Coal India is likely to report a decline in operating profit for the June quarter, both on a sequential and year-on-year basis, primarily due to lower volumes, weaker dispatches and increased supply from captive mines.

Higher cost of production too has weighed on profitability. The firm will report its earnings on 31 July.

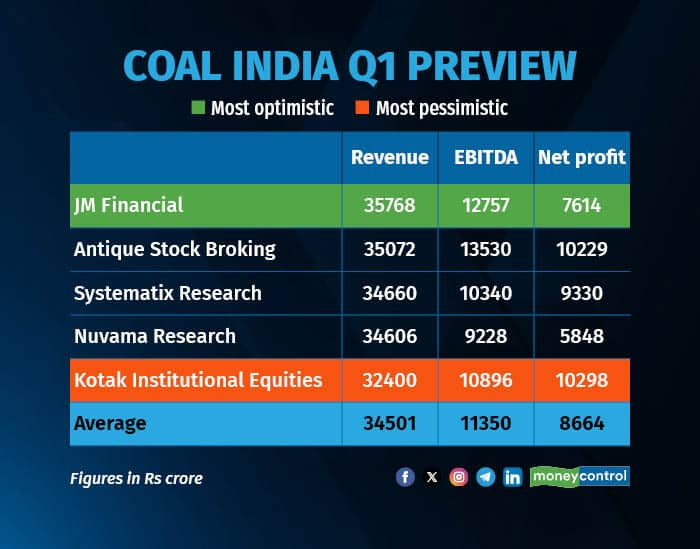

According to the average estimates from five brokerages polled by Moneycontrol, revenue for the quarter is projected at Rs 34,500 crore, down 9 percent quarter-on-quarter and over 5 percent year-on-year. The EBITDA for Coal India is estimated at Rs 11,350 crore, reflecting a 4 percent sequential decline and a 21 percent fall compared to the same quarter last year. Net profit is likely to come in at Rs 8,664 crore, down 4 percent quarter-on-quarter but up 6 percent year-on-year.

E-auction realisations are expected at Rs 2,550 per tonne compared to Rs 2,411 per tonne a year ago, supported by stable imported prices over the past two-to-three quarters. Blended realisations are estimated at Rs 1,704 per tonne, up 2 percent year-on-year, supported by higher e-auction prices of Rs 2,650 per tonne, marking a 10 percent rise. Analysts have modelled 11 percent volume contribution from e-auction sales for the quarter.

However, offtake declined 5 percent year-on-year in the June quarter. EBITDA per tonne (excluding overburden removal costs) is projected at Rs 571, marginally lower than Rs 576 a year ago. Lower volumes (down 4 percent year-on-year to 190 million tonne) and a one percent drop in blended realisations (to Rs 1,650 per tonne) are expected to pull EBITDA and EBITDA per tonne down by 20 percent and 16 percent year-on-year to Rs 9,200 crore and Rs 485, respectively.

Fuel Supply Agreement (FSA) realisation is expected to rise by 2 percent year-on-year to Rs 1,555 per ton, while e-auction prices are estimated to have declined 8 percent to Rs 2,225 per tonne. Both FSA and e-auction volumes are likely to fall by 3 percent to 168 million tonne and 14 percent to 20 million tonne, respectively

Factors Impacting EarningsVolumes: The decline in EBITDA is primarily attributed to consistently lower volumes and only moderate premiums in e-auction amid subdued thermal coal prices. Coal India’s EBITDA is expected to decline 20 percent year-on-year, driven by a 4 percent drop in volumes and a one percent decline in blended realisation, along with a rise in cost of production.

Dispatches: CIL's dispatches fell 5 percent as supply from captive mines increased, affecting Coal India’s offtake. Total dispatches stood at 190 million tons in Q1FY26, down 4.5 percent year-on-year, impacting the company’s earnings performance for the quarter.

What to Watch in EarningsKey monitorables include dividend, volume and dispatch trends, movement in e-auction and FSA realisations, cost of production pressures, and the management’s guidance on demand outlook, pricing strategy, and inventory levels.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.