Mumbai-headquartered Mahindra Mahindra (M&M) Limited is set to release its earnings report for the third fiscal quarter of FY25 on February 7. Analysts expect a sharp uptick in revenue, driven by strong auto and farm equipment business volumes and better realisation.

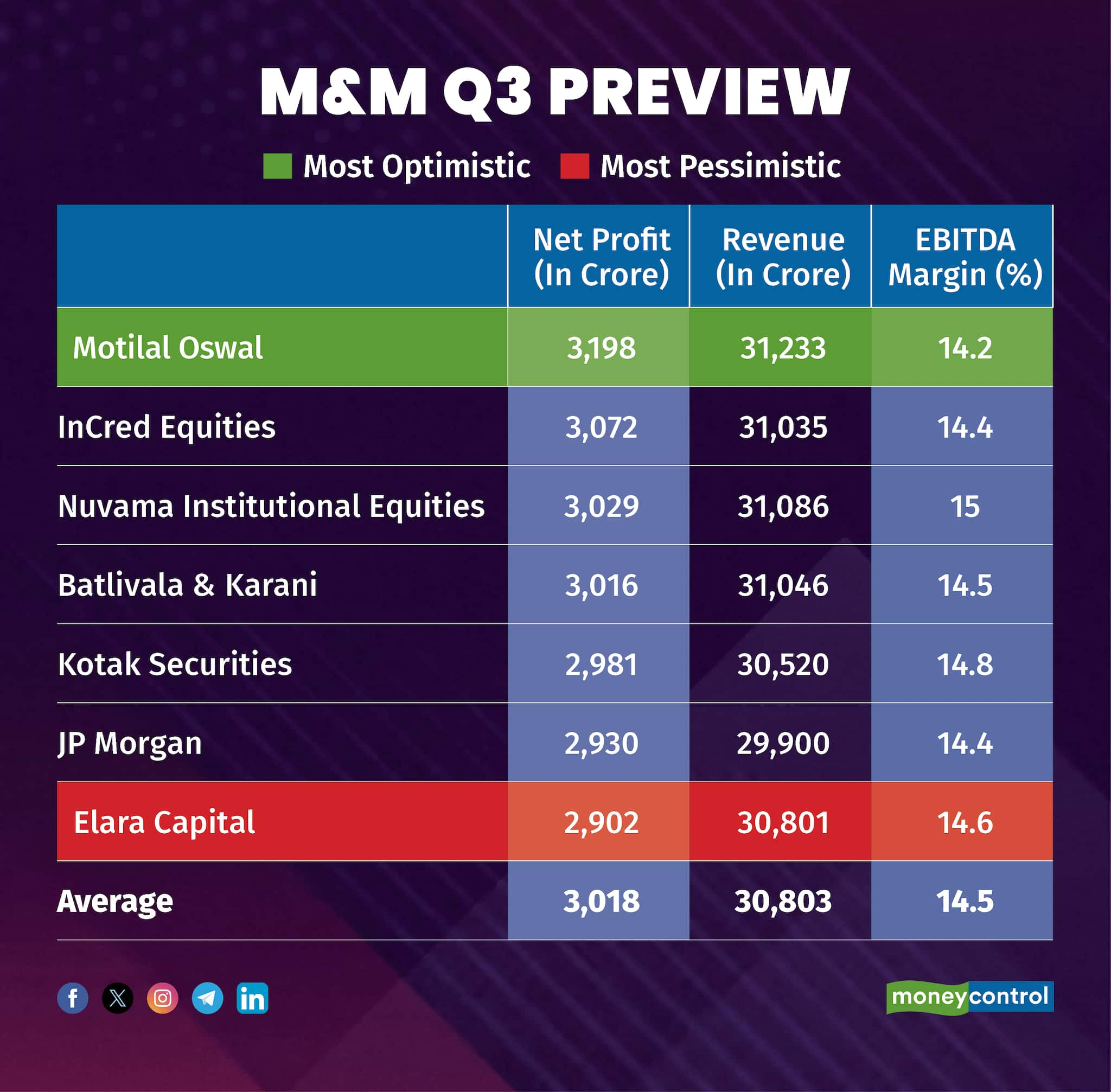

According to a Moneycontrol poll of seven brokerage firms, the Thar maker is anticipated to record a 21.8 percent year-on-year increase in revenue, reaching Rs 30,803 crore. Net profit is projected to surge 23 percent to Rs 3,018 crore from Rs 2,454 crore in the same quarter of the previous fiscal year.

Follow our LIVE blog for all the latest market updates

Earnings estimates from analysts polled by Moneycontrol are in a narrow range, indicating that any positive or negative surprises could trigger a sharp reaction in the stock price.

What factors are driving M&M's earnings?Stong Volumes: M&M, one of India's leading EV makers, witnessed a 4 percent rise in volumes, positively impacting revenue growth during the third quarter. Despite the overall slowdown in the auto sector, the company has sold 3,67,273 units in Q3, higher than the 3,13,115 units sold in the same quarter last year.

Strong Tractor Segment: Analysts believe tractors are well-positioned, with volumes expected to grow in the mid-to-high single digits over FY24–27E. Elara Capital says that the segment will likely be 36 percent of overall volumes.

Robust Margins: The company's tracker sales from the farm equipment business will likely help EBITDA margins improve to 14.5 percent, an improvement of 170 basis points year over year. As Nuvama points out, EBITDA margin shall expand on better margins in the tractor segment.

Also read: Market sell-off: Financials, consumer services, IT stocks see heavy selling in January as FIIs exit

What to look out for in the quarterly show?Key factors to watch include order bookings for electric vehicles (EVs) and the demand outlook for tractors. Additionally, market attention will be on the company's guidance regarding the demand for its new EV models, such as the BE 6E and XEV 9E and any strategic insights on future product rollouts.

Mahindra & Mahindra shares were trading at Rs 3,175 on February 7, up 1.1 percent from the previous close on the NSE. M&M was the best-performing Nifty stock of 2024, having surged over 83 percent.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.