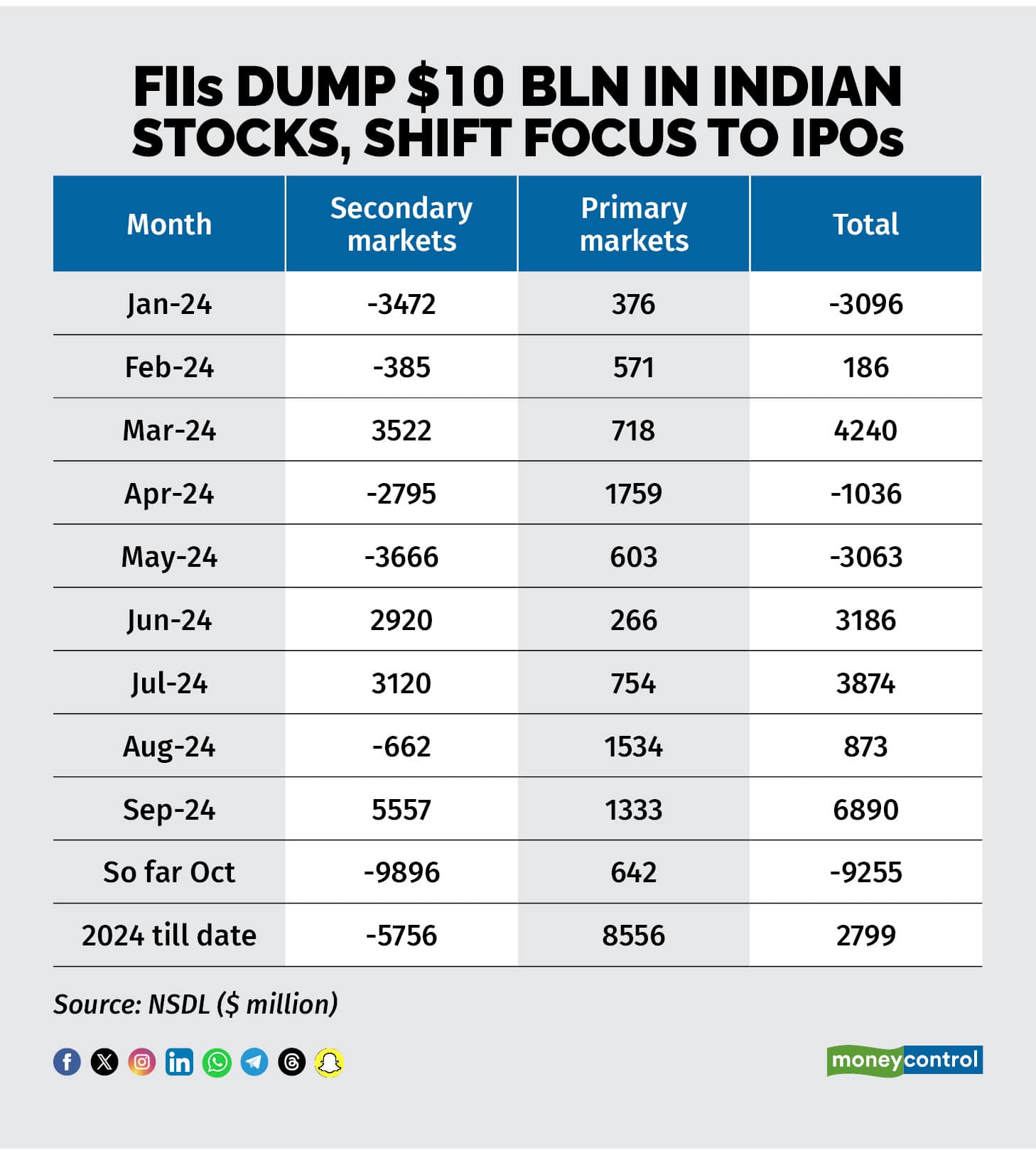

Foreign institutional investors (FIIs) have sold nearly $10 billion in shares in the secondary markets so far in October, despite continuing to invest in the primary markets, where a wave of IPOs is emerging. FIIs have been net buyers in the primary market, accumulating $645 million in October to date.

According to data from the National Securities Depository Limited (NSDL), FIIs were net sellers in the secondary markets for 12 consecutive sessions, offloading approximately $9.9 billion by October 17. Provisional data from the National Stock Exchange (NSE) further indicates that FIIs sold shares worth around Rs 5,485 crore on October 18.

Catch all the market action on Moneycontrol's live blogFurther, October has seen FIIs registering their highest-ever monthly outflow with the previous record for FII outflows witnessed in March 2020 at around $8.3 billion.

Meanwhile, the primary market saw significant activity due to major IPOs, including Garuda Construction & Engineering and Hyundai Motor India Ltd, with a combined value exceeding Rs 28,000 crore. Additionally, five SME IPOs worth Rs 267 crore were launched in October.

Ajay Bagga, an independent analyst, says that markets had already anticipated aggressive Fed rate cuts following the unexpected 50-basis-point reduction in September. Despite these expectations, recent US economic data indicating a robust economy while suggesting a “no-landing” scenario has driven a sustained rally in the US dollar over the past three weeks, leading to rising US yields, which typically have a negative impact on emerging markets (EM) capital flows.

Consequently, India has experienced FII outflows, partly due to these factors and partly in response to China's stimulus measures, which significantly boosted Chinese markets.

Analysts also highlight that Indian markets are trading at elevated levels with historically high valuations, which seem overly optimistic given the current economic backdrop of slowing growth, persistent inflation, high taxes, and elevated interest rates.

Coupled with these challenging macroeconomic conditions, recent earnings reports across various sectors have been disappointing. These factors together have contributed to the sustained FII outflows from Indian markets.

Kranthi Bathini, Director of Equity Strategy at WealthMills Securities, observed that a significant amount of speculative capital has flowed into India recently, with FIIs remaining net buyers even in September. However, the emerging valuation narrative suggests a "sell India, buy China" trend, as Chinese markets currently appear more attractive in terms of medium- to short-term valuations.

As a result, some capital outflows from India are likely, they say while adding that despite this, flows from domestic institutional investors (DII) have remained robust, providing some support to the Indian markets.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.