Goa Carbon, the second largest manufacturer of calcined petroleum coke (CPC) in India, provided a weak start to the earnings calendar for carbon companies. Sequential growth numbers weakened despite improved product realisations due to lower sales, amid plant shutdowns and lower shipments. While strong end market demand and order backlog keep us positive on sales improvement, the surge in raw material cost needs to be watched closely.

Sharp decline in sales volumes

Source: Company

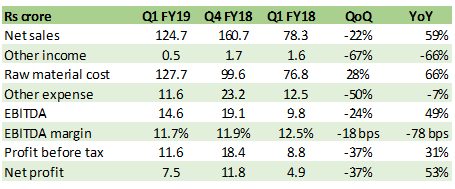

The company reported net sales of Rs 125 crore in Q1 FY19, a year-on-year (YoY) growth of 59 percent. Sequentially, volumes dropped 25 percent and revenues contracted 22 percent quarter-on-quarter (QoQ).

Despite plant shutdowns in Bilaspur (9 days) and Paradeep (29 days), production volumes increased 8 percent sequentially, which apparently doesn’t seem to the reason for contraction in sales. In Q4 FY18 as well, there was a production loss due to plant shutdowns in Goa (37 days) and Paradeep (17 days).

Capacity utilisation in Q1 has been to the tune of 76 percent (versus 71 percent in Q4 FY18) compared to nearly 100 percent in Q3 FY18.

Lower sales may be more on account of shipment delays as the management cites higher order backlog.

Sales realisation (Rs 33,675 per tonne) continues to remain firm, up about 3 percent QoQ and 15 percent in the last six months. Monthly production data indicates trending increase in CPC prices throughout Q1.

Gross margin, however, contracted 522 bps sequentially due to surge in raw material cost. But earnings before interest, tax, depreciation and amortisation (EBITDA) margin moderated marginally due to lower other operating expense.

CPC volume trend

Source: Moneycontrol Research, Company

Higher input costThe management attributed spike in raw material prices (green coke) to two developments. One, new capacity additions in China is leading to higher demand for green coke. Two, the trade war between the US and China has impacted global pricing of green coke.

CPC demand-supply and raw material cost need to be watchedThough Goa Carbon’s operational result was weak, improved product pricing trend augurs well for companies operating in the CPC segment like Rain Industries. While this assuages some CPC supply-demand concerns, the surge in green coke prices needs to be watched closely.

Follow @anubhavsaysFor more research articles, visit our Moneycontrol Research pageDiscover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.