Despite witnessing a temporary blip in January due to a seven ay shut-down of its Toluene di-isocyanate (TDI) plant at Dahej , Gujarat Narmada Valley Fertilizer & Chemicals (GNFC) reported a stellar set of Q4FY18 numbers post which the stock has run up almost 7.5 percent in trade today.

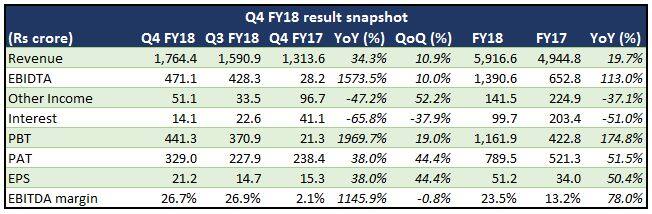

Performance was aided by a 34 percent year-on-year (YoY) growth in topline along with a 38 percent YoY expansion in net profit. Earnings before interest, tax, depreciation and amortisation (EBITDA) margins saw a sharp growth due to inventory gains and lower power costs. Interest expenses reduced 66 percent due to significant debt repayment which boosted operating profit significantly. On a quarter-on-quarter (QoQ) basis, the company reported healthy 11 percent growth in topline, accompanied by 44 percent expansion in net profit.

Earnings per share (EPS) saw a 38 percent uptick YoY. The management has announced a 75 percent dividend totalling around Rs 150 crore.

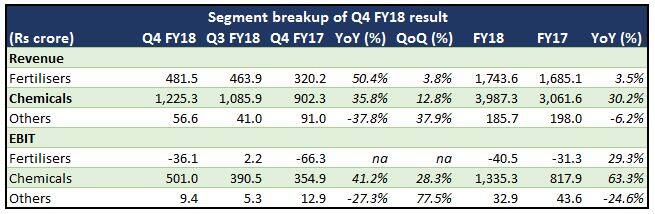

Segment performance

The expansion in earnings was led by the chemical division which saw a 50 percent YoY (3.8 percent QoQ) revenue growth along with 41 percent YoY expansion in earnings before interest and tax (EBIT). The company has started exporting ethyl acetate and formic acid which is expected to bring traction to the segment in coming days.

TDI prices have started firming up in April (around Rs 310/kg) post a temporary weakness in March (dipped from Rs 330/kg to Rs 290/kg), which is a positive for the company. Support from prices along with the management’s target of pulling up utilisation levels to almost 110 percent will be the major upcoming drivers to watch out for. The management is now focusing on ramping up its non-TDI business which would help in diversifying risks inherent due to the highly corrosive nature of its TDI plants.

Issue of water shortageWith temperatures soaring, there have been talks about risks arising from water shortage at the company’s plants. The management has commissioned drilling of bore wells to facilitate water supply if need be.

Q4 also saw a significant reduction in debt. The management delivered on its target of being debt free. It has now repaid its entire long-term debt and around 80 percent of its short-term borrowings, leaving around Rs 230 crore debt on its books. From Rs 1,700 crore, GNFC has brought down its working capital utilisation to around Rs 225 crore. It expects to further lower it, which would further pare down finance costs. Given the reduction, we expect a substantial reduction in finance cost in coming quarters which would provide significant traction to margins and earnings.

OutlookThe stock has corrected 15 percent in the last three months and has seen an uptick of 56 percent in the past 12 months. It is now trading at a trailing price-to-earnings (P/E) multiple of nine times and an EV/EBITDA of 5.3 times. Given the improving performance, healthier balance sheet quality and a positive guidance from the management, we expect traction in earnings to continue which could lead to a further re-rating of the stock. The company has moved from a heavy debt profile to an almost debt free balance sheet and will have substantial cash on its books going forward. Utilisation and allocation of cash would be a key factor to watch out for as it would also define the future earnings trajectory.

Follow @RuchiagrawalFor more research articles, visit our Moneycontrol Research Page.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.