HCLTech, India's third largest information technology company, is slated to release its numbers for the October-December quarter on January 13. With a favourable seasonality for its products business, the company is expected to outperform other industry peers in terms of revenue and net profit growth in Q3.

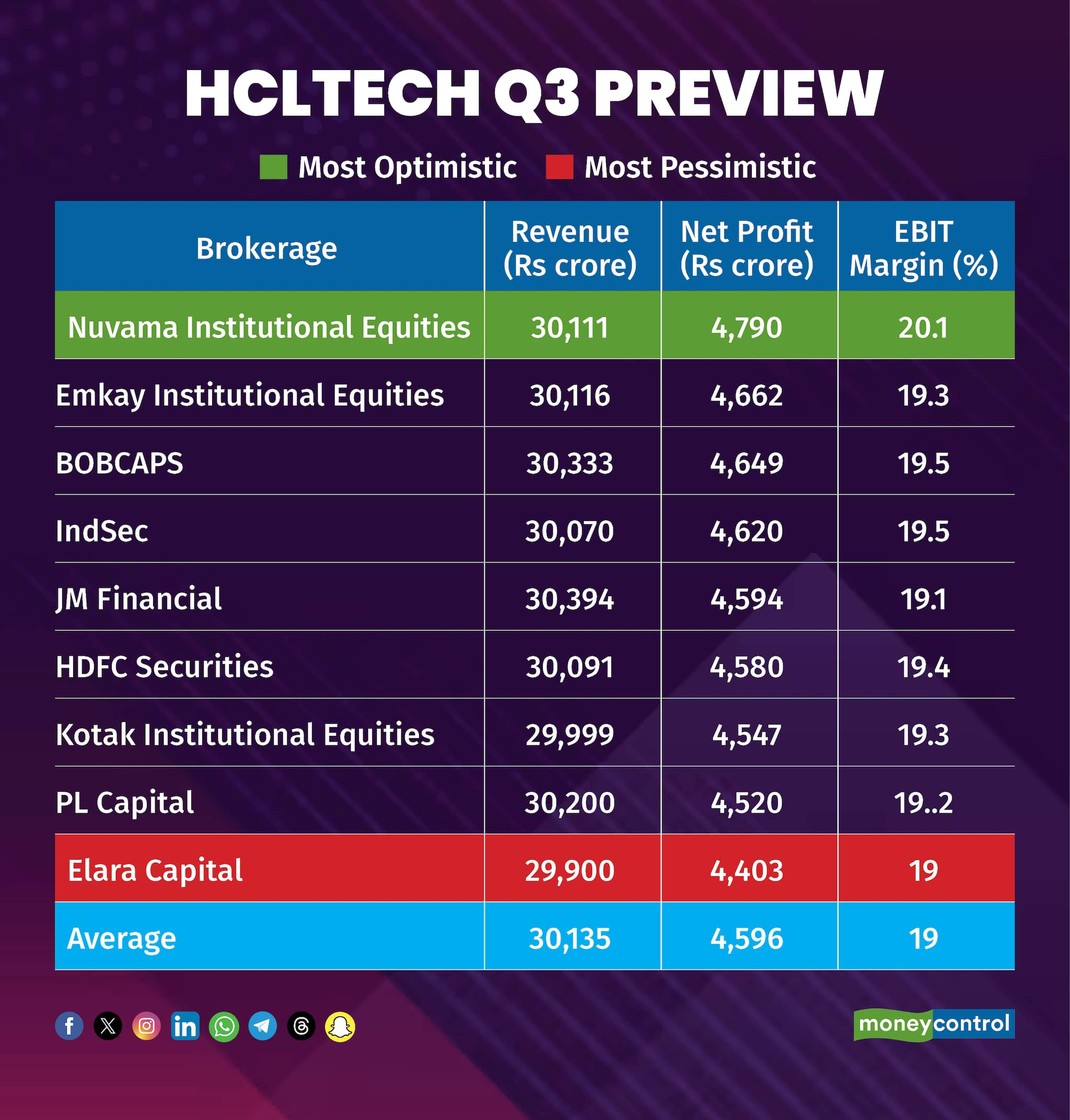

According to a Moneycontrol poll of nine brokerages, HCLTech is pegged to deliver a 4.4 percent increase in revenue to Rs 30,135 crore, up from the Rs 28,862 crore that it clocked in the previous quarter.

Analysts also estimate consolidated net profit for HCLTech to grow 8.5 percent on quarter to Rs 4,596 crore. The IT major had recorded a net profit of Rs 4,235 crore in the preceding quarter.

Estimates of analysts polled by Moneycontrol are shown to be in a narrow range, meaning any positive or negative surprises may elicit a sharp reaction in the stock price. Among the brokerages polled, Nuvama Institutional Equities rolled out the most bullish projections while Elara Capital forecasted the slowest growth for HCLTech.

What factors are driving the earnings?Seasonal strength in HCLTech's Products & Platform (P&P) business, especially in a quarter that is seasonally weak to peers is expected to drive growth outperformance.

Strong P&P revenue: HCLTech's likely strong sequential revenue growth is expected to be aided by its seasonally strong P&P business. Kotak Institutional Equities estimated a 26 percent sequential rise in revenue from the segment, at around $416 million.

Deal wins: Brokerages across the board expect deal wins for the IT major to be in the range of $2-2.5 billion in Q3, similar to the previous quarter.

Margin improvement: HCLTech's EBIT margin expected to rise marginally on quarter in Q3 on the back of cost optimisation. Even though the company may face some impact on its margins due to wage hikes, which it deferred from July to September, Elara Capital expects the impact to be mitigated by momentum in the P&P business, resulting in a 40 basis QoQ improvement at the company level. Analysts polled by Moneycontrol estimated HCLTech's EBIT margin to expand 40 basis points on quarter to 19 percent in Q3, as against 18.6 percent in Q2.

What to look out for in the quarterly show?Amid expectations of a strong outperformance from HCLTech, investors are eagerly waiting to see an upward revision in the company's revenue growth guidance. While margin guidance is largely expected to remain unchanged, investors would still be focused on how the company plans to meet its aspirational target range of 19-20 percent margins.

Focus will also be on the outcome of the annual client budgeting exercise and what it means for discretionary spending environment. Market participants will watch out for the management's outlook on revenue and demand growth in the coming quarters.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.