting gases. Despite slowdown in the domestic business, the management is hopeful of utilising its quota for emissive gases production and sales. The company sees higher usage of its existing refrigerant gases for non-emissive applications in pharma.

In the case of inorganic fluorides, the management sees sustainable improvement in export opportunities to Europe. This opportunity emerged a couple of quarters back due to lower exports from China, which is now sustainable due to repeat orders mainly from steel and oil and gas end markets.

Specialty chemicals growth was due to improved sales in pharma end markets. The management said turnaround for specialty chemicals has arrived and is led by pharma end markets.

Elevated raw material prices

Higher fluorspar prices remains a key concern. As far as the last quarter is concerned, the management has been able to pass on raw material prices. In the interim, it is trying to diversify raw material sourcing, which at present is majorly done from South Africa.

Result was mixed

The only business which was as per expectation was inorganic fluoride. In case of the refrigerant gases business, gradual slowdown in the domestic business is possible as we progress towards the next phase of production cut down in the hydro chloro fluoro carbons (HCFC).

Progress in the Piramal joint venture and CRAMS was sluggish due to operational issues (catalyst replacement) and seasonal slowdown, respectively. We view this as transitory. Improved turnout in the specialty chemicals was a major positive.

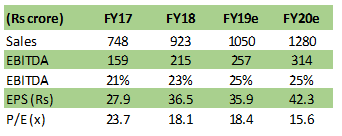

Source: Moneycontrol Research

The company is inching towards a higher exposure to high margin molecules through contract research as the new capacity expansion gets streamlined. Higher exposure to pharma end markets and improved turnout in specialty chemical is a key positive, which can help company re-rate in the medium term.

The stock has corrected 25 percent from its 52 week high and trades at 18.4 times FY19 earnings which is a reasonable level for accumulation.

For more research articles, visit our Moneycontrol Research page

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.