Madhuchanda Dey Moneycontrol Research

The quarterly earnings season was overshadowed by macro events like the government’s recapitalisation of public sector banks, massive road sector capex and the more recent Moody’s ratings upgrade. While the notable earning hits and misses did get the attention of the market, the aggregate numbers may give the big picture.

Hearteningly for the bulls, Indian Inc managed to overcome GST and demonetisation blues, and reported a decent operating performance overall.

The long road to profitability

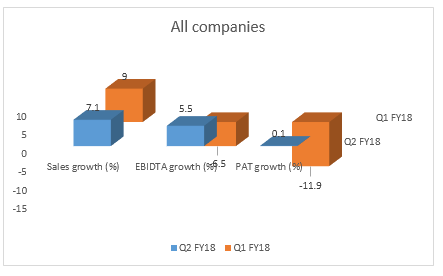

The aggregate picture, which was quite dismal in the run-up to the GST in the previous quarter, has got better. Our analysis of over 4200 companies showed tepid growth in the topline, but surprisingly there was a marked improvement in margins. Finally, unlike in the previous quarter when profitability declined, there was some revival in the September quarter with the trend line flattening.

Importantly, the absolute number of companies reporting losses fell to 36 percent of the universe during the September quarter compared to 37 percent in the previous quarter.

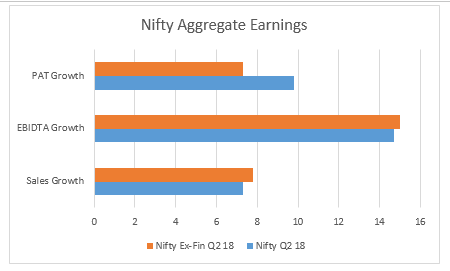

Nifty – a much better show

The large-cap universe did not disappoint. For Nifty companies, aggregate revenue growth was a tad lower compared to the June quarter. However, EBIDTA (earnings before interest, depreciation and tax) rose 14.7 percent year-on-year growth against a decline of over 5 percent in the preceding quarter. This aided the near double-digit growth in profit for the Nifty aggregate.

A key macro enabler of the performance, particularly for domestic-focused businesses was the re-stocking post GST implementation. An early festive season and the near-normal rains also aided sentiment.

Domestic-focused businesses like automobile, cement, consumer staples and consumer durables reported a good quarter. In the post result commentary, most companies said post GST restocking was gathering pace.

The winners from Nifty were names like Reliance Industries, Tata Motors, GAIL and ONGC. Bharti Airtel also reported a marked improvement in internals with strong cost control in India wireless and decent margin performance in Africa.

For financials, it was a mixed bag. While the likes of HDFC duo and IndusInd Bank were the usual steady performers, asset quality divergence took some sheen off Axis Bank and Yes Bank. For the rest, namely ICICI Bank and SBI, provisions remained elevated though incremental asset quality pain was not visible.

For the defensive sector, there wasn’t anything overtly different to reverse the cautious outlook. In the reported numbers of most of the large IT companies, the struggle to drive growth, the trade-off between growth and margin and slow hiring were visible.

For most of the pharmaceutical companies caught between regulatory overhang and pricing pressure in the US generic business, there was little respite in the regulated markets. However, the India business appears to be getting back on track with restocking happening at a brisk pace.

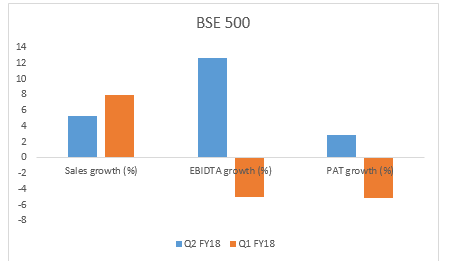

The BSE 500 universe – early green shoots

The bigger winners of the rally in the markets have come from a broader universe like the BSE 500. At an aggregate level, the performance looks subdued compared to Nifty. But the broad trend was similar, with a distinct improvement in operating performance that had a positive rub-off on profitability.

While generalisation of the broad universe is incorrect, it was heartening to observe many winners within BSE 500 coming from a range of sectors. Hence, it wouldn’t be wrong to conclude that the green shoots are emanating from different pockets.

There were a few sectoral winners like aviation, where all three listed airlines stocks reported strong numbers. Companies catering to metal and allied sectors also fared well.

A lot of the other winners, however, stood out on the strength of their respective business models. The notable names in this category are Avanti Feeds, Avenue Supermart, Bharat Forge, Caplin Point Lab, Chennai Petrochem, Dalmia Bharat, Godrej Industries, Godrej properties, Rain Industries, Future Retail etc. Our analysis suggests that close to 10 percent of the BSE 500 universe reported very healthy numbers.

The positivity is yet to reflect in the fortunes of companies that are critically dependent on the investment cycle. Infrastructure bellwether L&T continues to remain sceptical about the revival in private capex.

Government capex, nevertheless, has gathered steam and the same was reflected in the much improved earnings of companies working in the road sector. Dilip Buildcon, IRB Infra and Sadbhav reported numbers that were worth taking note of.

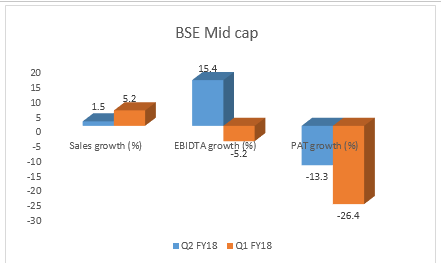

BSE Midcap – weighed down by leveraged companies

In the BSE Mid Cap index, the bottomline performance was subdued compared to the operating numbers, with the indebted firms in the index to blame. The other important constituent, namely some of the mid- sized public sector banks, continued to disappoint on reported financials although there was visible improvement in incremental asset quality pain.

The laggards in this index were the over-leveraged companies like Adani Enterprise, GMR Infra, Jindal Steel and Power, Reliance Communications, Tata Communications, SAIL etc and the beleaguered lenders like Canara Bank, Central Bank and IDBI Bank.

What to expect from the market now?

India’s overall macro indicators had worsened in recent times with growth falling, inflation firming up and crude looking set to spoil the party. However, we feel the recent reform announcements offer hope.

The economy is gradually coming out of the impact of twin disruptions of demonetisation and GST. Recent reports suggest that GST collections are improving. Finally, while monsoon was a bit lower, it wasn’t altogether disappointing.

The fiscal neutral recapitalisation of PSU banks should help expedite the bad loan resolution process and eventually pave the way for revival in private capex after some serious restructuring in the state-owned banking sector. Till such time, it will be a journey of gradual revival with government in the driving seat to fill the void of the private players.

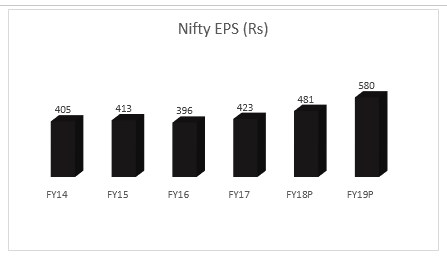

With minimum political risk in the horizon, relative strength of the macro and the green shoots from corporate earnings (the second half of FY18 has the support of a low base of last fiscal), markets are unlikely to de-rate. But further re-rating will be gradual as valuations at 21X FY18P earnings are not exactly cheap.

The relative strength of India vis-à-vis other economies and the fundamental shift in household savings pattern should keep the momentum going in the medium term. Investors should be watchful of any dip to accumulate well researched stock ideas.

(Disclosure : Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.)

For more research articles, visit our Moneycontrol Research Page.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!