Cigarette-to-soap maker ITC is likely to post a decent set of numbers for the December 2022 ended quarter, with standalone revenue growing 11 percent year-to-year to Rs 4614 crore. The company will report its Q3 earnings on February 3, after market hours.

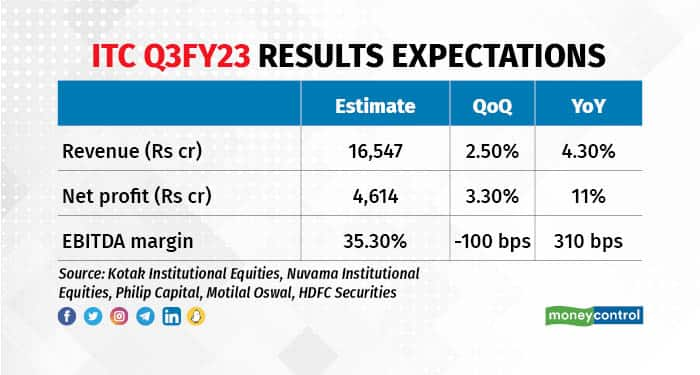

According to an average of estimates of brokerages polled by Moneycontrol, the company's revenue will rise 4.3 percent on-year to Rs 16,547 crore. Sequentially, topline and bottomline are expected to grow 2.5 percent and 3.3 percent.

ITC’s mainstay business of cigarettes, which has been in the limelight for hike in NCCD (National Calamity Contingent Duty) announced in Union Budget 2023, will likely report 10-11 percent YoY growth in volumes and 12 percent growth in sales, as per Kotak Institutional Equities.

Sales from FMCG business is expected to grow 20 percent YoY. While rural demand has been weak for most FMCG companies, ITC’s business does not have much of impact from it. This is due to higher salience of foods, noted analysts at Nuvama Institutional Equities.

“Similar to Britannia, ITC’s biscuits portfolio continues to perform well in rural as well as in urban,” they added.

Also Read: ITC nears Rs 400 mark; why costlier cigarettes are great news for shareholdersOf all the segments, hotels business is expected to be the outperformer. Analysts at KIE have forecast 40 percent growth in the segment with EBIT (earnings before interest and taxes) margin of 17.8 percent. “Hotels revenue growth and profitability will be key to watch out for as leisure and business travel return to normalcy,” according to analysts at Motilal Oswal Financial Services.

Meanwhile, sales from agriculture business might see a dip on a year-on-year basis due to a high base effect, which included wheat and rice exports.

ITC shares are now close to the Rs 400 mark and clocked an all-time high of Rs 384.70 apiece on the NSE on February 2. The stock corrected 6 percent on Budget day as the finance minister said the NCCD on cigarettes was hiked by 16 percent. The reaction was overdone as the Street soon realised the total tax component on a cigarette stick goes up by only 1-2 percent, said analysts.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.