FMCG leader Hindustan Unilever Ltd (HUL) is expected to report flat sales and volume growth in the December quarter of the current financial year with price cuts hitting the topline and a weak pick-up in festival demand impacting volumes.

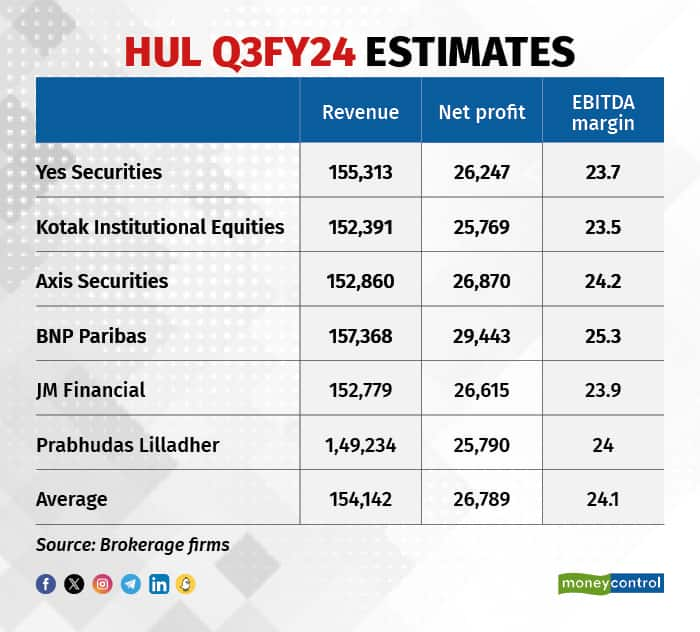

Hindustan Unilever's Q3 net profit is expected to be flat year-on-year at Rs 2,678 crore, an average of polls of six brokerage firms says. Revenue, too, is expected flat at Rs 15,414 crore when the FMCG major announces its results on January 19.

HUL’s EBITDA margin is expected to increase 77 basis points to 24.1 percent. Brokerages expect a 470 basis points YoY increase in gross margins as input costs like palm oil, tea, and coffee declined.

EBITDA is short for earnings before interest, tax depreciation and amortisation. One basis points is one-hundredth of a percentage point.

Volumes have remained weak for the lifebuoy and Dove manufacturer since the September quarter of the previous financial year, ranging from 2-5 percent. Volume growth has been slow due to a weak pick-up in rural demand even as small and regional players eat into its market share.

The company's home-care category is expected to report a modest 0.5 percent growth in sales YoY due to price cuts in the laundry portfolio, Kotak Institutional Equities said in its Q3FY24 results update.

The personal care and food and refreshments category is estimated to grow 3.5 percent and 3 percent YoY, respectively, BNP Paribas said.

Also read: Why HUL is not an analyst darling at the moment

The price of palm oil, an essential raw material for the FMCG sector, fell fallen 10 percent YoY and 3 percent QoQ in the December quarter, Kotak Institutional Equities said. Palm Oil is used in making soaps, shampoos, biscuits, and other products.

Domestic tea prices likely fell 4 percent YoY and QoQ in the October-December period, while sugar went up 11 percent and 6 percent , respectively, the brokerage firm said.

In its last earnings call, HUL said it was facing competition from local players in the tea and laundry categories. Tea prices have fallen further, which may lead to increased competition, analysts say. In a situation of easing inflation, small players start entering the market and gain market share from big and listed players.

Advertising and promotional spends for the FMCG company is estimated to be around 10 percent of Q3FY24 sales, BNP Paribas said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.